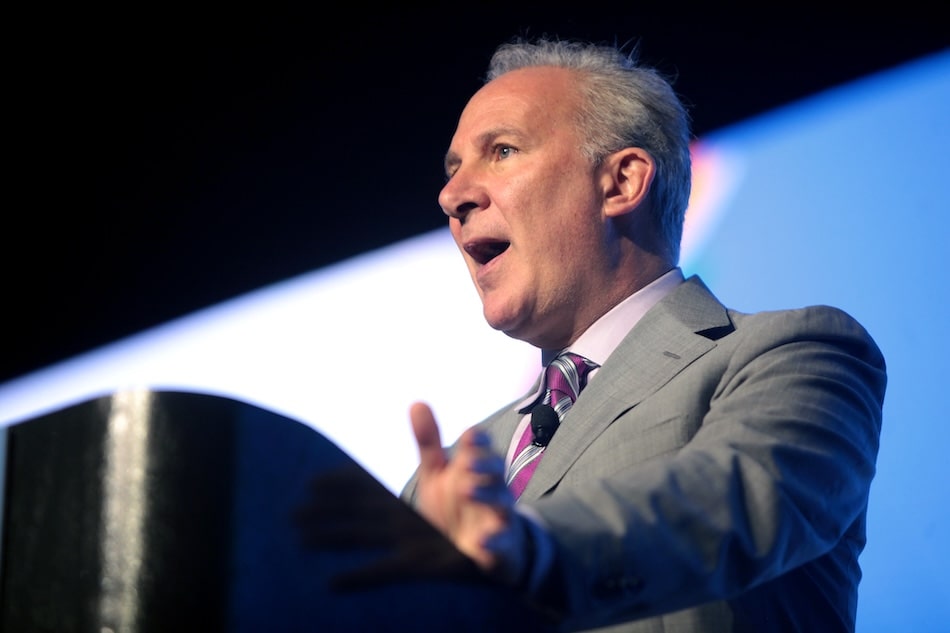

A high-profile debate between gold advocate Peter Schiff and Binance co-founder Changpeng “CZ” Zhao at Binance Blockchain Week in Dubai underscored the challenges of verifying physical gold and the ongoing rivalry with bitcoin.

Panel highlights gold’s verification problem

During the panel, CZ handed Schiff a gold bar and asked if he could confirm its authenticity. Schiff replied:

“I don’t know.”

The audience responded with laughter, highlighting the difficulty—and trust requirements—in verifying physical gold.

CZ emphasized that anyone can verify bitcoin instantly using a full node or by checking its cryptographically secure public ledger, while gold still relies on centralized trust and costly audits.

Tokenized gold vs. bitcoin

Schiff promoted his TGold platform, which allows users to buy tokenized, vaulted gold and eventually redeem either the physical bar or a digital token.

He argued that tokenization solves some issues of portability and divisibility but maintained that gold’s intrinsic value makes tokenized gold superior to bitcoin.

CZ conceded some benefits, stating:

“Tokenized gold is actually almost better than the gold itself … divisible, transferable, transportable.”

Arguments over scarcity, utility, and speculation

Schiff argued:

“Bitcoin is backed by nothing … it doesn’t have a utility beyond the fact that I can transfer it to you and you can transfer it to somebody else.”

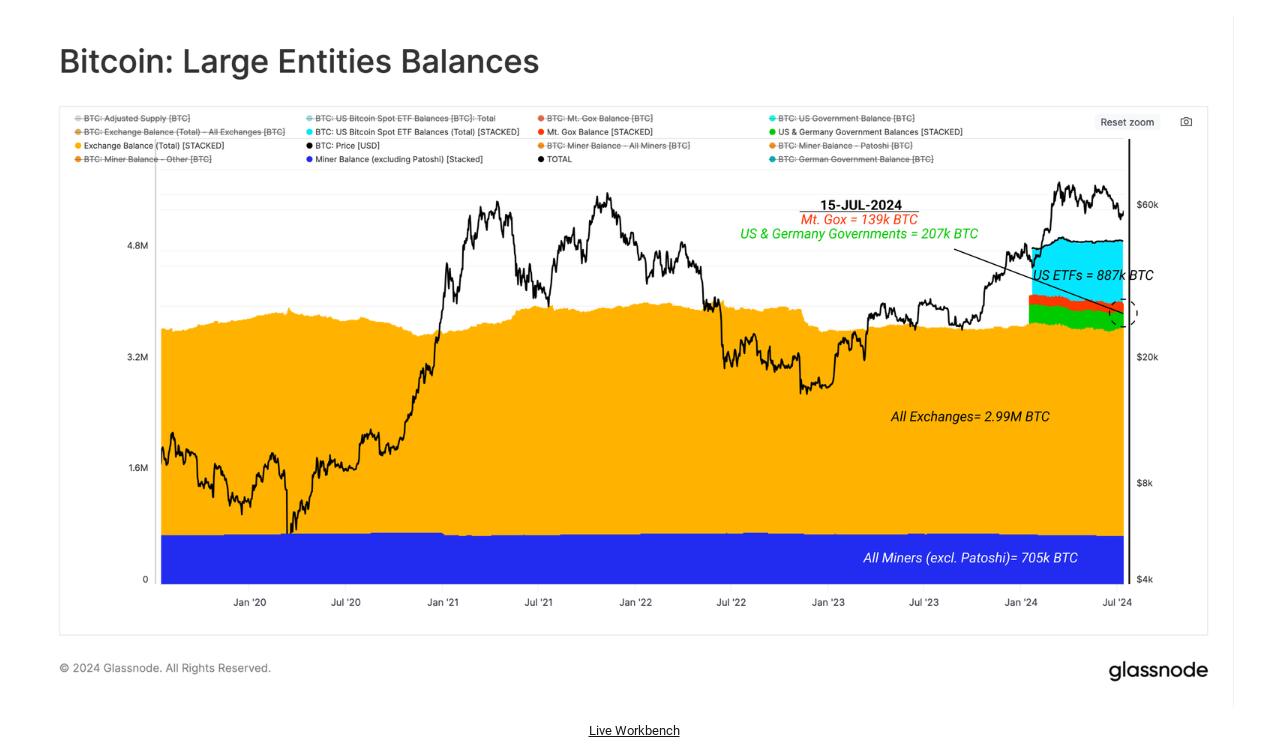

He claimed bitcoin’s real-world purchasing power has lagged gold in recent years, even with major ETF inflows and adoption.

CZ countered, noting bitcoin’s utility in real-world payments and its verifiable scarcity. Comparing gold’s unknowable true supply to bitcoin’s fixed issuance, CZ said:

“With Bitcoin, we know exactly how much there will be, and we know exactly where they are.”

The debate closed with CZ predicting bitcoin would outperform gold, while Schiff insisted rising demand for precious metals would ultimately outshine digital assets.

Gold verification remains costly

According to the London Bullion Market Association, only fire assaying—melting down the metal—can verify gold with 100% certainty, making non-destructive verification impossible.

This underlines the trust gap that bitcoin’s open ledger aims to solve.