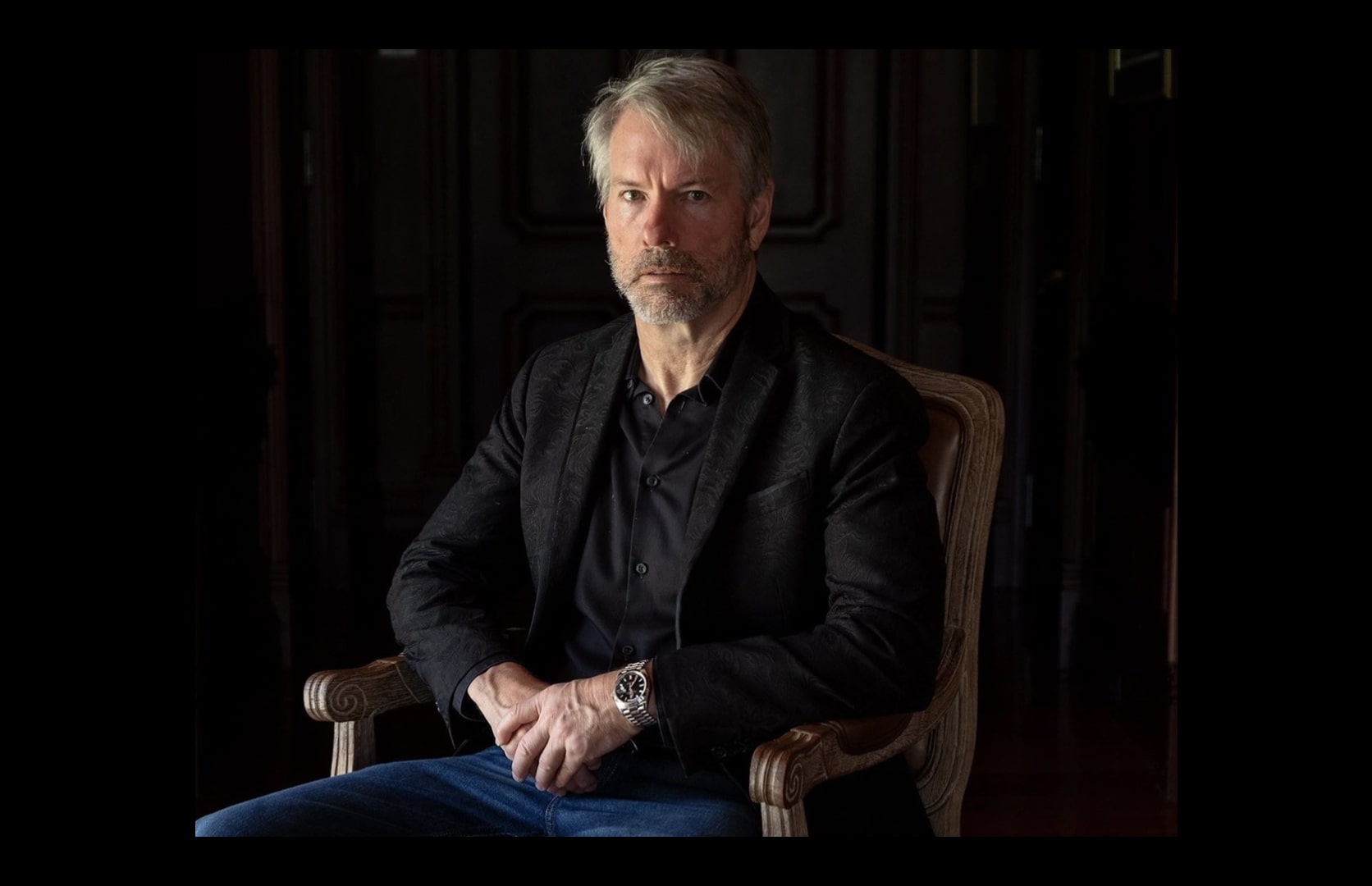

Michael Saylor, co-founder of Strategy and leader of the largest public Bitcoin treasury, has projected that Bitcoin could reach $150,000 by the end of 2025.

Saylor’s optimism on bitcoin’s future

Speaking at the Money 20/20 conference in Las Vegas, Saylor highlighted the past year as a turning point for the industry.

He pointed to the U.S. Securities and Exchange Commission’s support for tokenized securities, US Treasury Secretary Scott Bessent’s endorsement of stablecoins for dollar stability, and a broader regulatory shift as factors underpinning his bullish outlook.

Saylor told CNBC:

“Our expectation right now is that by the end of the year, it should be about $150,000, and that’s the consensus of the equity analysts who cover our company and the Bitcoin industry.”

Market crash and trade tensions

His forecast follows a sharp decline in bitcoin prices, largely triggered by U.S. President Donald Trump’s announcement of 100% tariffs on Chinese imports, which spooked markets and fueled macroeconomic uncertainty.

Despite the sell-off, analysts maintain that the long-term uptrend for bitcoin remains intact.

For a deeper look at bitcoin’s price drawdowns from all-time highs, see the bitcoin drawdown chart.

Investors eye trade deal progress

Market participants are hopeful that a U.S.-China trade agreement will reverse recent losses.

In recent weeks, officials from both sides have signaled a willingness to negotiate, culminating in Trump’s confirmation of an upcoming meeting with President Xi Jinping at the APEC summit in Seoul. US and Chinese leaders have reportedly reached a “substantial” trade framework, prompting investor enthusiasm.

Investor Anthony Pompliano stated:

“Asset prices will get crazy this week if the US-China trade deal is announced and the Fed cuts interest rates. Buckle up.”