Key Takeaways

- MicroStrategy may resume Bitcoin purchases after a one-week pause, according to hints from Michael Saylor.

- The company currently holds 597,325 BTC, worth over $70.9 billion.

- Institutional treasury holdings are outpacing newly mined Bitcoin supply.

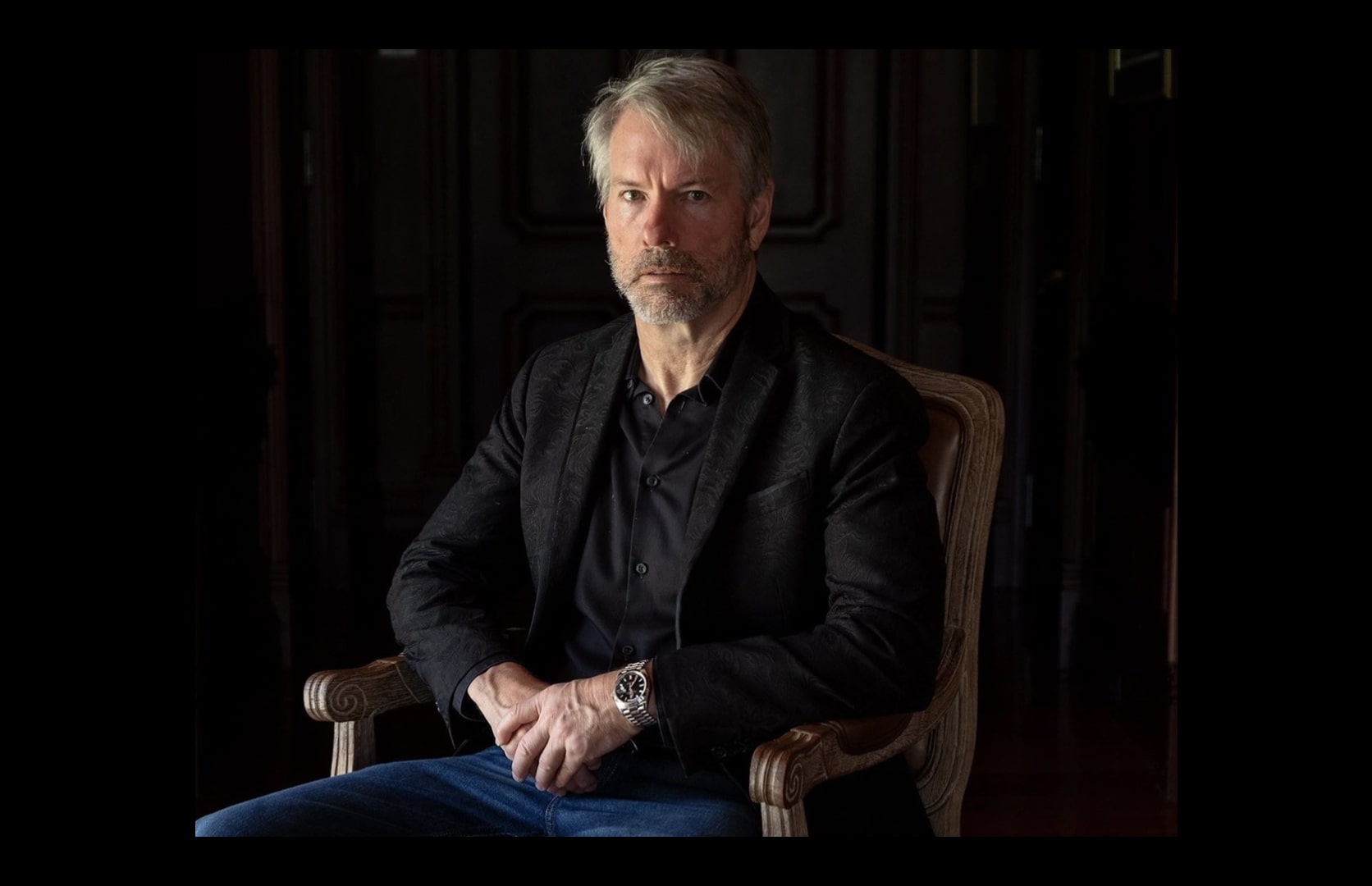

MicroStrategy co-founder Michael Saylor has hinted that the company could soon resume its Bitcoin purchases after a week-long pause, though no official announcement has been made.

Saylor’s comments come after MicroStrategy recently completed a $4.2 billion capital raise, following 12 consecutive weeks of Bitcoin accumulation.

Latest buy

On June 30, MicroStrategy acquired 4,980 BTC for $532 million, pushing its total holdings to 597,325 BTC, now valued at over $70.9 billion.

The company’s stock is trading at approximately $434, up more than 16% this month, but still below its all-time high of $543 per share reached in November 2024.

Largest holder

MicroStrategy remains the largest corporate holder of Bitcoin, a position tracked on the MicroStrategy historical bitcoin holdings page.

Treasury companies as a group purchased 159,107 BTC in the second quarter of 2025, a figure that outpaces the rate at which new Bitcoin is mined, currently around 450 BTC per day.

There are now 3.5 million BTC held in institutional treasuries, including public and private companies, government entities, and asset managers.

Analyst Adam Livingston commented on the rapid pace of accumulation, stating:

“MicroStrategy has accumulated 379,800 in the past 182 days. That’s 2,087 BTC per day — far outpacing the miners.”

This aggressive buying strategy, some analysts warn, could lead to a supply shock and potentially drive prices higher.

However, others caution that debt-fueled institutional buying may not be sustainable and could increase market risks.

For more on all public and private companies holding Bitcoin, see the database of all etfs, public and private companies holding btc.