Key Takeaways

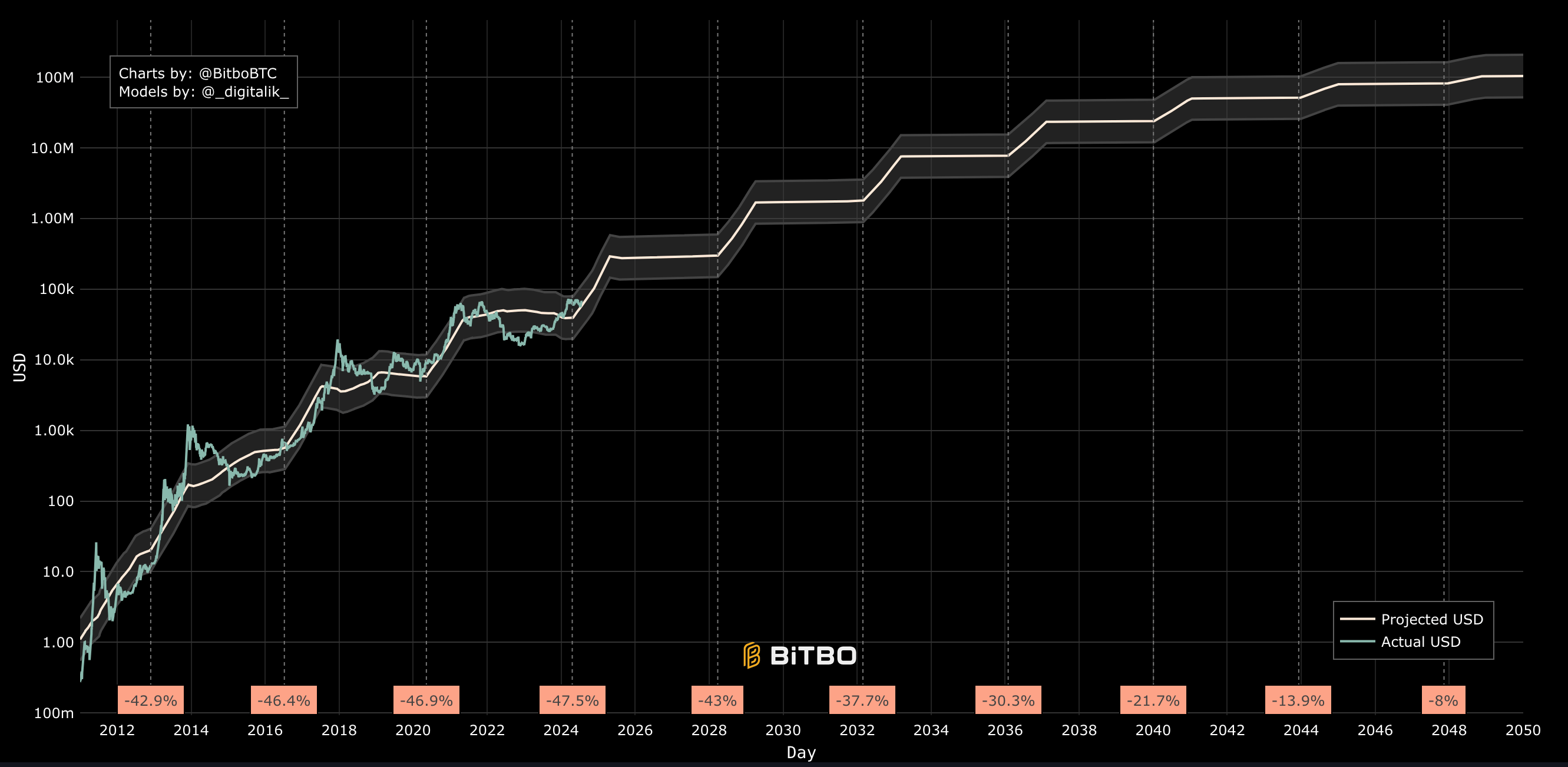

- Bitbo introduces a Stock to Income model for better Bitcoin price projections.

- The model includes miner transaction fees and uses updated data.

- Only active coins from the last ten years are considered in the model.

Bitbo has unveiled its new Stock to Income model, offering a refined approach to Bitcoin price prediction.

Unlike the Stock to Flow model, this new model includes transaction fees earned by miners, not just newly mined bitcoins, and its model is updated daily.

Video explanation

How it works

The Stock to Income model compares Bitcoin’s total stock with miners’ total income, encompassing both the subsidy (mining rewards) and transaction fees.

This inclusion is vital as miners are more likely to sell bitcoins from fees compared to long-term holders. Over time, as the mining subsidy decreases, transaction fees will become the primary income source for miners, impacting Bitcoin’s price.

To ensure accuracy, the model uses a moving average of subsidies and fees over the past 365 days.

For future projections, it assumes fees will remain consistent with this average.

Additionally, the model considers only active coins from the last ten years, excluding bitcoins lost due to forgotten keys or negligible value in the early years.

This model aims to provide a more precise and current picture of Bitcoin’s price movements by incorporating both fees and updated data.