Bitcoin slid to $59,930 on Friday, its lowest level since October 2024, before rebounding

Kaiko Research said the 32% drawdown was the largest correction since the 2024 halving and may represent a “halfway point” in a historically typical bear phase that lasts about 12 months.

Kaiko flags post-halving shift

In a note shared Monday, Kaiko said the market appears to have moved out of the euphoric post-halving phase and toward key technical support that could determine whether the four-year cycle framework holds.

Kaiko wrote:

“Analysis of on-chain metrics and comparative performance across tokens reveals a market approaching critical technical support levels that will determine whether the four-year cycle framework remains intact.”

Volume and leverage cool off

Kaiko pointed to a 30% drop in aggregate spot trading volume across the 10 leading centralized exchanges, from about $1 trillion in October 2025 to $700 billion in November.

It also noted combined bitcoin and ether futures open interest fell from $29 billion to $25 billion over the past week, a 14% decline that Kaiko attributed to deleveraging.

Is $60,000 the bottom?

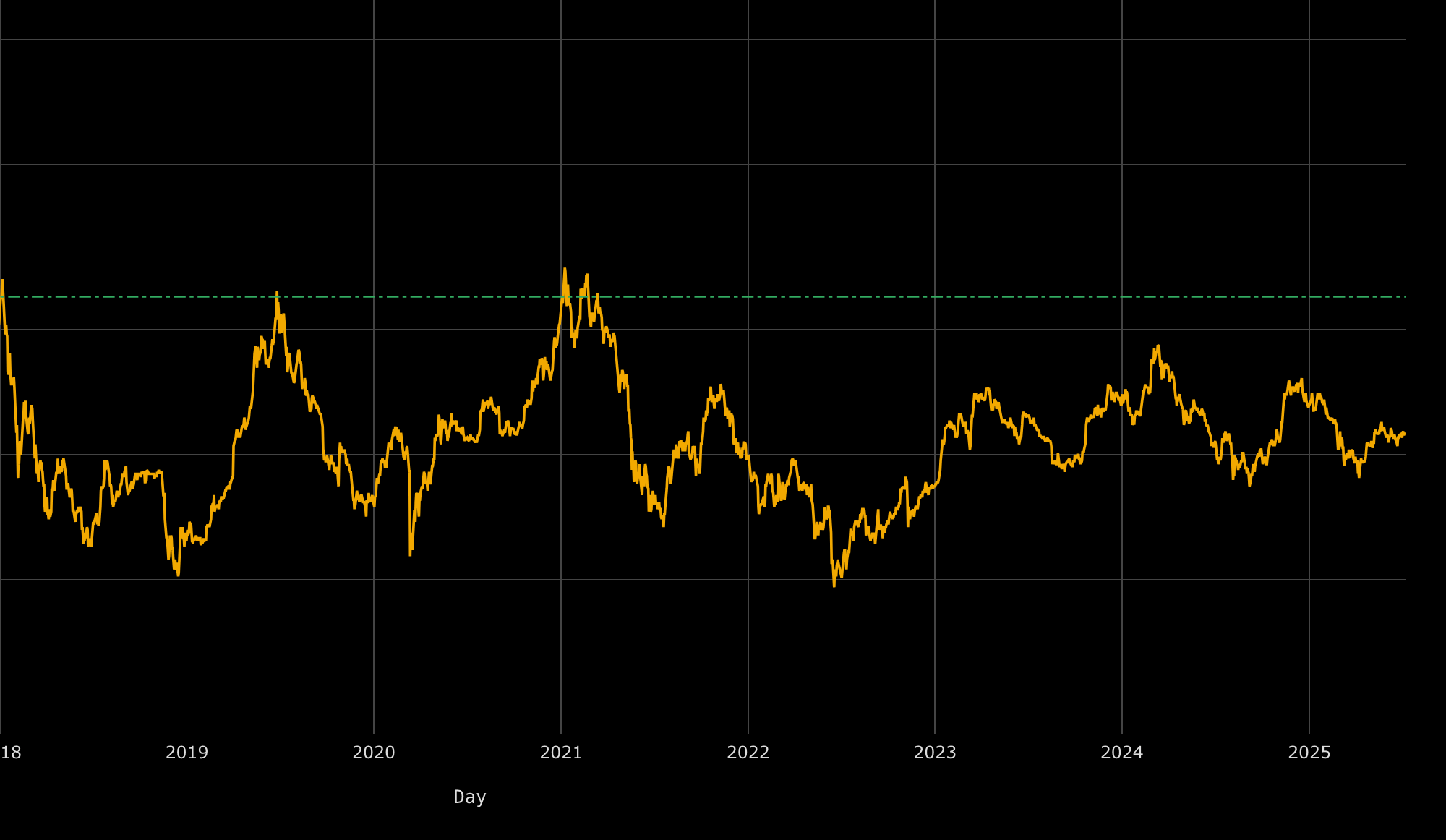

Kaiko said a 52% retracement from the prior all-time high is “unusually shallow” versus prior bear markets.

It argued a 60% to 68% drawdown would better match historical patterns, implying a potential bottom in the $40,000 to $50,000 range.

That aligns with deeper historical pullbacks tracked on Bitbo’s price drawdown from all-time high chart.

Nansen research analyst Nicolai Sondergaard said it remains difficult to conclude the cycle has fully reverted.

Sondergaard told Cointelegraph:

“With that said, it is still very hard to say if it means we are going back to the conventional 4-year cycle. I have seen many prominent figures in the space air the idea, but equally many who do not think so.”

The $60,000 area also roughly aligns with bitcoin’s long-term support zone near the 200-week moving average.

MN Capital founder Michaël van de Poppe separately described the move to $60,000 as a local bottom, citing a sharp drop in the relative strength index.

Four-year cycle debate continues

MEXC Research chief analyst Shawn Young said catalysts that drove bitcoin’s rally to $126,000 may still be in place.

Young said:

“With oversold indicators emerging on multiple timeframes, the rebound conversation around BTC is more a question of when, not if.”