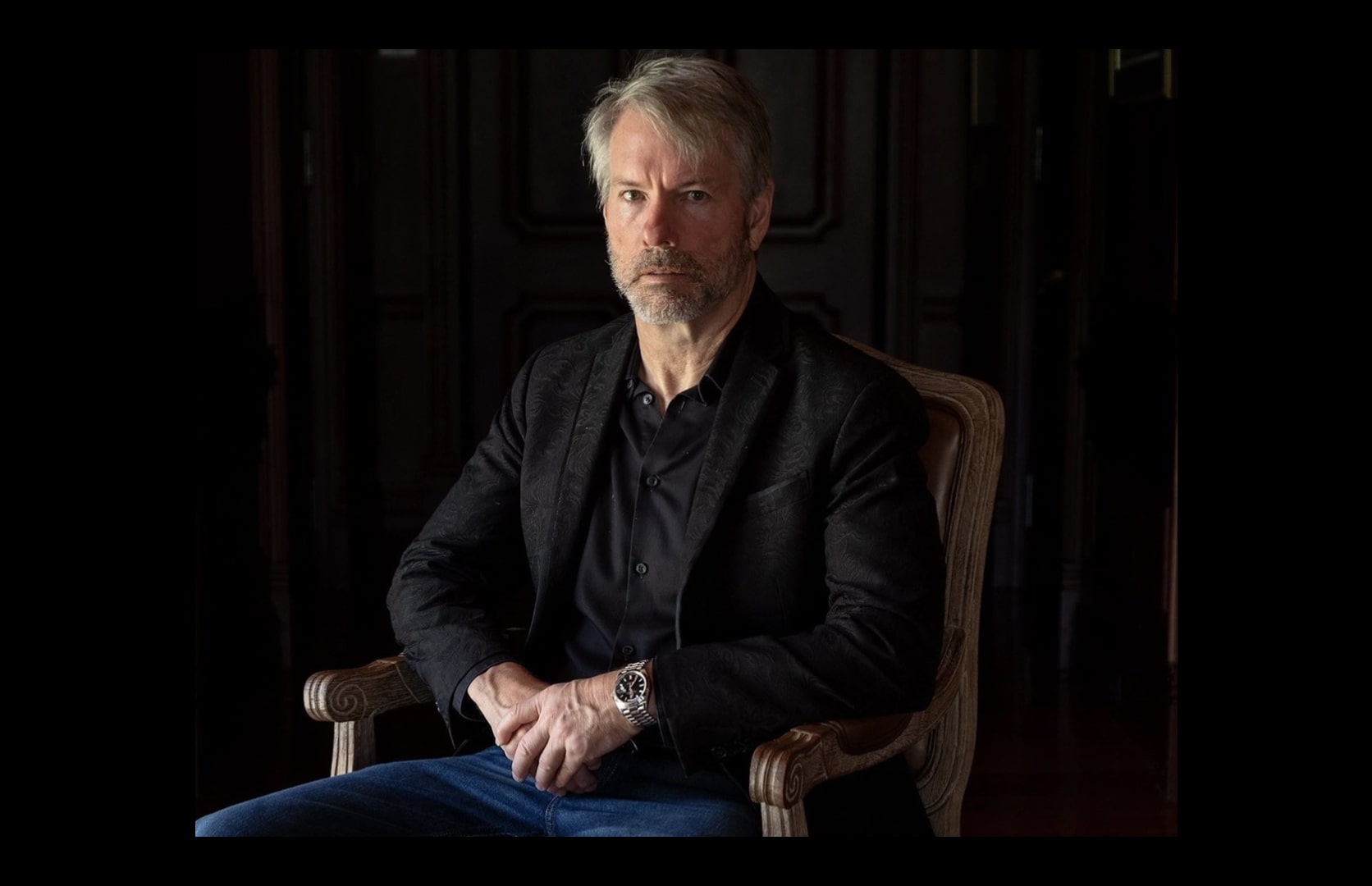

Michael Saylor, executive chairman of Strategy, highlighted the firm’s ability to swiftly turn new capital into bitcoin, stating that $100 million can be deployed within an hour of raising it.

This rapid investment cycle, he claims, is far quicker than in technology, real estate, or other asset classes.

Rapid bitcoin accumulation

In a recent podcast appearance, Saylor described how Strategy can complete massive bitcoin purchases almost instantaneously. He explained:

“Sometimes we’re literally selling 50 million an hour or 100 million an hour and buying the $100 million of Bitcoin the same hour. Like we could do a billion dollars of capital raising in a day and we might have 20 million of exposure at 4 pm, and by 5 pm, 6 pm, we’re fully done.”

This approach enables Strategy to respond quickly to market opportunities, making it a leader among public companies holding bitcoin.

The company currently owns 640,250 BTC—nearly 2.5% of all bitcoin in existence, according to recent disclosures.

For details on Strategy’s historical and current holdings, see the MicroStrategy bitcoin holdings tracker.

Building in real time

Saylor emphasized the firm’s unique model, likening its process to constructing value in real time. He stated:

“If someone hit the bid and wanted to buy $500 million in a minute, we build a building in a minute. In 60 seconds. Trade is done. Cash changes hands. We create the collateral. We bought the Bitcoin underlying that day.”

Addressing criticism

Despite Strategy’s aggressive accumulation, some critics raise concerns about shareholder dilution and risk.

Saylor dismissed these concerns, arguing that critics are “strategically ignorant” of the benefits and mechanisms behind the company’s approach.

He explained that equity investors assess the company based on bitcoin yield and appreciation per share, while credit investors focus on the security’s USD yield, now swapped for a bitcoin yield using the bitcoin as collateral.