Key Takeaways

- U.S. Treasury Secretary Scott Bessent projects stablecoins could reach a $2 trillion market in three years.

- The U.S. Senate is advancing stablecoin regulation with the Genius Act, requiring 1:1 reserves.

- Major banks like Bank of America are preparing to enter the stablecoin space as regulatory clarity emerges.

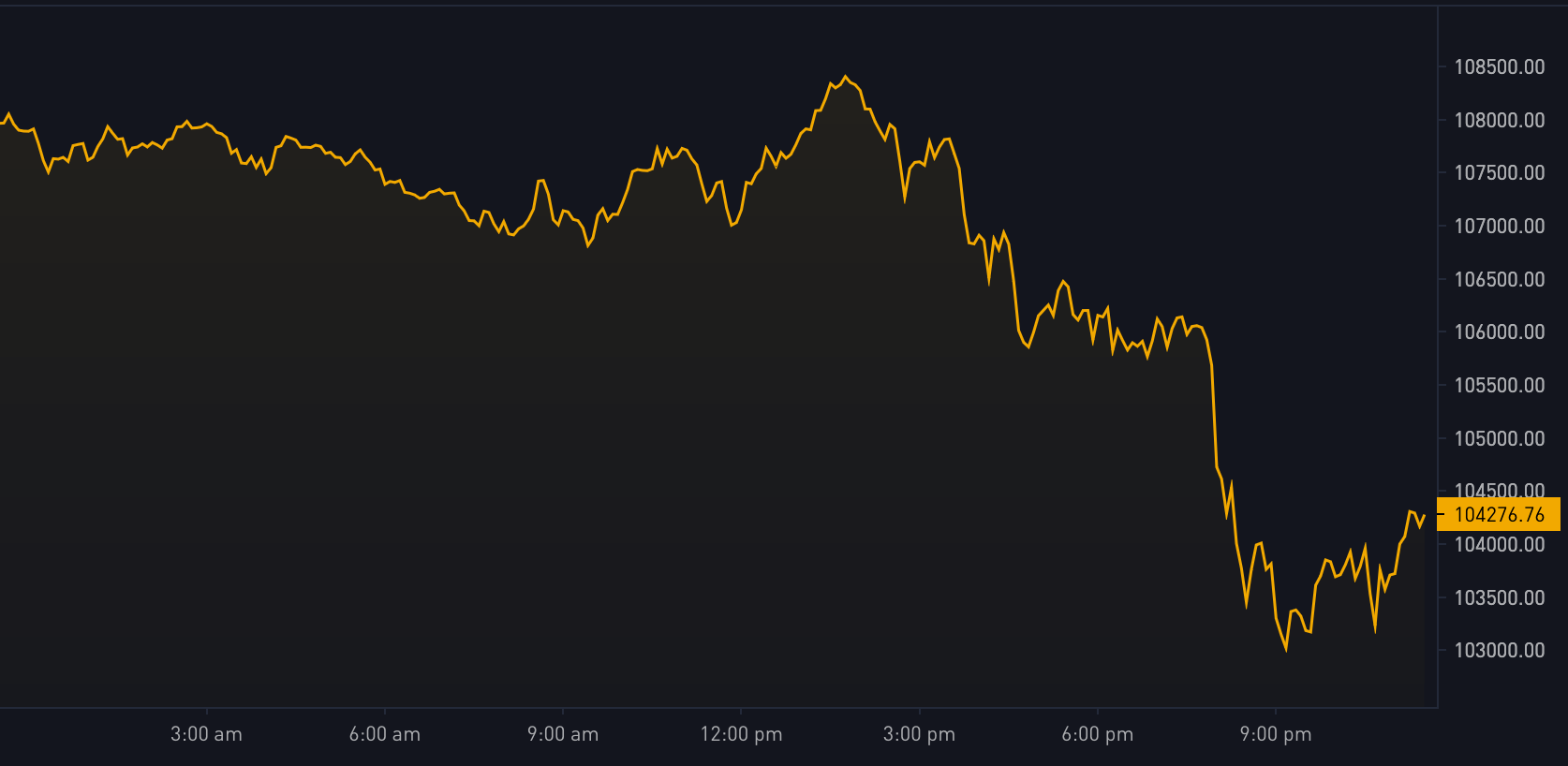

Bitcoin has climbed nearly 50% from its April lows, nearing its all-time high of $112,000, amid economic uncertainty and anticipation of major regulatory moves.

The surge has been linked to concerns about the U.S. dollar’s stability, with high-profile figures like Elon Musk suggesting bitcoin could challenge the dollar’s reserve status.

Bessent’s $2 trillion stablecoin forecast

U.S. Treasury Secretary Scott Bessent stated during a House ways and means committee hearing that dollar-pegged stablecoins could grow tenfold to reach a $2 trillion market within three years, potentially “greatly exceed[ing] that.”

“I believe that stablecoin legislation backed by U.S. treasuries or T-bills will create a market that will expand U.S. dollar usage via these stablecoins all around the world. I think that $2 trillion is a very reasonable number.”

This aligns with forecasts from Standard Chartered Bank analysts, who expect U.S. stablecoin regulation to legitimize and expand the industry, with implications for U.S. Treasury demand and dollar dominance.

Regulatory developments and banking interest

The U.S. Senate has advanced the Genius Act, which would regulate stablecoins and require 1:1 reserves, toward a final vote. S

enate Majority Leader John Thune commented:

“It’s time to move forward and pass this legislation.”

Market strategist Joel Kruger called the bill a “significant tailwind” for bitcoin, while Wall Street banks, including Bank of America, are preparing to enter the stablecoin market following anticipated regulatory clarity.

Bank of America CEO Brian Moynihan noted that regulatory uncertainty had previously kept banks out of the stablecoin sector, stating:

“The problem before was it wasn’t clear we were allowed to do it under the banking regulations.”