Key Takeaways

- Stablecoin market cap reaches $170 billion.

- Analysts say a rising stablecoin supply and declining Bitcoin reserves signal a potential rally.

- Global liquidity increases could push Bitcoin higher in Q4 2024, according to BIC.

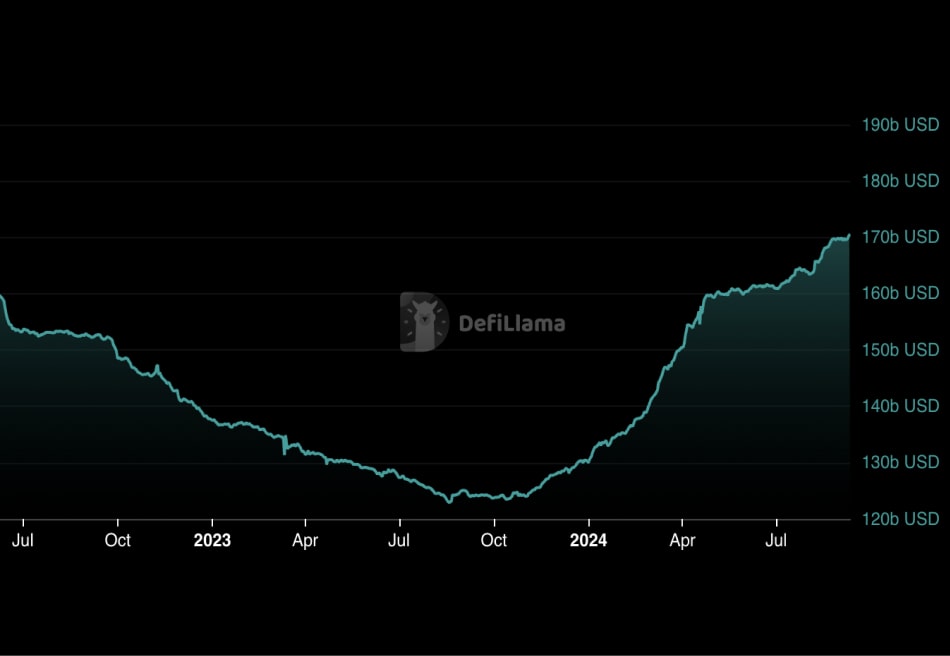

The stablecoin market has surged to a new peak, reaching $170 billion in market capitalization, its highest level since TerraUSD’s collapse in May 2022.

Data from DeFiLlama shows a 42.86% rise in the market cap, up from $119.1 billion in November 2023.

This growth is driven by the top three stablecoins—Tether (USDT), USD Coin (USDC), and Dai (DAI)—which account for 94% of the total stablecoin market, with USDT alone comprising 69.54%.

According to a CoinGecko report, 8.7 million stablecoin holders, including 5.8 million USDT holders, are contributing to this market boost.

Analysts see the increase in stablecoin supply as a positive sign for Bitcoin, indicating that investors are preparing to buy.

A decrease in Bitcoin reserves on exchanges further supports this bullish outlook. This is evident by the fact that reduced selling pressure and increased buying power often lead to price rallies.

Additionally, a rise in global liquidity could provide further momentum for Bitcoin, potentially driving a strong Bitcoin surge in Q4 2024.

Macro analyst Julien Bittel highlighted:

Bitcoin, being extremely sensitive to liquidity conditions, has the potential to move explosively as fresh liquidity flows into the system.