Key Takeaways

- Senator Lummis proposes comprehensive tax reform for bitcoin and digital assets.

- Key measures include a $300 de minimis exemption, fairer mining tax rules, and securities parity.

- The bill is projected to generate $600 million in net revenue over the next decade.

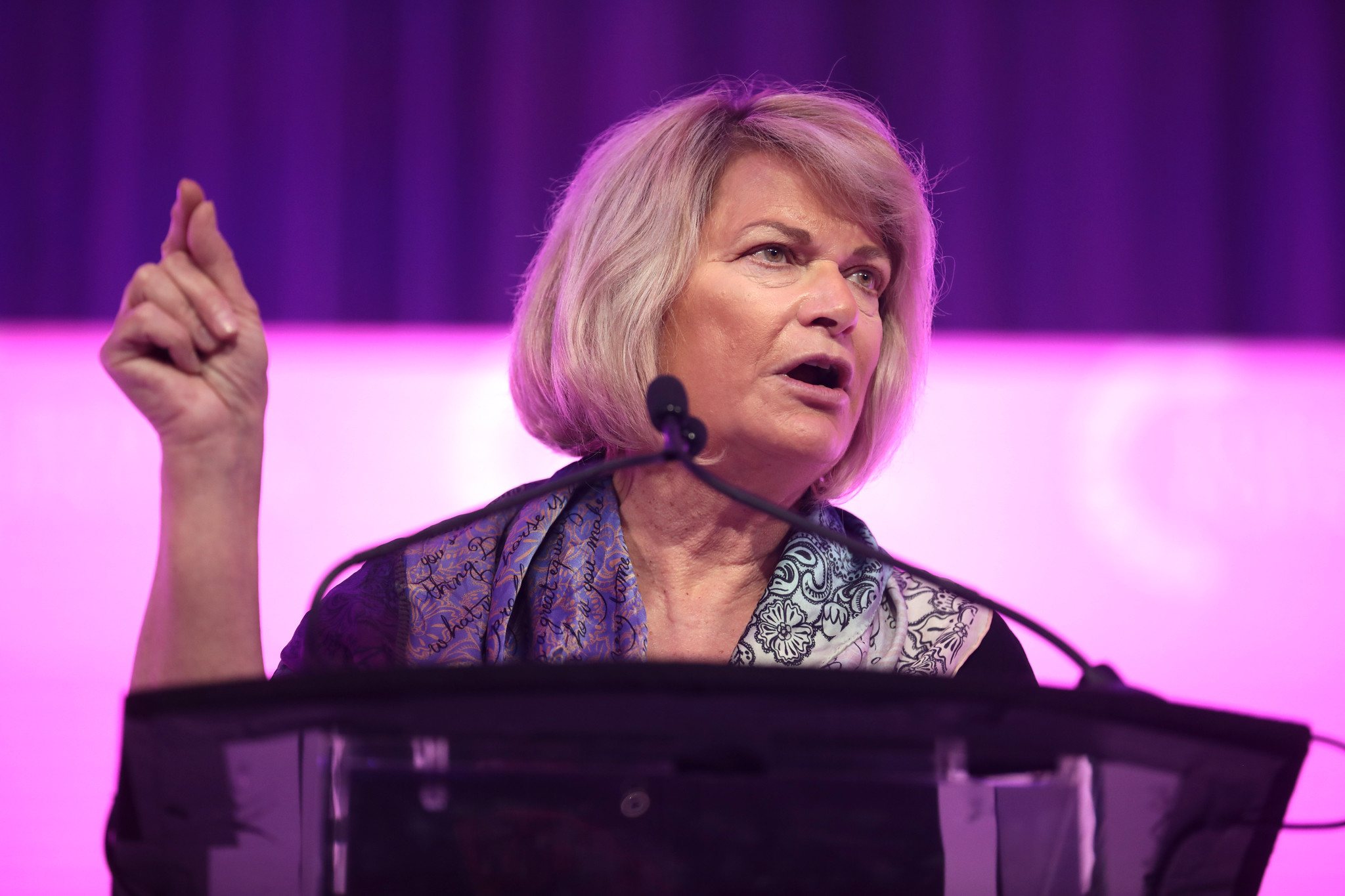

U.S. Senator Cynthia Lummis (R-WY) has introduced sweeping tax legislation targeting key issues in the taxation of bitcoin and other digital assets.

The bill aims to reduce compliance burdens, align digital asset tax treatment with traditional finance, and encourage innovation in the digital economy.

Senator Lummis said:

“In order to maintain our competitive edge, we must change our tax code to embrace our digital economy, not burden digital asset users. This groundbreaking legislation is fully paid-for, cuts through the bureaucratic red tape and establishes common-sense rules that reflect how digital technologies function in the real world.”

She is inviting public comments as the bill advances through Congress.

Key provisions

- De minimis exemption: A new $300 threshold excludes small gains from bitcoin sales or exchanges from taxation, with an annual $5,000 cap and inflation adjustment. This provision recognizes the impracticality of tracking every small transaction, such as buying coffee with bitcoin, and mirrors foreign currency rules.

- Mining and staking income: Income from mining and staking would not be recognized until the assets are sold or disposed of, addressing volatility and cash flow issues for miners.

- Lending, wash sales, and mark-to-market: The bill extends securities lending rules to digital assets, applies a 30-day wash sale rule, and allows dealers and traders to elect mark-to-market tax treatment, ensuring parity with securities and commodities.

- Charitable contributions: Actively traded digital assets would be exempt from qualified appraisal requirements for charitable donations, reducing bureaucratic barriers.

The Congressional Joint Committee on Taxation estimates the reforms would generate approximately $600 million in net revenue through 2034.

Industry impact

Senator Lummis’ bill addresses long-standing demands from the bitcoin industry for clarity and fairness in tax treatment, and could mark a significant shift in U.S. policy toward digital assets.