Key Takeaways

- Nvidia's $600B market drop could indirectly aid Bitcoin.

- Crypto IPOs worth $100B may sustain Bitcoin's rally in 2025.

- Bitcoin might peak at $110,000 before a correction in February.

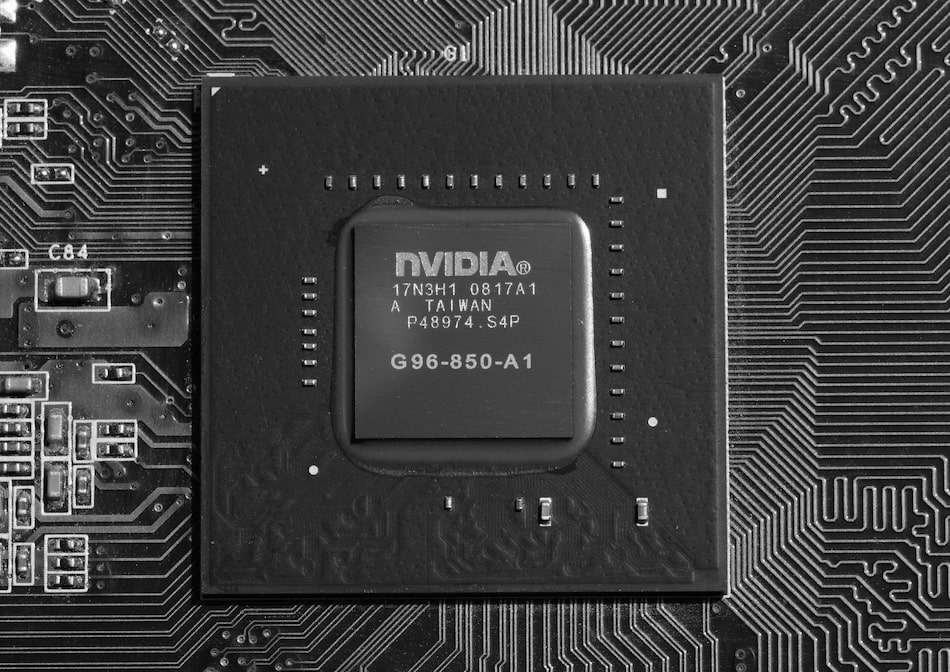

On Jan. 27, Nvidia shares dropped by nearly 17%, wiping out $600 billion in value, marking the largest one-day loss in U.S. stock market history.

The decline followed competition concerns over DeepSeek, a Chinese AI firm rivaling OpenAI.

Analysts at 10x Research consider the slump a potential boost for Bitcoin prices.

Impact on monetary policy

The report suggests reduced spending on AI, due to Nvidia’s setback, could ease inflation.

This may prompt a less aggressive monetary policy from the U.S. Federal Reserve, indirectly benefiting Bitcoin markets.

The report said:

Reducing AI spending keeps share buybacks as a key driver of U.S. equity returns and eases inflationary pressures.

Upcoming crypto IPO wave

Additionally, a wave of upcoming IPOs in 2025 could create incentives for keeping Bitcoin prices elevated.

At least ten major crypto firms plan to go public, with estimated valuations exceeding $73.9 billion.

These IPOs could generate combined valuations of $100 billion to $150 billion, depending on Bitcoin’s performance.

IPO valuation dependencies

The report pointed to patterns seen during Coinbase’s 2021 IPO.

The report noted:

Maintaining high crypto asset prices is critical for achieving these inflated IPO valuations.

Price predictions

Bitcoin is predicted to peak at $110,000 by January before dropping below $70,000 in February, based on its correlation with global liquidity trends, according to Global Macro Investor CEO Raoul Pal.