Bitcoin fell sharply to $87,600 on Sunday evening before rebounding above $89,000, marking its lowest price since early December.

The recent pattern of weekend volatility has become familiar to traders, with some attributing the latest downturn to macroeconomic developments in Japan.

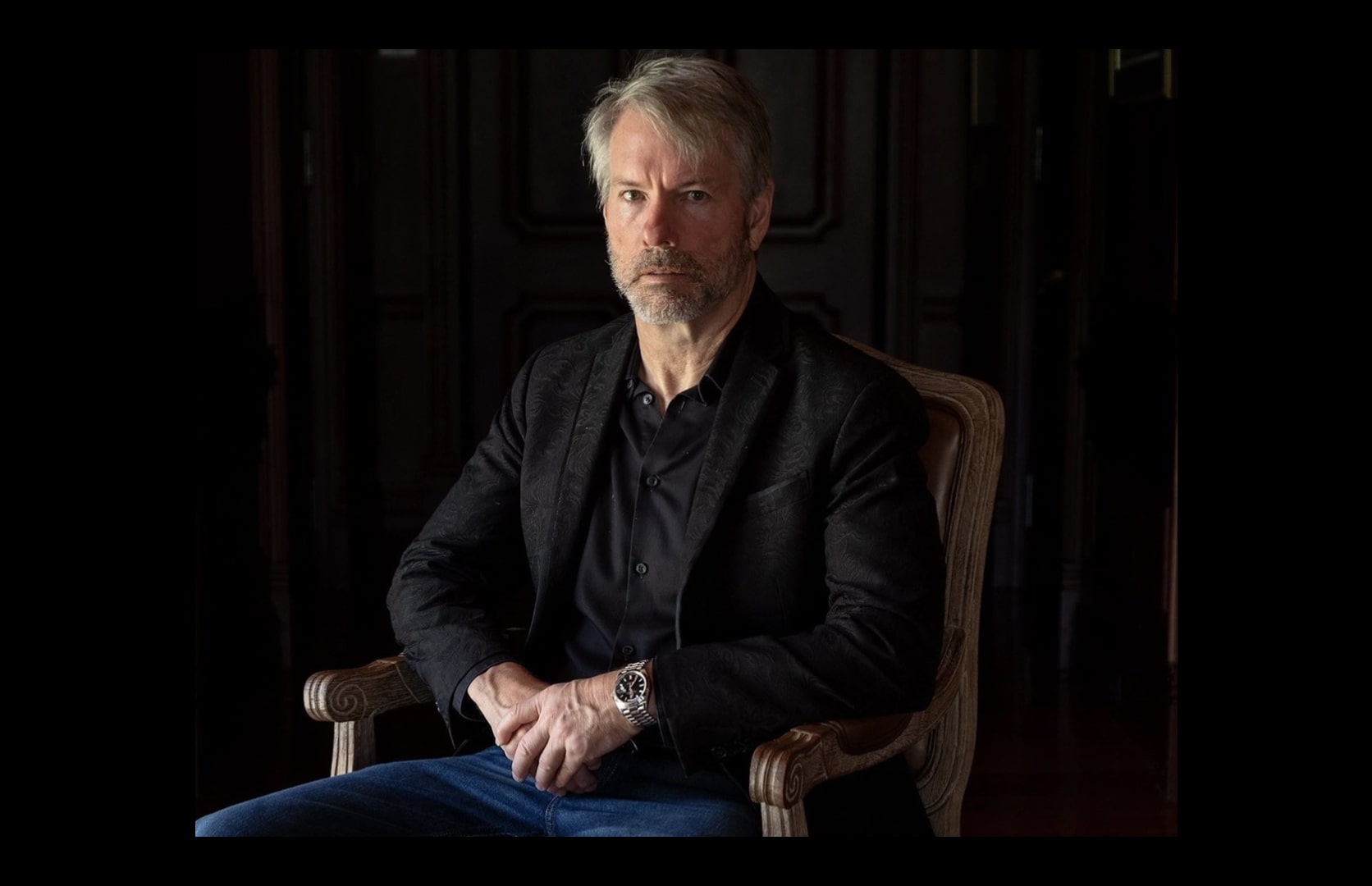

Saylor signals another bitcoin purchase

Michael Saylor, chair of Strategy, appeared to hint at a new bitcoin acquisition, posting “Back to More Orange Dots” on X, referencing the firm’s signature portfolio chart.

Strategy’s most recent purchase, the largest since July, was 10,624 BTC on December 12.

According to public data, the company currently holds 660,624 BTC, valued at approximately $58.5 billion. Strategy’s average cost basis stands at $74,696 per coin.

Bank of Japan eyed as source of selling

Analysts have suggested that fears around an anticipated interest rate hike by the Bank of Japan are driving selling pressure. Analyst “NoLimit” said on Sunday:

“People are seriously underestimating what Japan is about to do to Bitcoin.”

Past Japanese rate increases have coincided with steep bitcoin price declines, as Japan is the largest foreign holder of U.S. debt.

Polymarket data suggests a 98% probability of a 0.25% rate hike this Friday.

Market reaction and outlook

Justin d’Anethan of Arctic Digital remarked that the drop to $88,000 “feels like a defeat,” noting that rate expectations in Japan have spurred fears of a carry trade unwind and selling by macro funds.

Another analyst, “Sykodelic,” argued the move was already priced in, stating markets act in advance of such events. D’Anethan predicts bitcoin will remain range-bound between $80,000 and $100,000 as traders await new catalysts.