Key Takeaways

- Saylor says shareholders would suffer if Bitcoin crashed 90% long-term.

- Strategy holds $59B in Bitcoin but only $60.3M in cash.

- The company raised $580M in preferred stock to fund more Bitcoin buys.

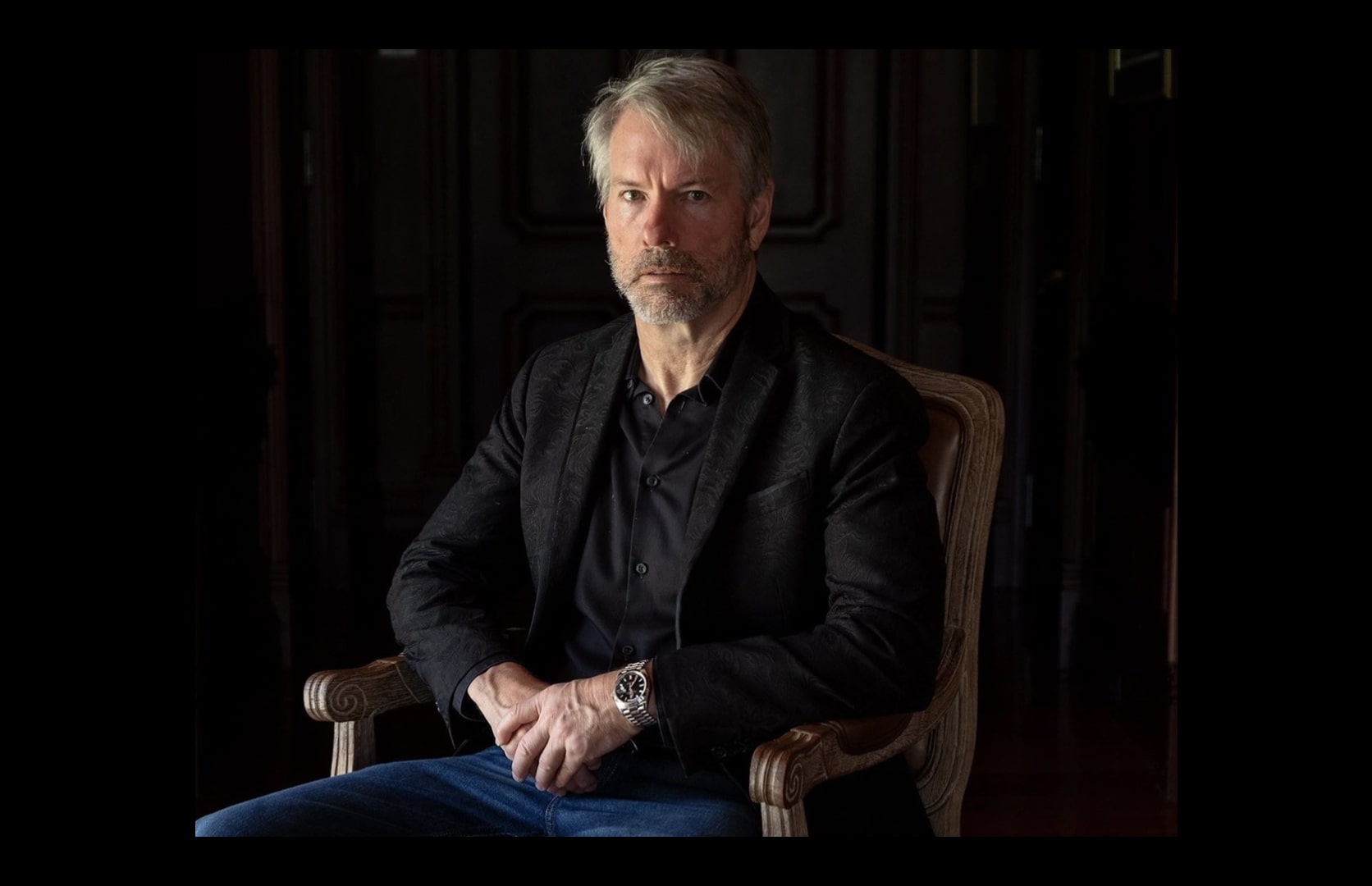

Michael Saylor, executive chairman of Strategy (formerly MicroStrategy), admitted that shareholders would face steep losses if Bitcoin fell by 90% and stayed there for four or five years.

Despite this, Saylor claims the company itself would remain stable due to its capital structure.

Strategy’s Bitcoin holdings and financial position

Strategy is the largest corporate holder of Bitcoin, owning 568,840 BTC—worth nearly $59 billion.

The company has raised capital through convertible debt and stock offerings to fuel more Bitcoin purchases.

As of March 31, Strategy held only $60.3 million in cash, while its Bitcoin holdings were valued at $43.5 billion.

Saylor’s statement on capital structure

In a Financial Times interview, Saylor stated:

Our capital structure is constructed (so) that Bitcoin could fall 90% and stay there for four or five years, and we would still be stable… It wouldn’t be a good outcome for the equity holders.

Risks of a highly leveraged strategy

The firm’s highly leveraged strategy poses risks to shareholders.

If Bitcoin prices drop significantly, equity holders—at the top of the capital stack—would be hit hardest.

Recent capital raises

Strategy’s recent capital raises include a $580 million preferred stock offering and a second “perpetual strife” preferred stock issuance.

Both are structured to bring in funds for additional Bitcoin purchases.

Saylor’s long-term vision

Despite concerns about long-term sustainability, Saylor remains steadfast in his goal:

Whoever gets the most bitcoin wins. There is no other endgame.