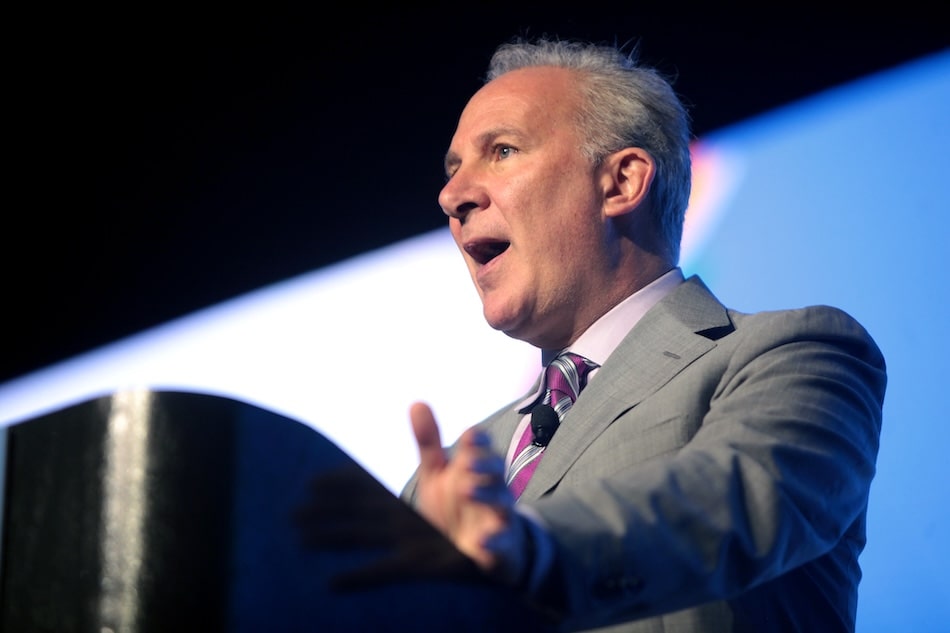

Gold investor Peter Schiff has publicly criticized MicroStrategy’s bitcoin-focused business model, labeling it a “fraud” and calling out company founder Michael Saylor for a debate at Binance Blockchain Week in Dubai this December.

Schiff issues debate challenge

Schiff, a well-known bitcoin skeptic and gold proponent, took to social media to challenge both Saylor and Binance co-founder Changpeng Zhao (CZ) to public debates. In one of his posts, Schiff argued:

“MSTR’s business model relies on income-oriented funds buying its ‘high-yield’ preferred shares. But those published yields will never actually be paid. Once fund managers realize this, they’ll dump the preferreds.”

Schiff warned that such an outcome would prevent MicroStrategy from issuing further debt, potentially sending the company into a “death spiral.”

Company metrics under pressure

This challenge comes as both bitcoin and MicroStrategy suffer from market declines.

Bitcoin’s price is down more than 20% from its October all-time high, now trading under $99,000.

MicroStrategy’s mNAV (multiple on net asset value), a metric reflecting the premium of its stock price over its underlying bitcoin holdings, recently dipped below 1 before rebounding to 1.21—still well below the 2.0 level considered healthy for treasury companies.

The company’s stock has dropped over 50% since July, now around $199 per share. For more on MicroStrategy’s bitcoin holdings, see the MicroStrategy historical bitcoin holdings page.

Gold remains resilient

Meanwhile, gold has held above the $4,000 per ounce support level despite a brief dip, trading at approximately $4,085.

Gold’s recent peak in October saw it hit a record $4,380 per ounce, with a market capitalization surpassing $30 trillion before moderating to current levels. In contrast, bitcoin continues to face price volatility and pressure on major corporate treasuries.