Key Takeaways

- Trezor reported a 600% weekly sales increase as Bitcoin surged.

- Bitcoin reserves on exchanges fell to a six-year low, supporting self-custody.

- Ledger also recorded its best revenue days as hardware wallet demand rose.

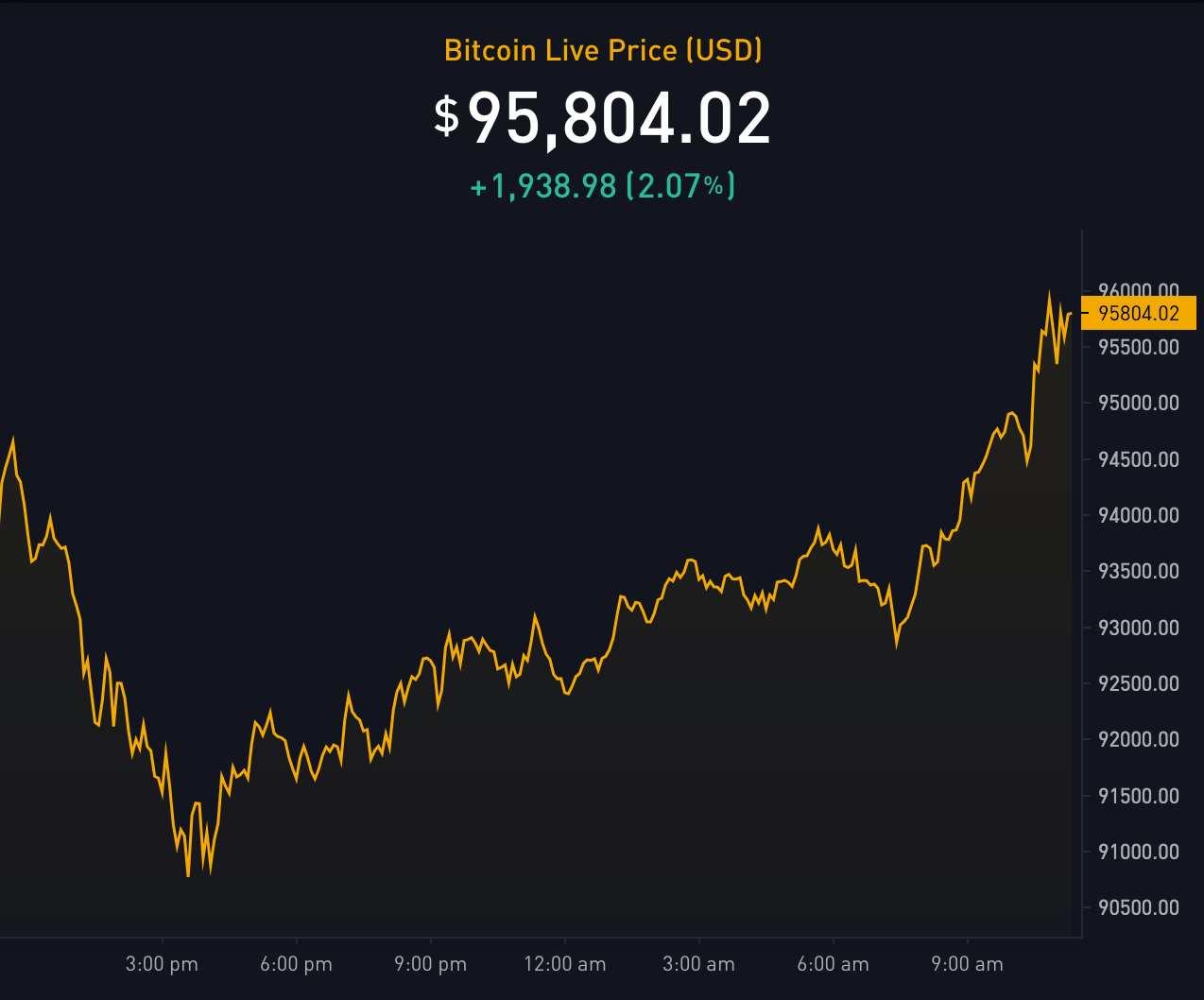

Trezor, a leading hardware wallet provider, has reported a massive 600% increase in weekly wallet sales as Bitcoin’s price surged to nearly $100,000 last week.

The spike in demand coincided with Bitcoin’s record high of $99,645 on November 22, as per CoinGecko.

This marks Trezor’s best single sales day, surpassing its May 2023 peak.

Factors driving demand

Trezor Chief Commercial Officer Danny Sanders attributed the increase to several factors, including the recent U.S. presidential election.

Donald Trump’s victory is expected to bring a regulatory shift in the cryptocurrency market, fostering greater institutional adoption. Sanders noted:

[Trump’s win] promises more regulatory clarity, which leads to an improved environment for businesses.

Other key drivers include Bitcoin’s fourth halving in April 2024 and macroeconomic factors like rate cuts by central banks in the U.S. and Europe, which have bolstered liquidity in the market.

Self-custody gains momentum

The demand for hardware wallets reflects a broader move towards self-custody.

Bitcoin reserves on exchanges such as Binance and Coinbase have plummeted to their lowest levels in six years, with over 427,000 BTC withdrawn in 2024 alone.

Sanders emphasized:

The mantra ‘not your keys, not your coins’ remains highly relevant.

Ledger, another hardware wallet provider, has reported similar demand. CEO Pascal Gauthier stated:

We just recently had our two best days in Ledger’s history in terms of revenue.

Trezor is currently offering a 10% discount on all orders for Black Friday ->