Key Takeaways

- Crypto leaders push for a Bitcoin-only U.S. reserve.

- Critics claim Trump's selection of altcoins is politically motivated.

- Grayscale supports the reserve, citing its similarity to its own fund.

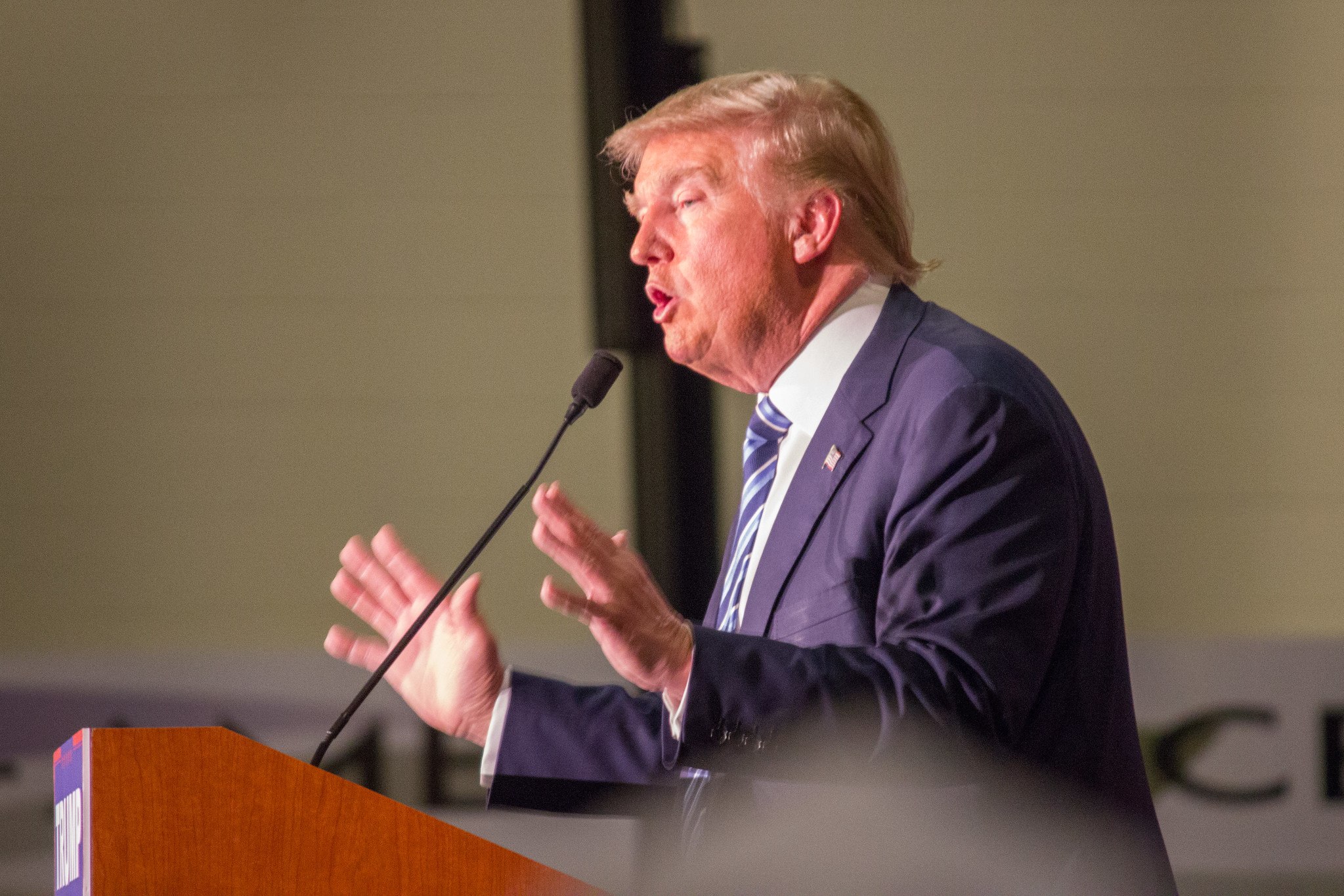

President Donald Trump’s announcement of a U.S. crypto strategic reserve has sparked intense debate among industry leaders.

While the reserve includes Bitcoin, Ethereum, XRP, Solana, and Cardano, many experts believe Bitcoin should be the sole asset.

Opinions on reserve composition

Coinbase CEO Brian Armstrong suggested that a Bitcoin-only reserve would be “simplest” and the clearest successor to gold.

Fred Krueger, an investor, proposed a market-weighted allocation, with Bitcoin at 75% and Ethereum at 12.4%.

However, critics like Jeff Park from Bitwise warned that including altcoins could raise concerns about political favoritism and insider dealings.

Skepticism from industry experts

Peter Schiff, a longtime Bitcoin skeptic, acknowledged Bitcoin’s place in a reserve but questioned the inclusion of XRP, calling it unnecessary.

Similarly, Mint Ventures’ Alex Xu suggested Trump’s move was politically motivated, favoring projects that financially supported him.

He argued that a sovereign wealth fund would be a more viable approach than seeking congressional approval for a reserve.

Support from Grayscale

Despite skepticism, Grayscale Investments CEO Peter Mintzberg praised the move, noting that Grayscale’s Digital Large Cap Fund already holds the same assets as Trump’s proposed reserve.

Conclusion on U.S. reserve

Industry leaders largely agree that a U.S. reserve is a positive step but remain divided on whether altcoins should be included.