Key Takeaways

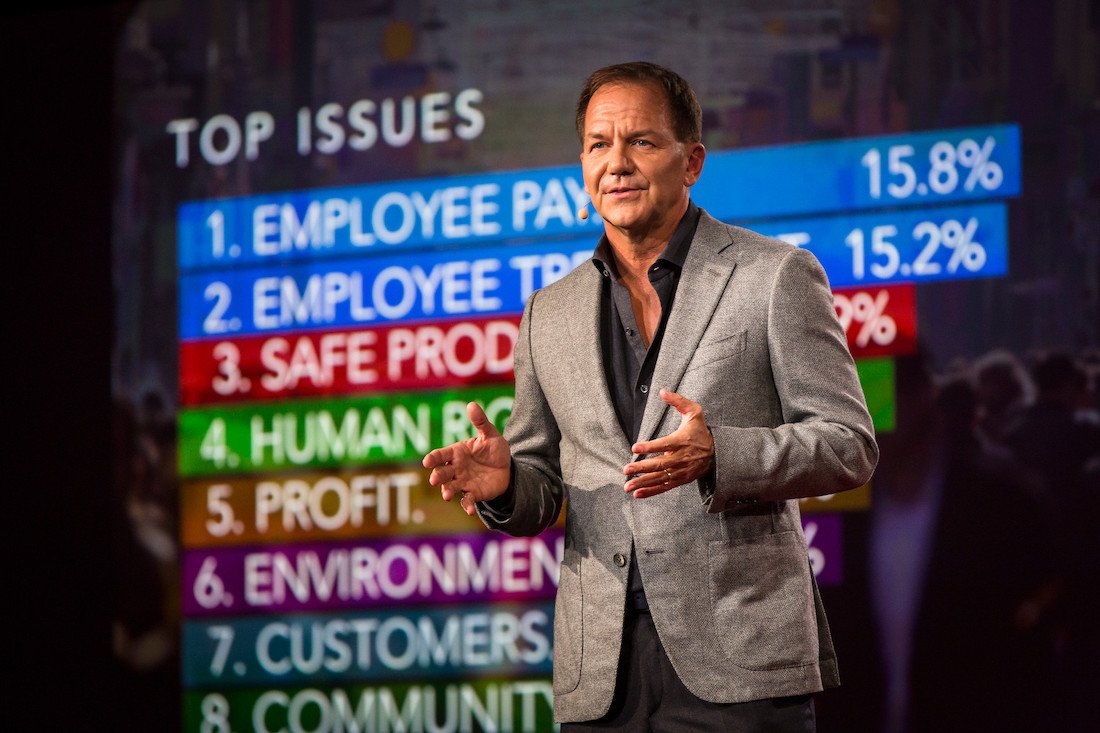

- Paul Tudor Jones eyes Bitcoin as a hedge against inflation.

- He criticizes rising U.S. debt and predicts long-term inflation risks.

- Capital inflows into Bitcoin ETFs have surged before the 2024 U.S. elections.

Billionaire investor Paul Tudor Jones is considering adding Bitcoin to his portfolio amid concerns over the U.S. government’s rising debt and inflation.

In a CNBC interview on Tuesday, Jones expressed that regardless of the outcome of the upcoming U.S. presidential election, “all roads lead to inflation,” steering him away from bonds and toward assets like Bitcoin, commodities, and tech stocks.

National debt

The veteran investor highlighted that the national debt has risen to 100% of GDP, a sharp increase from 60% over the past 25 years.

With fiscal spending and potential tax cuts on the horizon, Jones believes inflation will continue to outpace the Federal Reserve’s 2% target, currently projected by consumers to reach 3% in the next year.

2020

Paul Tudor Jones first embraced Bitcoin in 2020, allocating around 2% of his assets to it, citing its value as a portfolio diversifier.

His renewed interest comes amid rising capital inflows into Bitcoin ETFs ahead of the U.S. elections, as both retail and institutional investors seek a hedge against economic instability.

JPMorgan analysts note that Bitcoin is gaining momentum as geopolitical tensions and economic uncertainty drive demand for safe-haven assets.