Key Takeaways

- NYSE plans to launch options tied to the CoinDesk Bitcoin Price Index.

- These new options will help investors manage risk with Bitcoin.

- NYSE's move into Bitcoin derivatives adds significant credibility.

The New York Stock Exchange (NYSE) plans to launch financial products tied to the spot price of Bitcoin, marking another major move into the Bitcoin space.

The NYSE is collaborating with CoinDesk Indices to develop cash-settled index options that will track the CoinDesk Bitcoin Price Index (XBX).

The XBX is a real-time spot price index for Bitcoin, calculated across major exchanges.

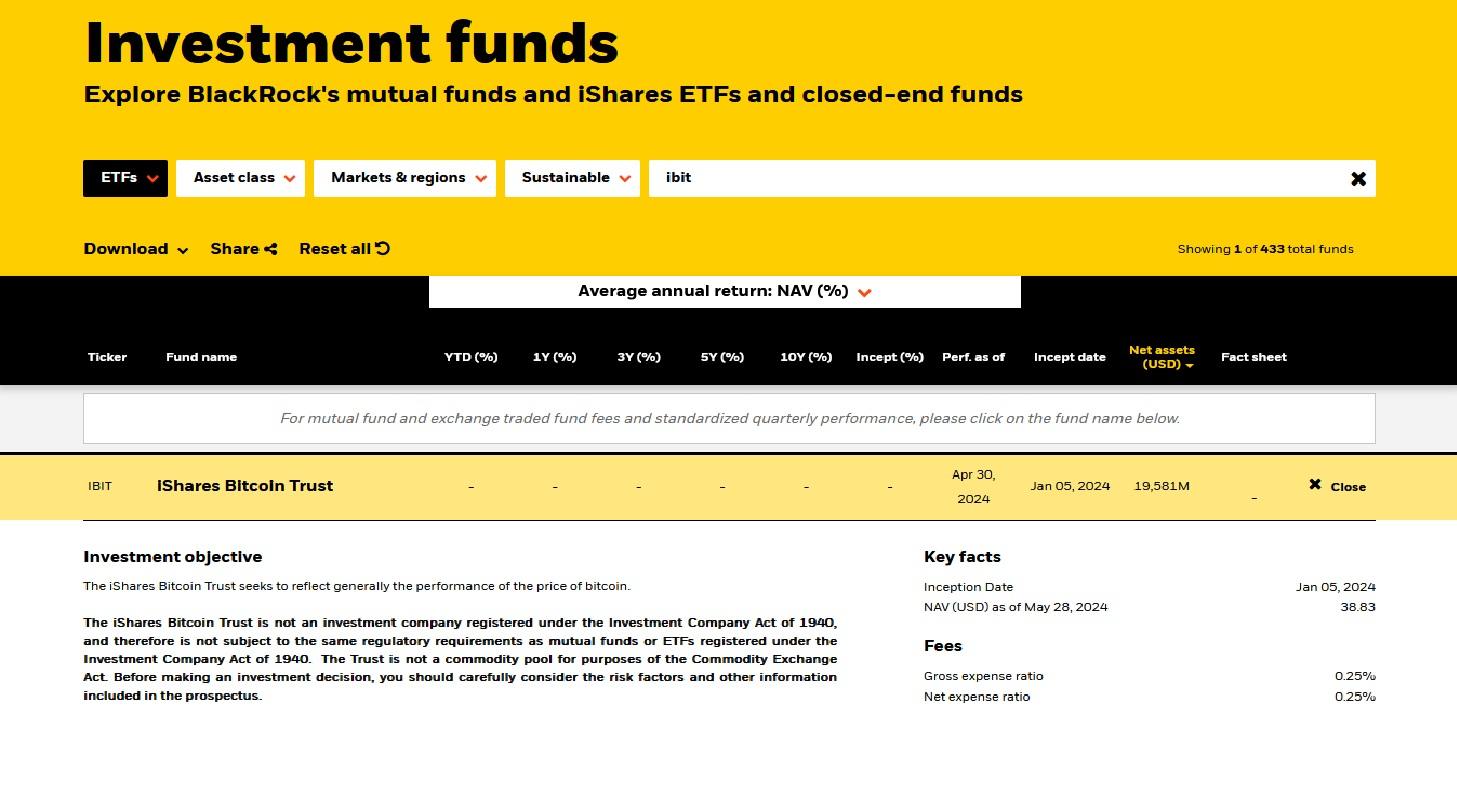

It has been the benchmark for $20 billion worth of Bitcoin ETF assets for over 10 years.

By offering options contracts based on the XBX, the NYSE aims to provide investors with new tools to manage risk as interest in Bitcoin continues to grow.

These products are subject to regulatory approval.

Jon Herrick, NYSE Chief Product Officer, said these new options contracts will give investors:

Access to an important liquid and transparent risk-management tool

Currently, entities like CME offer Bitcoin derivatives products.

The NYSE’s entry into this space adds credibility and highlights the growing acceptance of Bitcoin in traditional finance circles.

With a market capitalization of $25 trillion, the NYSE brings extensive reach and influence to Bitcoin indexing and derivatives, reflecting the asset class’s mainstream acceptance in 2024.