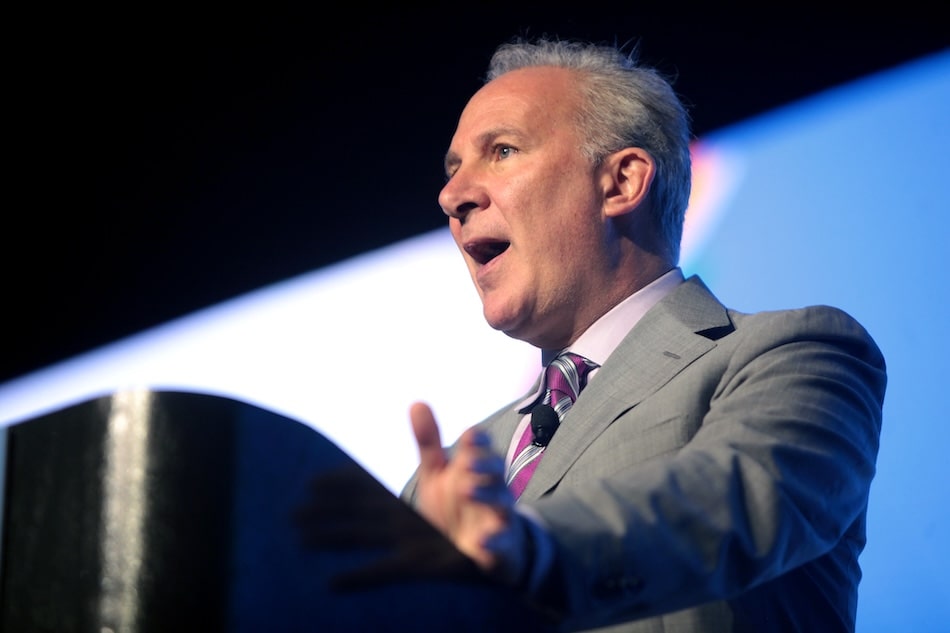

Economist and gold advocate Peter Schiff has renewed his criticism of Bitcoin, arguing that its current bull market is not organic but the result of political influence from Washington, DC and vested interests on Wall Street.

Schiff doubles down on bitcoin criticism

In a recent interview, Schiff dismissed the narrative that Bitcoin acts as a hedge against inflation or U.S. dollar weakness.

Instead, he claims the very institutions Bitcoin was designed to bypass are now supporting it, creating what he calls a “bubble.”

He stated:

“Bitcoin’s rise is not due to its fundamentals, but because of manipulation and interests in Washington and on Wall Street.”

Warning of a looming collapse

Schiff has remained steadfast in his belief that Bitcoin will eventually “go to zero,” despite being proven wrong in previous market cycles.

He suggests that the current support from powerful financial and political players may not last, leaving Bitcoin exposed to a sharp downturn should their stance change.

Questions on store of value narrative

The economist also challenged the narrative that Bitcoin is a safe haven, arguing that gold could reclaim its role as the primary store of value in times of financial instability.

This position comes amid ongoing debates about bitcoin’s price history and its relationship to broader economic trends.

Industry reactions and market context

Schiff’s stark warnings come as Bitcoin maintains a market capitalization above $2 trillion, with high daily trading volumes and ongoing interest from institutional investors.

However, some analysts continue to argue that Bitcoin remains underpriced based on its fundamentals, underscoring the divide in market sentiment.