Bitcoin’s appeal to major institutions is growing, but this shift may come at the cost of the high volatility that has attracted many retail traders.

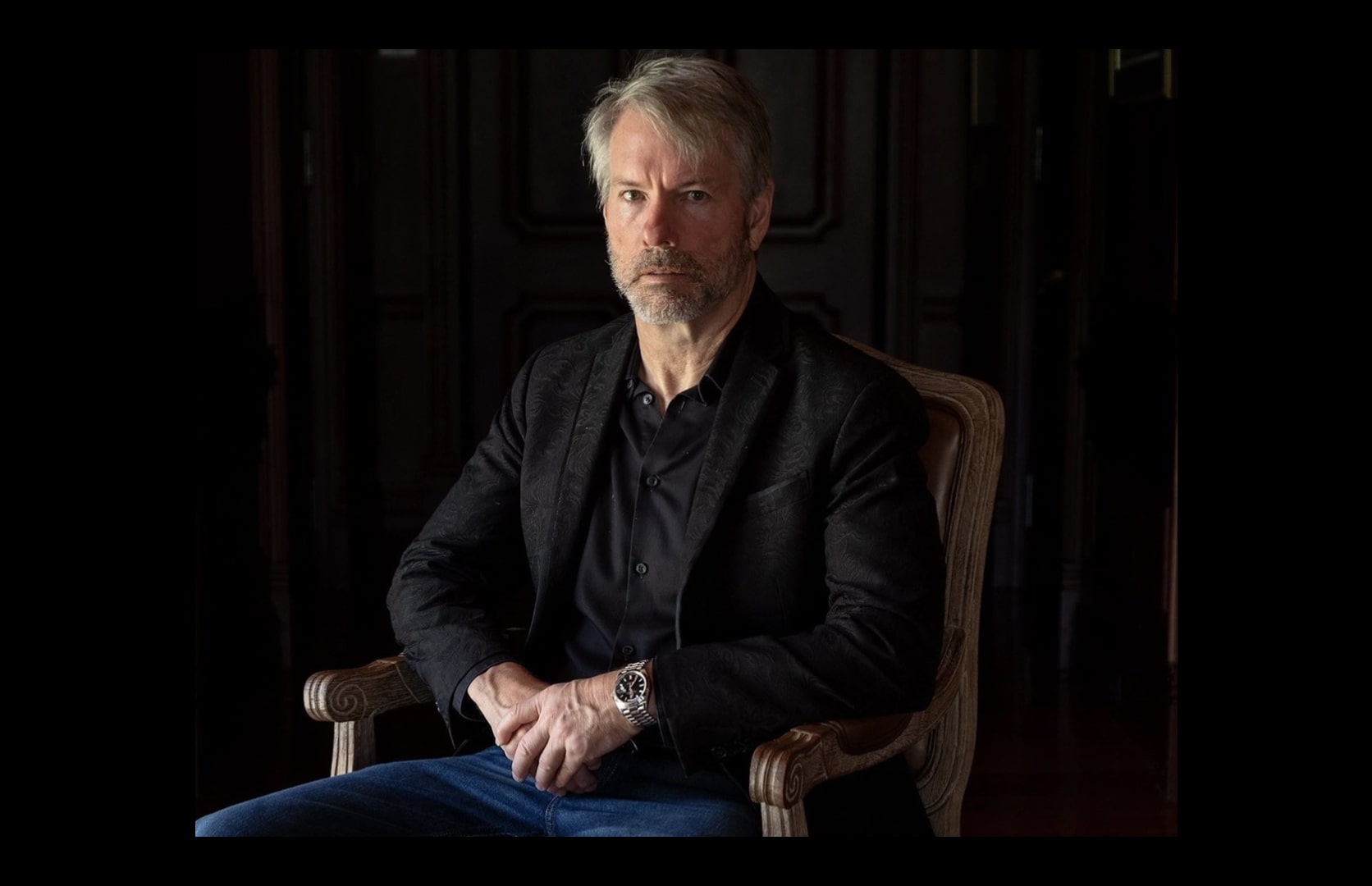

According to Strategy executive chairman Michael Saylor, decreased volatility is a necessary step for Bitcoin’s maturation into an institutional-grade asset.

Saylor addresses the volatility conundrum

Saylor, speaking on the Coin Stories podcast, explained that while institutions prefer a stable market, this could dampen the excitement for some retail participants. He stated:

“It’s like they had this big high and now the adrenaline is wearing off and they’re a little bearish.”

He described this as a natural part of Bitcoin’s life cycle, adding that the reduction in volatility signals the asset is maturing and attracting larger players.

Price stagnation and market reactions

Bitcoin recently reached a new high of $124,100 on August 14, but has since traded sideways, hovering near $115,760.

This stability has prompted questions about the next major move.

Some analysts believe the recent U.S. Federal Reserve interest rate cut was already priced in, but anticipate that additional cuts could provide upward momentum for Bitcoin.

Diverging price outlooks

Market opinions remain divided.

BitMEX co-founder Arthur Hayes projects a year-end target of $250,000, while other analysts foresee more modest gains around $150,000.

Some, including analyst PlanC, argue that the cycle peak may not come this year.

Conversely, Benjamin Cowen warns of a potential 70% drawdown from the eventual all-time high.

Institutional adoption and future growth

Saylor emphasized that Bitcoin is still in its early innovation phase, likening it to a “digital gold rush” for the next decade.

He expects continued product and business model experimentation as institutional involvement grows.

Currently, publicly-listed companies have accumulated approximately $117.91 billion in Bitcoin.