Key Takeaways

- RFK Jr. plans to create a Bitcoin strategic reserve and strengthen the dollar with hard assets.

- The proposal includes nonreportable and nontaxable Bitcoin transactions.

- Kennedy aims for the US to purchase 500 Bitcoin daily to build a significant reserve.

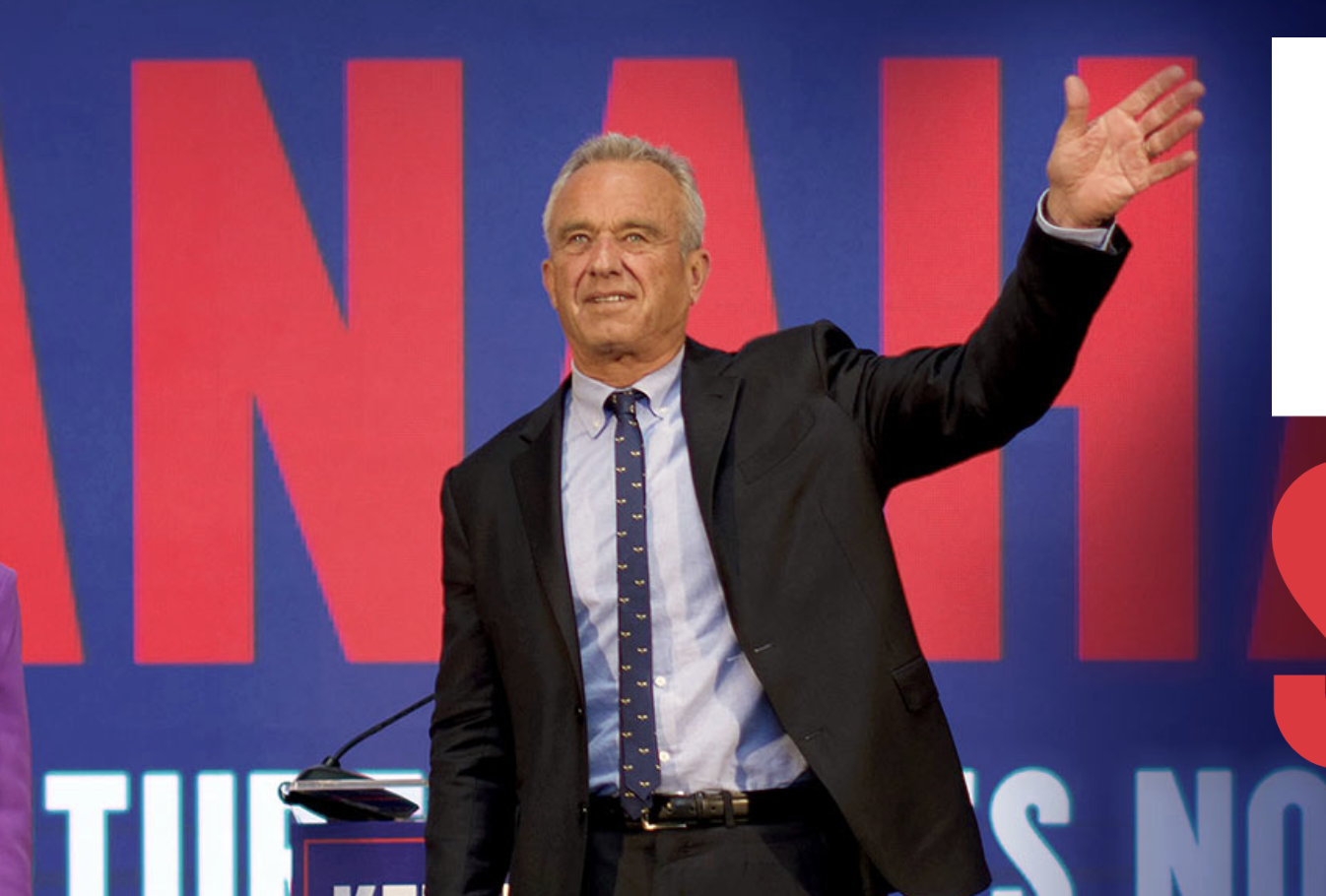

Independent presidential candidate Robert F. Kennedy Jr. highlighted Bitcoin’s potential to revitalize the US economy during his speech at the Bitcoin 2024 conference on July 26. He committed to several executive orders aimed at integrating Bitcoin into the nation’s financial system if elected.

Bitcoinization by Executive Order

Kennedy outlined plans to transfer 204,000 Bitcoins held by the US government to the Federal Reserve as a strategic asset. Additionally, he proposed the Treasury Department purchase 500 Bitcoins daily until the reserve hits four million BTC. This move, he claimed, would ensure a dominant financial position for the US, with Bitcoin reserves potentially worth…

Hundreds of trillions of dollars.

Kennedy also promised tax reforms for Bitcoin transactions, including making them nonreportable and nontaxable, and allowing Bitcoin to qualify for the 1031 Exchange program, encouraging real estate investment.

Bitcoin’s Broader Advantages

Kennedy emphasized Bitcoin’s role in promoting transactional freedom, likening it to the First Amendment’s freedom of expression. He suggested that Bitcoin could help restore the US economy to its pre-1971 state before President Nixon removed the dollar from the gold standard.

Kennedy argued that fiat currency was created to fund wars, which wouldn’t be possible under a Bitcoin standard. He stated:

If the world was on a BTC standard, there would be no more war because you can’t print Bitcoin.

He also proposed hiring Space Force Major Jason Lowery as a national security adviser due to his thesis on Bitcoin as a “cyber-defense system.”

Finally, Kennedy promised to back US Treasury securities with hard assets, including Bitcoin and precious metals, to curb inflation and stabilize the dollar. He believed this would attract global investment in an American-backed decentralized currency.