Key Takeaways

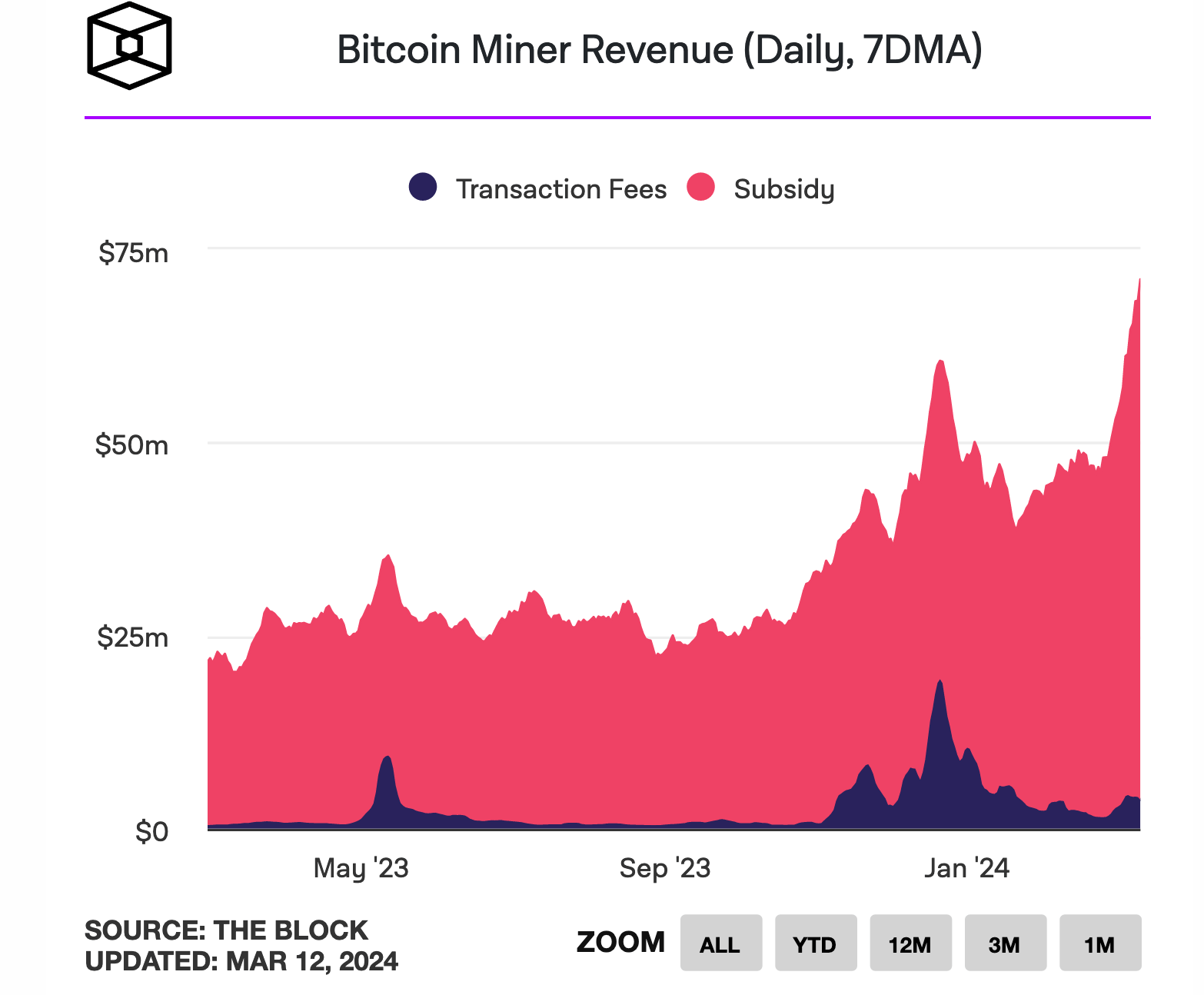

- Bitcoin mining revenue sets a new all-time high, surpassing $68 million.

- Bitcoin's price has soared over 230% year-over-year, bolstered by spot ETF approvals.

- Upcoming halving event in April will halve miner rewards, influencing supply.

Over the weekend, Bitcoin mining revenue soared to a new record, eclipsing its 2021 high.

The seven-day moving average of miner earnings reached $68.28 million on March 9, with a slight increase to $68.35 million by Sunday.

This peak coincides with Bitcoin’s price surge, setting a record high near $73,000 on Monday.

Price surge and ETF approvals

Bitcoin’s price has experienced significant growth, rising over 230% from its value a year ago.

This increase is attributed to the approval of spot Bitcoin ETFs in the U.S. earlier this year.

Additionally, the transaction volume on the Bitcoin network hit an 18-month high last week, indicating a robust interest in Bitcoin trading and investment.

Miners and upcoming halving event

Miners are capitalizing on the current bull run, with 13 major Bitcoin mining companies investing over $1 billion in mining rigs since last February.

Bitcoin is also approaching its next halving event in April, which will reduce miner rewards from 6.25 to 3.125 Bitcoin per block, potentially impacting supply growth.