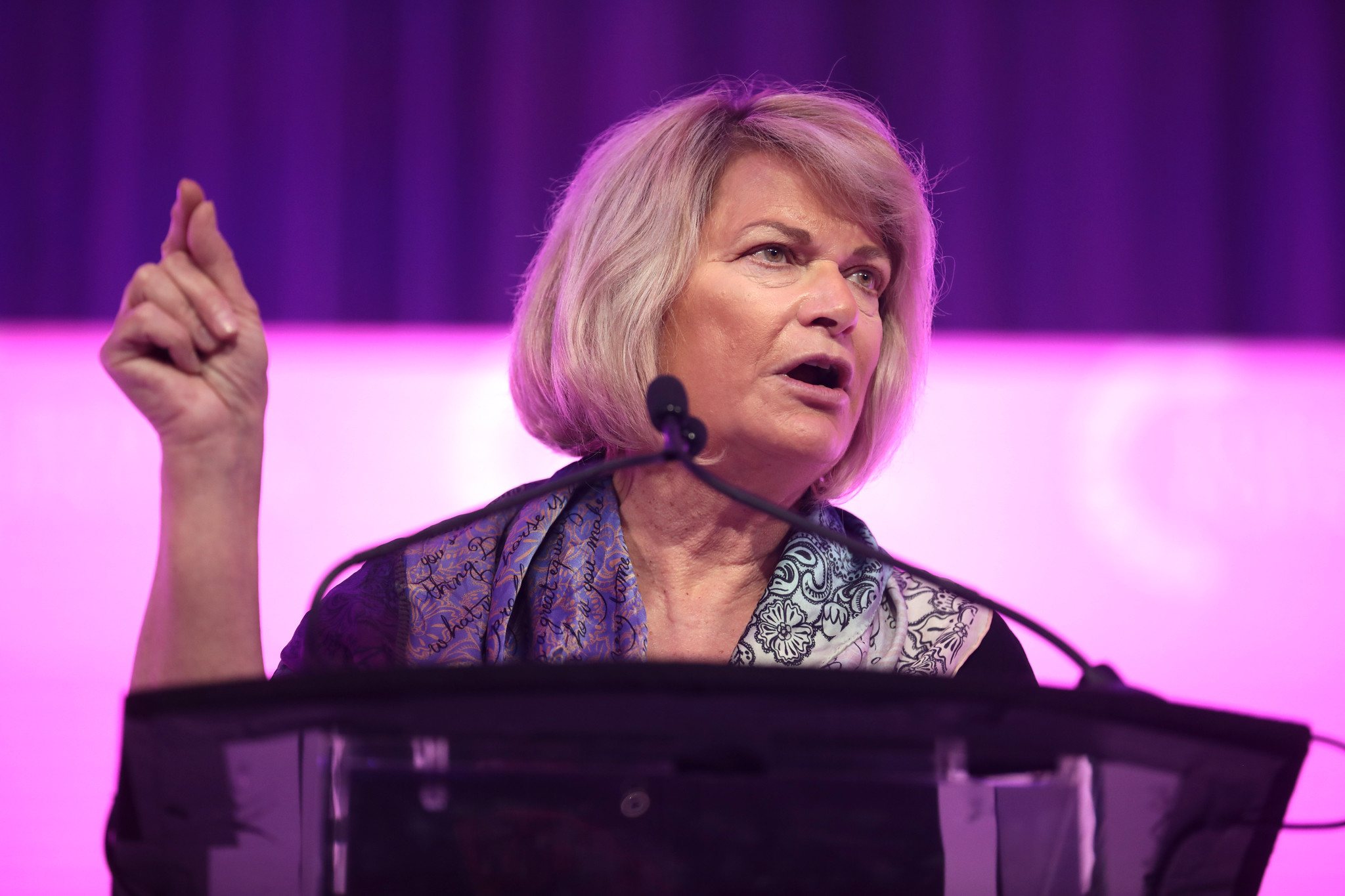

U.S. Senator Cynthia Lummis has announced her intention to introduce a de minimis tax exemption for everyday Bitcoin transactions.

This legislative proposal seeks to exempt small-scale Bitcoin payments from capital gains taxes, aiming to reduce reporting burdens and promote the use of Bitcoin in daily commerce.

Legislative aim to ease adoption

The proposed exemption is designed to simplify the tax process for individuals making low-value Bitcoin purchases.

By removing the need to report minor gains on routine transactions, the measure could make using Bitcoin for everyday goods and services more practical for average users.

Encouraging mainstream use

The initiative reflects a broader move by lawmakers to integrate digital assets like Bitcoin into the mainstream financial system.

Legislative interest in making Bitcoin more accessible has grown as public adoption increases and as more businesses begin to accept Bitcoin for payment.

Potential impact on the bitcoin economy

If enacted, a de minimis exemption could encourage more frequent use of Bitcoin for small payments, potentially increasing transaction volume on the network.

This aligns with ongoing efforts to clarify and modernize regulatory frameworks for digital assets in the United States.

Senator Lummis commented on her proposal:

“This initiative is about making it easier for Americans to use Bitcoin in their everyday lives, without unnecessary tax complexity.”