Key Takeaways

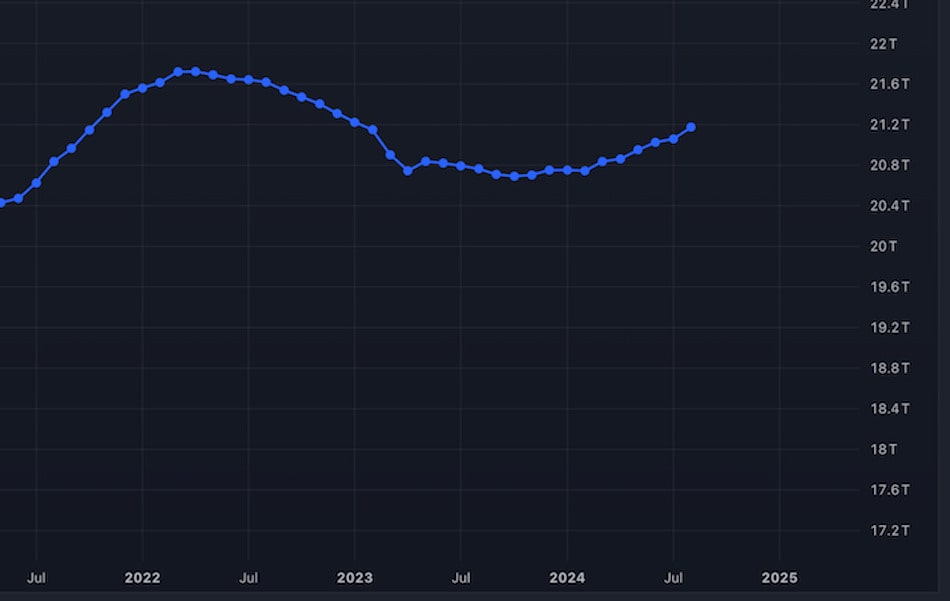

- M2 money supply rose by nearly 1% in August 2024.

- The S&P 500 hit a record high of 5,735 on September 24.

- Bitcoin's CAGR of 50% over five years reflects its correlation with liquidity.

In August 2024, the U.S. M2 money supply surged nearly 1%, coinciding with a 50 basis point interest rate cut by the Federal Reserve. With another rate cut expected in November, aggressive monetary easing by central banks globally has driven asset price appreciation across markets, including the S&P 500 and gold.

On September 24, the S&P 500 hit a record 5,735, while gold climbed to $2,670 per ounce, marking its best year since 2000. The growth of the M2 money supply—now with a compound annual growth rate (CAGR) of 7%—has played a crucial role in supporting financial markets. Central banks’ combined balance sheets exceeded $31 trillion in September, reflecting a large-scale monetary stimulus that has boosted market liquidity.

Historically, the M2 money supply and the S&P 500 have shown a strong correlation, moving together during periods of economic volatility, such as the 2020 pandemic and recent market downturns. Bitcoin has been another key asset benefiting from this liquidity, with a staggering CAGR of 50% over the past five years, outpacing the S&P 500’s 14% growth rate.

As central banks continue to inject liquidity into the economy, the M2 money supply remains a key driver of asset price performance.