Key Takeaways

- U.S. spot bitcoin ETFs surpass $500 billion in trading volume.

- BlackRock's IBIT leads, with $5.2 billion volume on Wednesday.

- Bitcoin ETFs net inflows total $28.3 billion since January launch.

U.S. spot bitcoin exchange-traded funds (ETFs) have reached a milestone, surpassing $500 billion in cumulative trading volume just ten months after their January debut.

The achievement highlights strong investor interest, with bitcoin ETFs hitting a record trading day of $5 billion in volume for BlackRock’s IBIT, supported by significant net inflows.

Initial surge

The trading volume for these ETFs initially spiked as bitcoin prices reached new highs of nearly $74,000 earlier this year.

However, volume growth temporarily slowed during a market consolidation phase as bitcoin traded between $50,000 and $70,000.

Recent growth

Following the U.S. presidential election, in which pro-bitcoin candidate Donald Trump won, bitcoin ETFs resumed their upward momentum, reaching a cumulative volume of $505.4 billion on Wednesday, The Block’s data shows.

Wednesday’s trading volume

On Wednesday, the U.S. spot bitcoin ETFs registered $7.9 billion in trading volume, marking the fourth-largest trading day since launch.

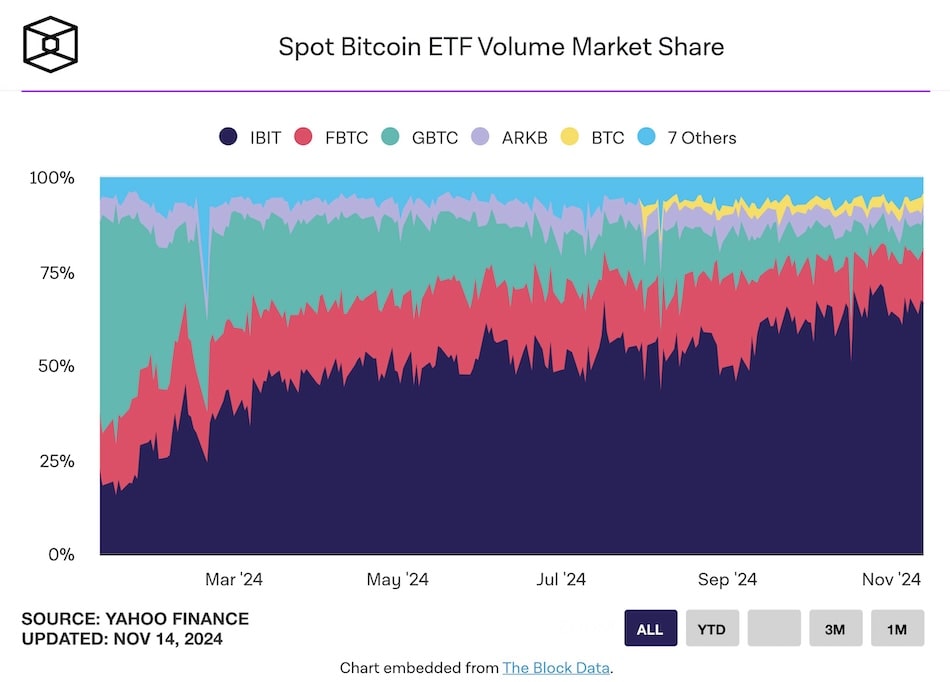

BlackRock’s IBIT ETF led the market with a record $5.2 billion in daily volume, followed by Fidelity’s FBTC at $1.2 billion and Grayscale’s GBTC at $670 million.

Net inflows

The ETFs are also seeing substantial net inflows, with $510.1 million added on Wednesday alone, pushing weekly inflows to $2.4 billion.

BlackRock’s IBIT again led with $230.8 million in net inflows. Since January, net inflows into bitcoin ETFs have totaled $28.3 billion, with IBIT alone amassing $41.1 billion in assets under management.

Bitcoin’s price has surged, now trading at $90,738, following a high of $93,000 earlier this week. Year-to-date, bitcoin has risen over 115%.