Strike vs Cash App: Which is Best? [2026]

Key differences

Strike vs Cash App Fees Calculator

Enter an amount & we'll show estimated fees.

Fee Calculator

Strike vs Cash App in Comparison

Description

Fast, secure US-based exchange with high limits.

Cash App is a mobile payment service by Block (formerly Square) that offers Bitcoin buying and selling features to US users. As of 2024, it processes $14.7 billion in annual revenue.

Supported Countries

Available in 65+ countries including United States, El Salvador, Argentina, Costa Rica, Philippines and more. Send Globally feature available in 12+ countries.

Available only in the United States. All users must verify their identity with legal name, date of birth, and SSN to buy Bitcoin. Unverified accounts limited to $1,000 sending/receiving in 30 days. Verified accounts have higher limits and can access Bitcoin trading, stocks, and Cash Card.

Get started with one of these exchanges

Supported Cryptocurrencies

Bitcoin (BTC) on-chain and Lightning, USDT

Bitcoin only

Fees

- Trading Fees:

- Under $250: 0.99%

- $250 - $2,000: 0.95%

- $2,000 - $5,000: 0.89%

- $5,000 - $50,000: 0.79%

- $50,000 - $500,000: 0.69%

- $500,000 - $5,000,000: 0.59%

- $5,000,000 - $15,000,000: 0.49%

- Over $15,000,000: 0.39%

- Bank transfers: Free

- On-chain BTC withdrawals: Network fee

~2% debit card deposit fee.

- Exchange Fees:

- $0 - $9.99: 3%

- $10 - $100: 2.25%

- $100.01 - $200: 2%

- $200.01 - $1000: 1.75%

- $1000.01 - $2000: 1.5%

- $2000.01 - $3000: 1.25%

- $3000.01 - $5000: 1%

- >$5,000.01: 0.75%

Spread Fee:- 0-1% (varies with market conditions)

- No spread on Auto-Invest, Roundups, or Custom Orders

Ready to start buying Bitcoin?

Payment Methods

Debit Card, ACH, and Wire Transfer

Cash App Balance, bank Account, debit card

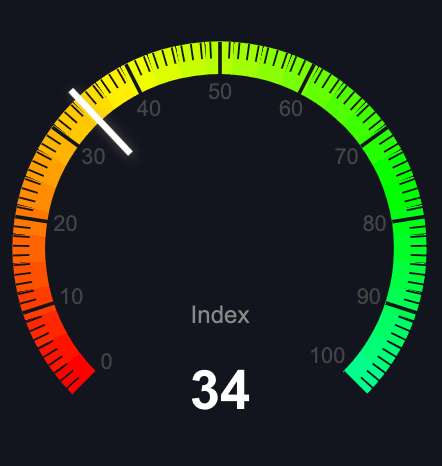

Do These Exchanges Allow you To Earn Interest on Crypto?

0

No Bitcoin interest earning, but offers Cash Card rewards program with instant savings at selected merchants. Users can activate one offer at a time.

Mobile App Ratings

iOS Rating: 4.8 Official rating from the iOS App Store as of November 18, 2024.

Android Rating: 4.6 Official rating from the Android Play Store as of November 18, 2024.

iOS Rating: 4.8 Official rating from the iOS App Store as of November 18, 2024.

Android Rating: 4.6 Official rating from the Android Play Store as of November 18, 2024.

Storage

Industry standard security measures including 2FA authentication. Non-custodial Lightning payments. Registered and regulated Money Services Business (MSB).

Bitcoin custody is managed by Cash App, with the option to withdraw to external wallets. Cash App implements strong security measures including Face ID/Touch ID and PIN protection. Users can set up automatic Bitcoin purchases with direct deposit, choosing their preferred investment percentage with no fees.

Have These Exchanges Been Hacked Before?

No publicly reported security incidents

No reported loss of customer Bitcoin.

Exchange Review

No review available

"Love the hourly auto buy feature on this app. Invite some friends and go fee free. Auto buy for a week and go fee free. Otherwise fees are super low compared to everything else. Will never buy BTC on the other platforms again. Highly recommend."

- Real user review from iOS App Store, Android Play Store or Trustpilot

No review available

"Cash App makes buying Bitcoin super simple. The instant deposit feature and ability to withdraw to my own wallet make it my go-to choice for small purchases."

- Real user review from iOS App Store, Android Play Store or Trustpilot

Strike vs Cash App Comparison

Fee Structures

Strike uses a tiered trading fee structure ranging from 0.99% for small trades to as low as 0.39% for trades over $15 million. ACH and Wire Transfers are free, while debit card deposits incur around a 2% fee. On-chain BTC withdrawals are subject to network fees. No spread fees are applied.

Cash App also uses tiered fees starting at 3% and going down to 0.75% for trades above $5,000. It charges a variable spread of 0-1% that varies with market conditions, though Auto-Invest, Roundups, and Custom Orders are exempt from spread fees. Users can fund purchases using their Cash App Balance, bank account, or debit card.

Feature Set

Strike supports on-chain and Lightning Bitcoin transfers, and offers automated recurring buys. It's designed with global transfers in mind and has advanced tiered pricing.

Cash App allows instant Bitcoin purchases and withdrawals, a custom Auto-Invest tool, and rewards via the Cash Card. However, it supports only Bitcoin and is limited to U.S. residents.

Geographic Availability

Strike is available in 65+ countries including the U.S., El Salvador, Philippines, Argentina, and more. Cash App is only available in the U.S. and requires identity verification with a legal name, DOB, and SSN.