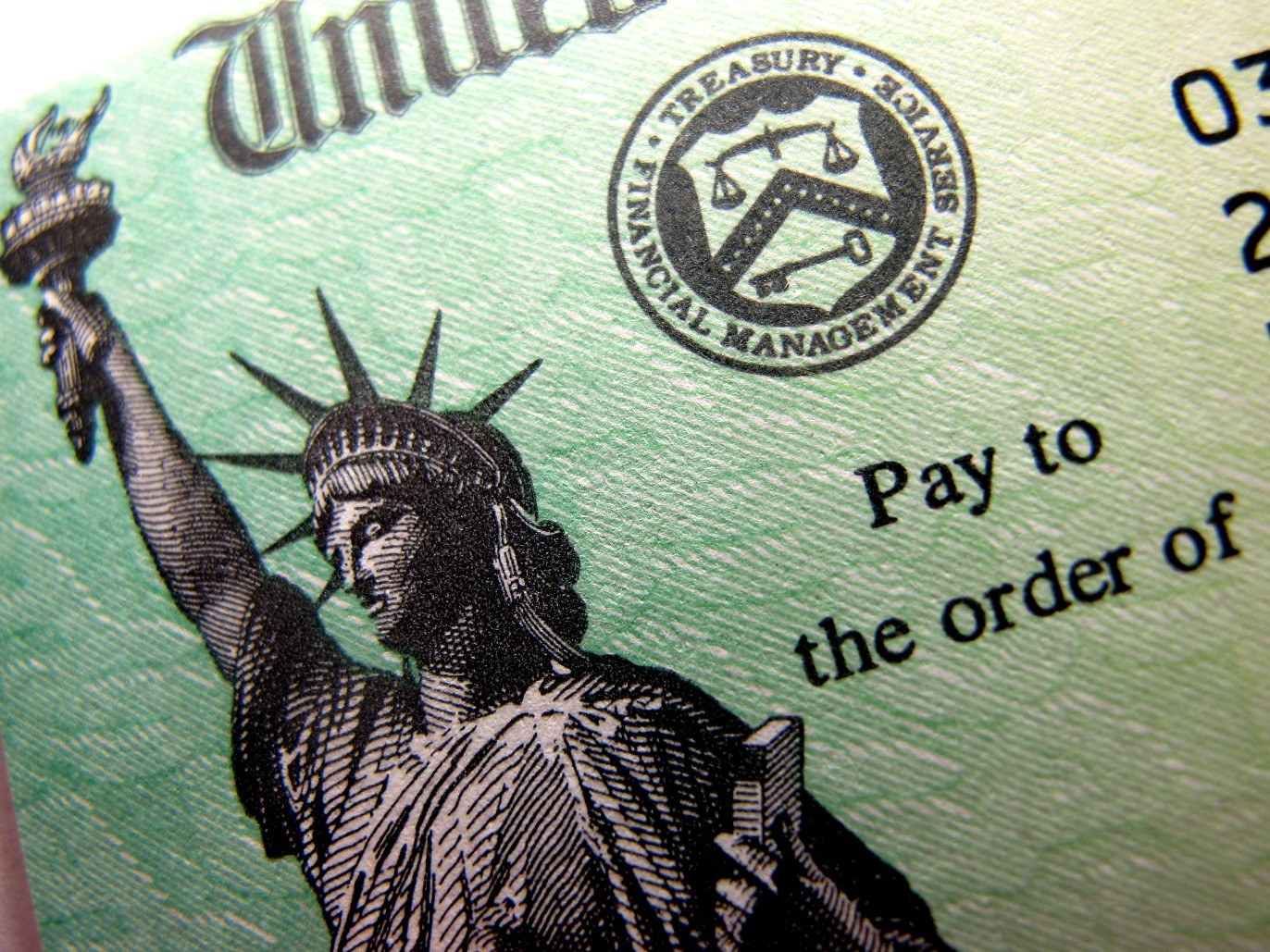

Tether, the issuer of USDT, is entering the U.S. domestic market with USAT, a dollar-backed token issued by Anchorage Digital Bank.

The launch was announced Tuesday and is Tether’s first product built to operate under the U.S. federal stablecoin framework established by the GENIUS Act.

How USAT is structured

Unlike USDT, which is geared toward global markets, USAT is issued through Anchorage, a federally chartered bank overseen by the Office of the Comptroller of the Currency.

Tether said Cantor Fitzgerald will serve as reserve custodian and primary dealer.

Competing for U.S. institutions

Circle’s USDC has long been viewed as the preferred stablecoin for U.S. institutions due to its transparency and domestic alignment.

Tether is positioning USAT as a U.S.-focused alternative while keeping USDT as its global product.

The project is led by Bo Hines, former executive director of the White House Crypto Council, who will serve as CEO of Tether USAT.

Exchange and payments rollout

At launch, USAT will be available on Kraken, OKX, Bybit, Crypto.com, and MoonPay.

Tether CEO Paolo Ardoino said in the release:

“USAT offers institutions an additional option: a dollar-backed token made in America.”

Tether added that USAT will coexist with USDT as the company formally enters the U.S. domestic regulatory regime.