Key Takeaways

- The Conference Board’s LEI fell by 0.6% in July.

- Recession fears caused market volatility in early August.

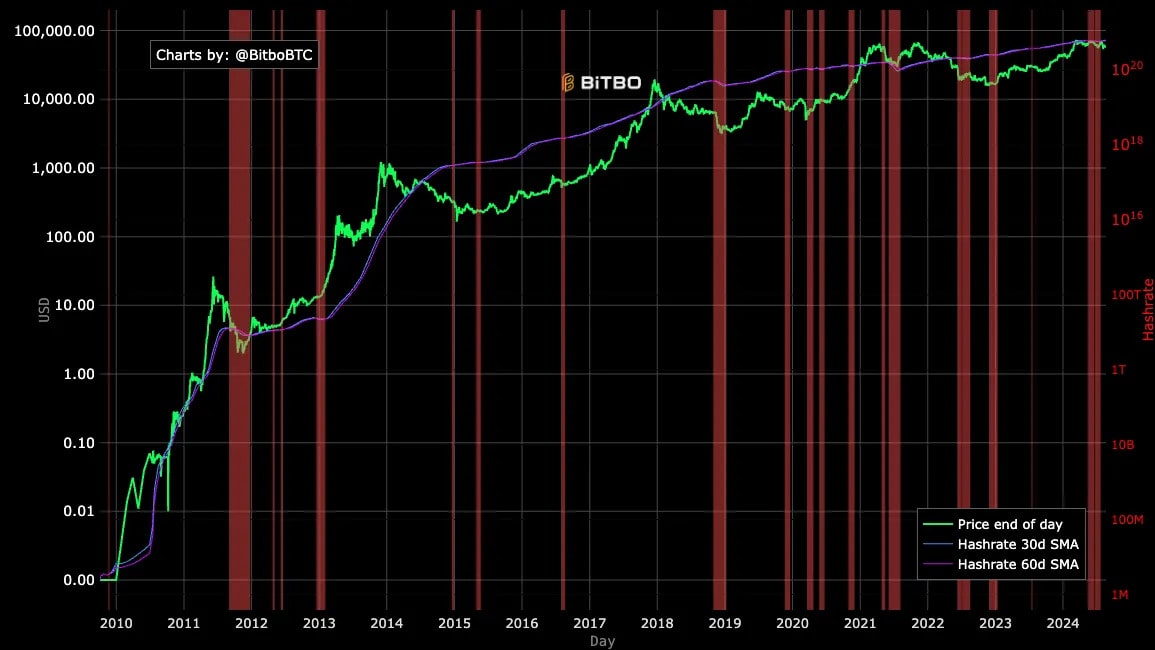

- Bitcoin dropped to $50,000 but has since rebounded to over $60,000.

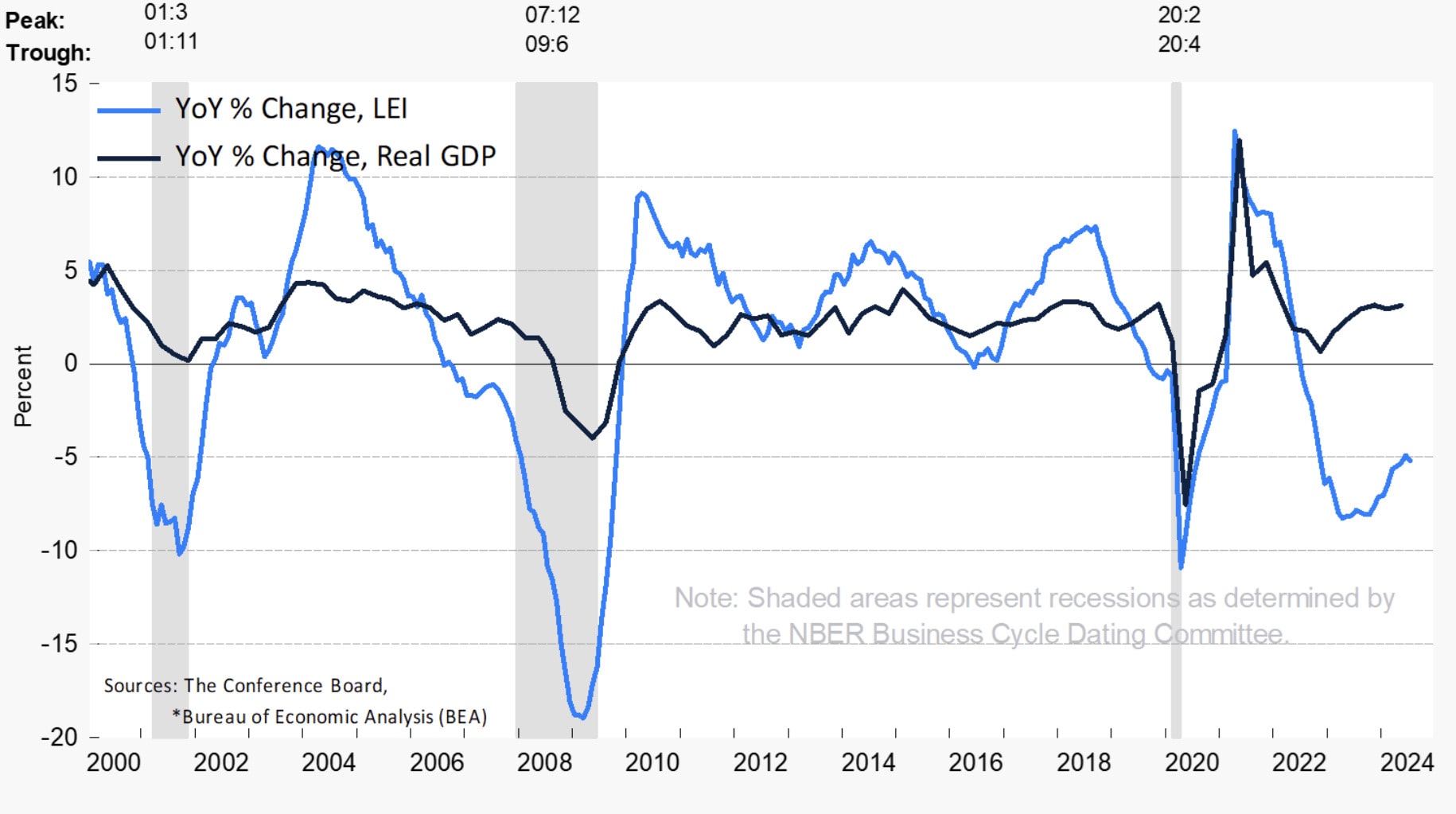

The U.S. Leading Economic Indicators (LEI) continued to drop in July, signaling an ongoing economic slowdown.

However, according to the Conference Board’s latest data, the indicators no longer suggest an imminent recession. The LEI fell by 0.6% in July, following a 0.2% drop in June, marking a continued decline from its 2022 peak.

What is tracks

The LEI tracks factors like manufacturing hours, jobless claims, stock prices, and credit conditions to predict shifts in economic trends.

While the decline indicates headwinds for the U.S. economy, the annualized six-month rate of change improved, falling from -3.1% in June to -2.1% in July.

Justyna Zabinska-La Monica, senior manager of business cycle indicators at the Conference Board, stated:

The LEI continues to fall on a month-over-month basis, but the six-month annual growth rate no longer signals recession ahead.

Market rebound

Despite a rough start in August, where U.S. recession fears drove down stocks and Bitcoin, the market appears to be rebounding, according to CoinDesk.

Bitcoin fell from $70,000 to $50,000 but has since recovered to over $60,000.