Key Takeaways

- US bitcoin ETFs now hold more than 1.24 million BTC, exceeding 6% of total supply.

- Despite geopolitical tensions, ETFs recorded 10 straight days of inflows, signaling strong institutional demand.

- The average ETF bitcoin purchase price is $73,000, with holders unlikely to sell soon as profit-taking pressure remains low.

U.S.-listed bitcoin ETFs have collectively amassed over 1.24 million BTC, now accounting for more than 6% of the total circulating supply, according to recent data. T

his milestone reflects the growing role of ETFs in traditional finance and bitcoin markets. For context, there are just 21 million bitcoin that will ever exist (see how many bitcoin).

Institutional demand remains resilient

Despite escalating geopolitical tensions in the Middle East over the past two weeks, spot bitcoin ETFs saw 10 consecutive days of inflows, as reported by Farside Investors.

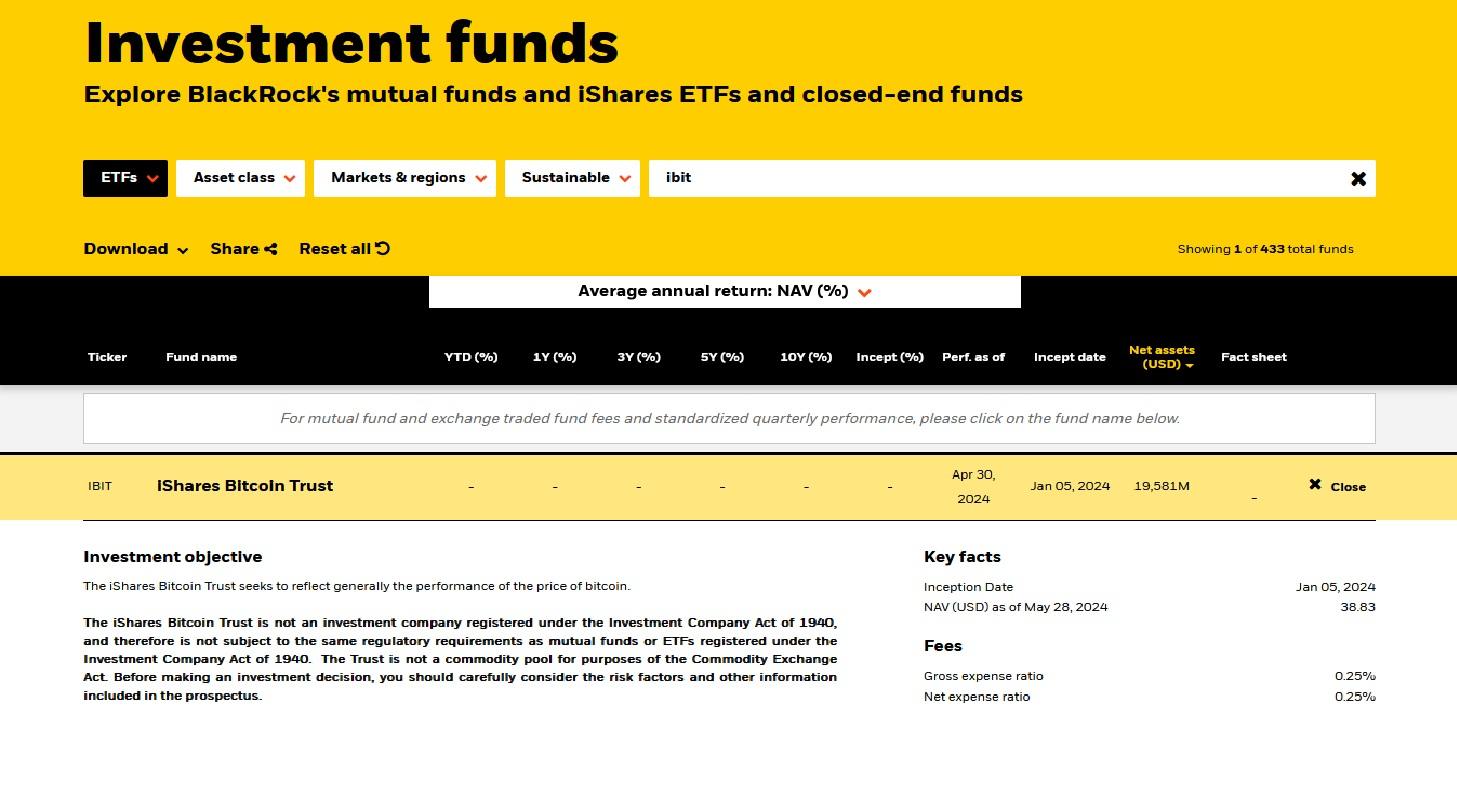

Major players like BlackRock and Fidelity continued to accumulate bitcoin through their ETF offerings.

BlackRock alone holds 695,829 BTC, representing more than 52% of all ETF-held bitcoin (track BlackRock ETF holdings).

Ecoinometrics commented on the trend:

“Institutional demand for Bitcoin doesn’t flinch easily. The streak is still intact and that sets the stage for Bitcoin’s upside potential to play out.”

Profit-taking not imminent

Analysts note that the average purchase price for ETF-held bitcoin is around $73,000, excluding Grayscale’s GBTC, while bitcoin currently trades between $105,000 and $107,000.

However, the Market Value to Realized Value (MVRV) ratio for ETF holdings stands at 1.43, well below the historical peak of 3.7 (see bitcoin MVRV chart).

This suggests institutional investors are not yet pressured to realize profits and are likely holding for the long term.

Supply tightening

With over 1.23 million BTC locked in ETFs (see US ETF holdings), the available supply for trading is shrinking.

Unless significant outflows occur, this structural shift could contribute to future supply constraints.