Key Takeaways

- MicroStrategy increased its Bitcoin holdings with a $458M purchase.

- The company now holds 252,220 Bitcoin worth nearly $16 billion.

- MicroStrategy used proceeds from a $1.01B convertible note offering to fund the purchase.

Nasdaq-listed software company MicroStrategy announced it has purchased 7,420 Bitcoin between September 13 and 19, using $458.2 million from a debt offering. The acquisition was made at an average price of $61,750 per Bitcoin. This brings the company’s total Bitcoin holdings to 252,220 BTC, currently valued at approximately $16 billion.

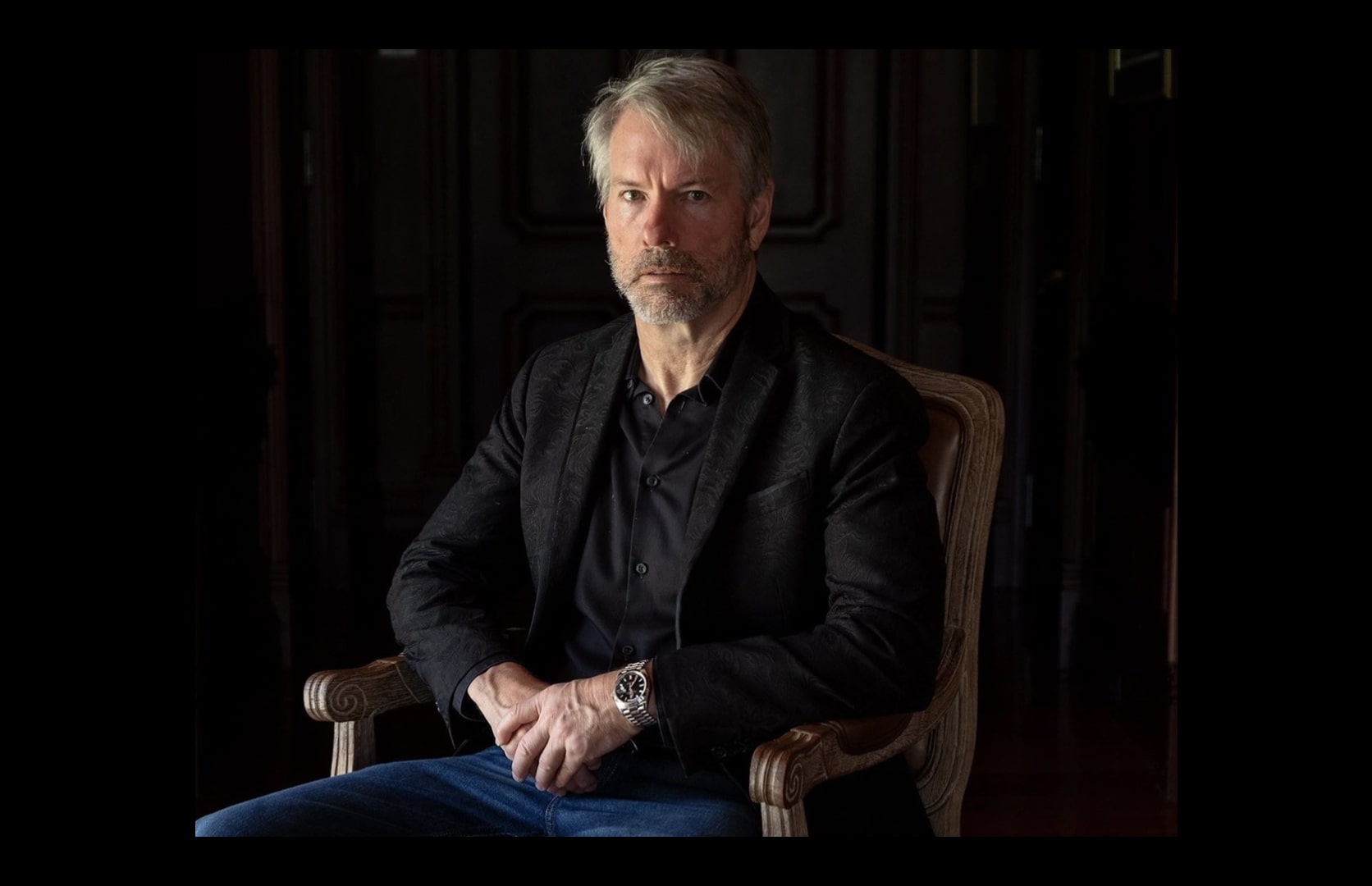

The company also increased the size of its convertible note offering to $1.01 billion from the initially planned $700 million. MicroStrategy’s Executive Chairman, Michael Saylor, has led the firm in becoming the largest corporate holder of Bitcoin, with purchases starting in 2020.

Company filings show that MicroStrategy’s Bitcoin yield, a metric measuring the percentage change in its BTC holdings relative to its fully diluted shares outstanding, rose to 5.1% this quarter, up from 4.4% on September 13. The company’s Bitcoin purchases to date have been made at an average price of $39,266, totaling $9.9 billion in cost.

MicroStrategy still has $889 million remaining from its previous $2 billion ATM equity issuance, potentially for future Bitcoin acquisitions. Despite this, the firm’s shares were down 1.5%, aligning with declines in both U.S. equity indices and Bitcoin prices.