Key Takeaways

- S&P 500 is down 15% against Bitcoin in 2025 despite hitting a record high.

- US spot Bitcoin ETFs now hold over 1.26 million BTC, about 6% of total supply.

- Bitcoin funds account for the vast majority of digital asset ETF inflows in the US.

The S&P 500 Index closed at a record 6,280.46 on Thursday, marking a 7% year-to-date gain and highlighting a robust recovery since April.

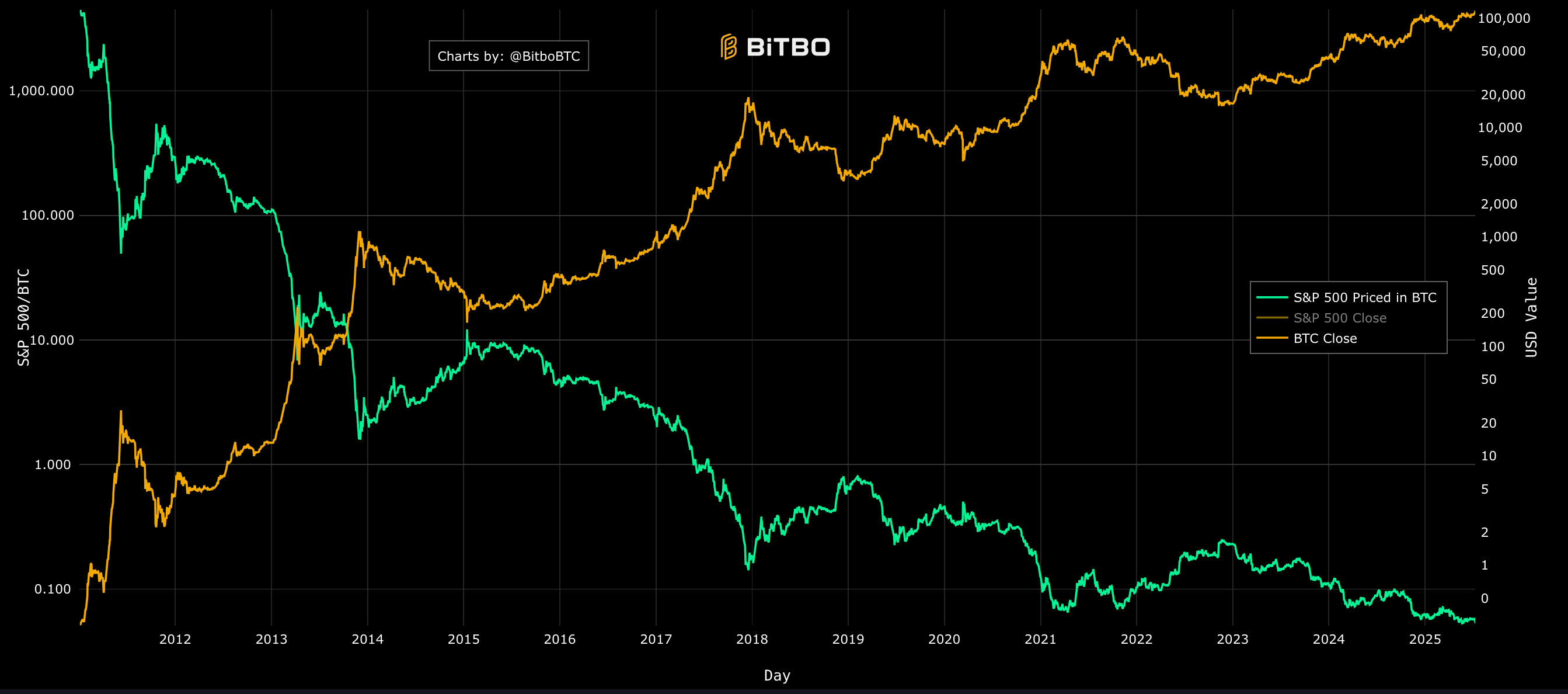

However, when measured in bitcoin terms, the S&P 500 is down 15% for 2025, according to market commentator The Kobeissi Letter, citing Bitbo’s chart.

Since 2012

Since 2012, the S&P 500 has lost 99.98% of its value compared to bitcoin, underscoring the digital asset’s long-term outperformance.

Bitcoin itself hit a new all-time high on Friday, briefly surpassing $118,800 on Coinbase.

Over the last 24 hours, BTC gained 5.5%, up 9% for the week and 24% since the start of the year.

Analyst Charlie Bilello emphasized bitcoin’s remarkable performance against not just the S&P 500, but also major tech stocks like Nvidia and Tesla.

2025 rally

Institutional demand is a key driver behind bitcoin’s 2025 rally.

The 12 US spot bitcoin ETFs now collectively hold 1,264,976 BTC valued at $148.6 billion, representing over 6% of the total supply.

This data, shows that digital asset ETFs rank as the third-largest fund category by inflows in the US this year, trailing only short-term government debt and gold.

On Thursday, US spot bitcoin ETFs saw their second-largest daily inflow ever, with $1.17 billion pouring into funds.

State Street data confirms that bitcoin funds dominate the digital assets ETF market in the United States.