Robinhood vs Strike: Which is Best? [2025]

Key differences

- Robinhood supports 20+ coins, Strike supports only BTC and USDT.

- Strike has higher fees for one-time purchases, but lower fees for recurring buys.

- Strike charges just 0.15% for recurring buys, Robinhood charges 0.55%.

- Robinhood is USA-only, Strike is available in 65+ countries.

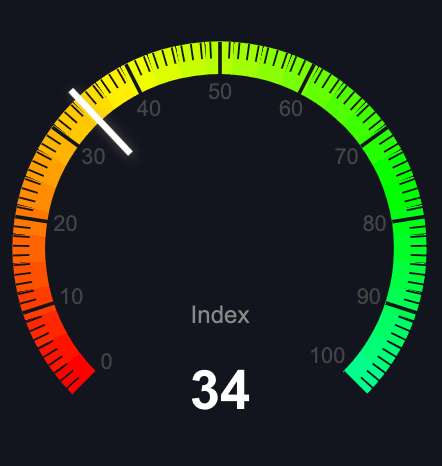

Robinhood vs Strike Fees Calculator

We built this fee calculator to help you compare the fees of Robinhood and Strike.

Enter the amount you want to buy and we'll show you the estimated fees for each exchange.

Robinhood vs Strike in Comparison

Description

Popular and well-known exchange based in the USA. Buy & trade with ACH transfers. Also offers ETFs like IBIT & FBTC.

Fast, secure US-based exchange with high limits.

Supported Countries

Only available in the United States, US Virgin Islands, Puerto Rico, and District of Columbia. Licensed by FinCEN and regulated as a broker-dealer by the SEC.

Available in 65+ countries including United States, El Salvador, Argentina, Costa Rica, Philippines and more. Send Globally feature available in 12+ countries.

Supported Cryptocurrencies

Over 20 cryptocurrencies available for trading including BTC, ETH, DOGE, SHIB, SOL, ADA, AVAX, LINK, XRP, LTC, BCH, COMP, AAVE, UNI, XLM and more.

Bitcoin (BTC) on-chain and Lightning, USDT

Fees

- Features:

- No commission crypto trading

- Minimum purchase of $1

- Instant deposits up to $1,000 (Instant account)

- Instant deposits up to Gold tier amount (Gold account)

- Trading Fees:

- Under $250: 0.99%

- $250 - $2,000: 0.95%

- $2,000 - $5,000: 0.89%

- $5,000 - $50,000: 0.79%

- $50,000 - $500,000: 0.69%

- $500,000 - $5,000,000: 0.59%

- $5,000,000 - $15,000,000: 0.49%

- Over $15,000,000: 0.39%

- Bank transfers: Free

- On-chain BTC withdrawals: Network fee

~2% debit card deposit fee.

Payment Methods

ACH, Debit Card, Bank Account, Wire Transfer

Debit Card, ACH, and Wire Transfer

Do These Exchanges Allow you To Earn Interest on Crypto?

Mobile App Ratings

iOS Rating: 4.2 Official rating from the iOS App Store as of November 18, 2024.

Android Rating: 4.2 Official rating from the Android Play Store as of November 18, 2024.

iOS Rating: 4.8 Official rating from the iOS App Store as of November 18, 2024.

Android Rating: 4.6 Official rating from the Android Play Store as of November 18, 2024.

Storage

Cryptocurrencies are stored using a combination of cold (offline) and hot (online) storage, with the majority held in cold storage for enhanced security. Users can withdraw cryptocurrencies to their own wallets. The platform employs industry-leading security measures and regular audits. Crypto assets are not FDIC insured or protected by SIPC.

Industry standard security measures including 2FA authentication. Non-custodial Lightning payments. Registered and regulated Money Services Business (MSB).

Have These Exchanges Been Hacked Before?

No. However, in November 2021, Robinhood reported a data breach affecting approximately 7 million customers. Prior to this, in July 2019, the company admitted to storing some users' passwords in plaintext. The company has also acknowledged occasional small-scale account compromises.

No publicly reported security incidents

Official Site

Exchange Review

No review available

"Good app! Relatively new to the crypto world, I've tried about 8-9 different wallets and Robinhood has been my favorite so far. Their interface is outstanding; you're able to see Live market data for current crypto prices; you can view returns by total returns or 24 hours, either by dollar amount or percentage. The buying process is instantaneous. The only improvement I'd like to see is hopefully they will adopt ALL ISO20022 compliant crypto. 🚀 💯"

- Real user review from iOS App Store, Android Play Store or Trustpilot

No review available

"Love the hourly auto buy feature on this app. Invite some friends and go fee free. Auto buy for a week and go fee free. Otherwise fees are super low compared to everything else. Will never buy BTC on the other platforms again. Highly recommend."

- Real user review from iOS App Store, Android Play Store or Trustpilot

Robinhood vs Strike Comparison

Fee Structures

Robinhood offers a flat 0.55% spread on all Bitcoin purchases with no added fees, including 0% debit card fees.

Strike uses a tiered fee structure: 0.99% for under $250, 0.95% for $250-$2,000, 0.89% for $2,000-$5,000, 0.79% for $5,000-$50,000, 0.69% for $50,000-$500,000, 0.59% for $500,000-$5,000,000, 0.49% for $5,000,000-$15,000,000, and 0.39% for over $15,000,000. Bank transfers are free, but debit card deposits incur a ~2% fee.

Feature Set

Robinhood stands out with Bitcoin ETF support and advanced trading features like margin and alerts. Strike offers Lightning Network support and non-custodial payments, but no ETF or margin trading capabilities.

Geographic Availability

Robinhood is only available in the USA, while Strike is available in 65+ countries including the U.S., El Salvador, Argentina, and more.

Payment Methods

Robinhood: ACH, Debit Card, Bank Account, Wire Transfer

Strike: ACH, Debit Card, Wire Transfer

Security Features

Robinhood: Cold/hot storage, FDIC/SIPC equivalent coverage

Strike: 2FA, Lightning non-custodial payments

User Interface

Robinhood: Advanced charts, alerts, fractional shares

Strike: Simple, minimalist design

Customer Support

Robinhood: Limited, some complaints

Strike: Responsive, good reviews

Regulatory Compliance

Robinhood: FinCEN, SEC, SIPC

Strike: FinCEN MSB

Additional Features

Robinhood: ETFs, IRA match, margin, alerts

Strike: Global remittance, Lightning support

Binance

Binance

Crypto.com

Crypto.com

Cash App

Cash App

Swan Bitcoin

Swan Bitcoin

Kraken

Kraken

Gemini

Gemini

Uphold

Uphold

Coinbase

Coinbase

River

River

Fold

Fold

Onramp Bitcoin

Onramp Bitcoin

Unchained

Unchained