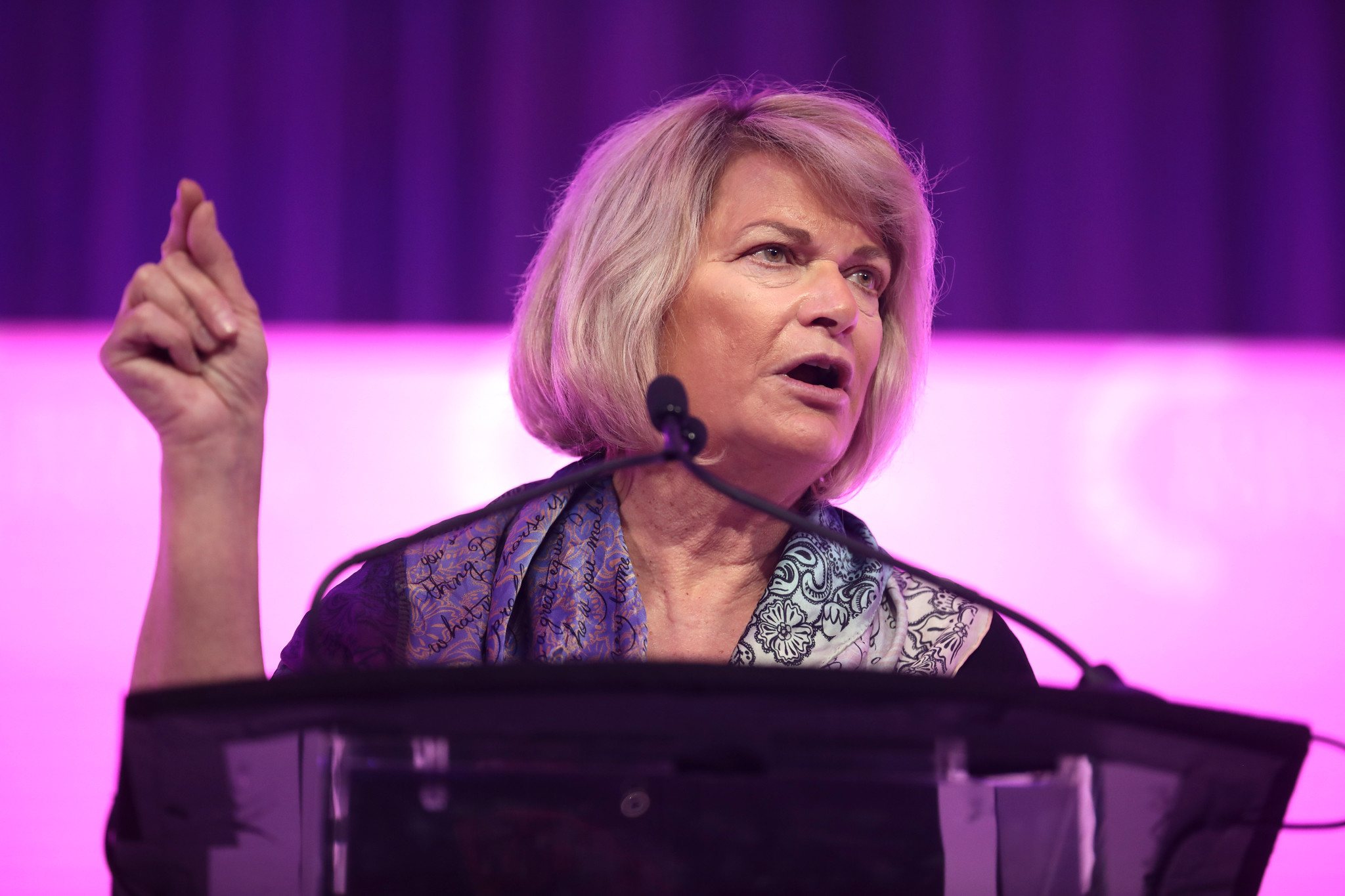

Senator Cynthia Lummis is championing the BITCOIN Act, a legislative proposal that would enable the United States to revalue its gold reserves at current market prices and use the resulting surplus to expand the nation’s Strategic Bitcoin Reserve (SBR).

Treasury stance on bitcoin purchases

Treasury Secretary Scott Bessent recently confirmed that the US will not directly purchase bitcoin for its reserve, opting instead to rely on assets acquired through legal seizures.

This method has drawn criticism for impeding the growth of the SBR, as only a portion of seized bitcoin is legally available for government use.

On-chain data indicates that just 15% of the bitcoin in federal custody has been legally forfeited, with the rest tied up in ongoing court cases or potential returns to prior owners.

For up-to-date figures on federal bitcoin holdings, see the US government bitcoin holdings tracker.

Lummis’ plan to accelerate reserve growth

Lummis argues that revaluing gold reserves offers a budget-neutral way to enhance the SBR without increasing the already substantial national debt. She stated:

“Scott Bessent is right: a budget-neutral path to building SBR is the way. We cannot save our country from $37 trillion debt by purchasing more Bitcoin, but we can revalue gold reserves to today’s prices and transfer the increase in value to build SBR. America needs the BITCOIN Act.”

This approach would allow the Treasury to allocate the paper gains from gold revaluation to bitcoin, sidestepping the bottleneck created by legal restrictions on seized assets.

Legislative and policy implications

Lummis has signaled readiness to collaborate with Treasury and Commerce officials to identify budget-neutral solutions for expanding the bitcoin reserve.

If enacted, the BITCOIN Act would represent a notable shift in US policy—marking the first time gold revaluation is used to fund strategic bitcoin holdings. This could bolster the country’s position in the growing global race for bitcoin reserves.