Key Takeaways

- U.S. spot Bitcoin ETFs exceed 500,000 BTC in net inflows.

- The ETFs represent more than 2.5% of Bitcoin's circulating supply.

- BlackRock's IBIT fund leads with over 520,000 BTC in holdings.

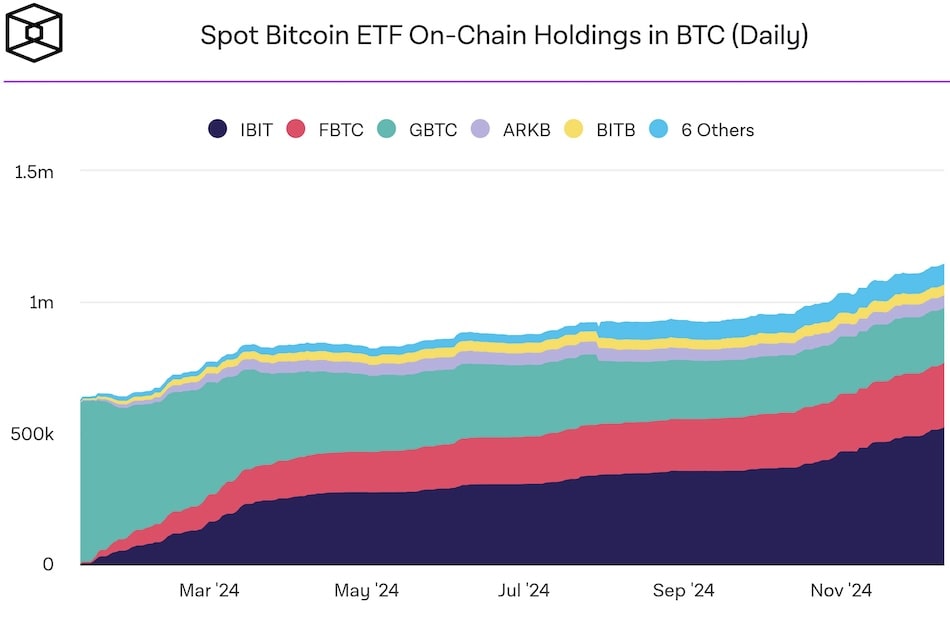

The 12 U.S. spot Bitcoin exchange-traded funds (ETFs) collectively exceeded 500,000 BTC in net inflows as of Wednesday, achieving this milestone less than a year since their debut on January 11, 2024. This total represents more than 2.5% of Bitcoin’s circulating supply of 19.8 million BTC.

Vetle Lunde, Head of Research at K33, highlighted the achievement, noting:

Year-to-date flows to spot ETFs have surpassed 500,000 BTC.

Recent inflow trends

Fidelity’s FBTC led Wednesday’s surge with $121.9 million in inflows, contributing to a total of $223.1 million for the day. The spot Bitcoin ETFs are on a 10-day streak, amassing nearly $4.3 billion in cumulative inflows.

BlackRock’s IBIT dominance

BlackRock’s IBIT spot Bitcoin ETF surpassed 500,000 BTC in net inflows last week, solidifying its position as the leader among these funds. Despite substantial outflows from Grayscale’s higher-fee GBTC fund, the overall cumulative net inflows have reached 500,925 BTC.

Additionally, IBIT now outpaces BlackRock’s iShares Gold Trust (IAU) in assets under management, holding over $50 billion.

CryptoQuant CEO Ki Young Ju, emphasizing Bitcoin’s growing dominance, commented:

Smart money already knows the winner.

Historic holdings comparison

The ETFs collectively now hold more Bitcoin than the 1.1 million BTC attributed to Satoshi Nakamoto, with IBIT leading holdings at over 520,000 BTC, followed by Fidelity’s FBTC with 247,000 BTC.