Key Takeaways

- Lyn Alden highlights the growing influence of liquidity and macroeconomic factors on the current bitcoin cycle.

- Traditional four-year halving patterns may be less predictive in today's market environment.

- Institutional and corporate adoption, along with political factors, are reshaping bitcoin's market cycles.

Bitcoin has hovered just above $100,000 for months, raising questions about whether this level marks the peak of the current cycle or if further upside remains.

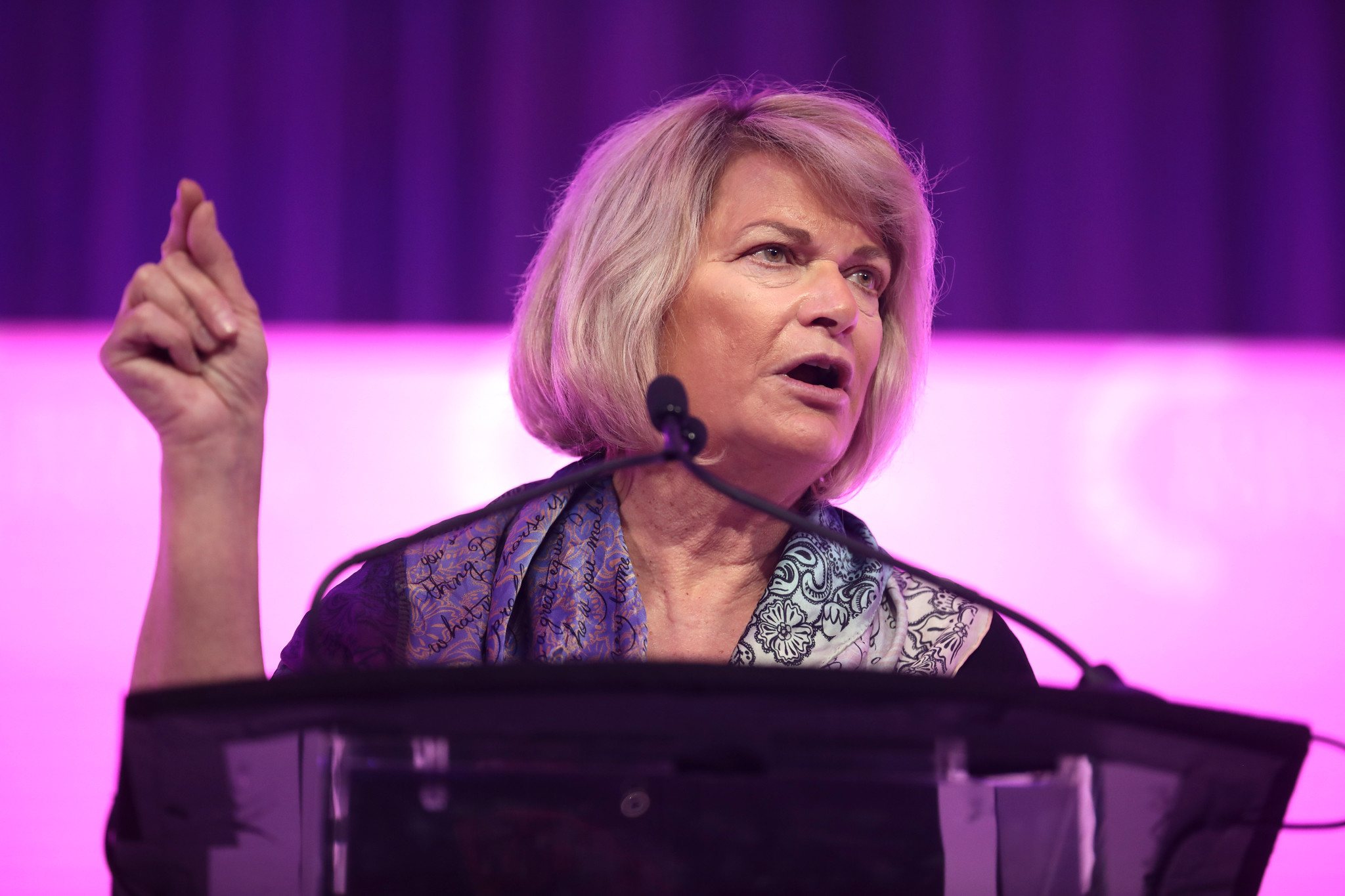

In a recent interview, macro analyst Lyn Alden examined the current stage of the bitcoin market, suggesting that this cycle may differ from previous ones due to shifting liquidity and broader macroeconomic factors.

Alden acknowledged the historical significance of the four-year halving pattern, which has traditionally guided bitcoin price expectations and market psychology.

However, she noted that current conditions may require a different approach, as liquidity trends and global financial shifts now play a more dominant role.

Influences shaping the market

The discussion also addressed the impact of political developments, the rise of corporate bitcoin treasuries, and the presence of institutional investors.

These factors, according to Alden, could be altering the nature and timing of bitcoin market cycles.

Alden offered a measured outlook for investors navigating uncertainty, emphasizing the need to focus on macroeconomic signals rather than relying solely on past cycle patterns. She stated:

“Rather than making bold predictions, investors should pay close attention to the current macroeconomic environment and evolving liquidity conditions.”

For further insights, the full interview can be viewed on Cointelegraph’s YouTube channel.