Key Takeaways

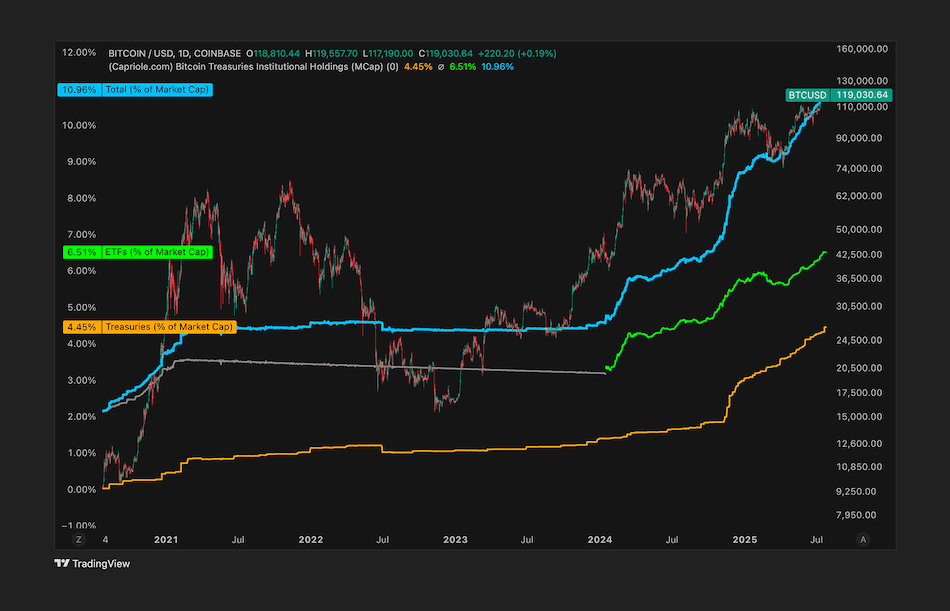

- Institutions now hold more than 10% of the total bitcoin supply, up from 4% in 18 months.

- Daily institutional demand for bitcoin is ten times higher than the number of new coins mined.

- Institutional activity on exchanges like Coinbase is closely linked to significant bitcoin price increases.

Institutional adoption of bitcoin has reached record levels, with over 10% of the total supply now held by public companies and exchange-traded funds (ETFs).

Charles Edwards, CEO of Capriole Investments, highlighted this trend on July 24, noting that institutional holdings have climbed from 4% to more than 10% in just 18 months.

Data from Bitcoin Treasuries indicates that ETFs currently control about 1.62 million BTC, while publicly listed companies hold approximately 918,000 BTC.

At current prices near $118,838 per coin, these institutional positions are valued at over $250 billion.

Demand outpaces mining supply

Edwards emphasized the unprecedented rate of accumulation:

The daily percentage of all Bitcoin in existence that is being acquired by institutions per day (blue) is currently 10X higher than the Bitcoin mining Supply Growth Rate (red)! Notice how every time institutional buying has exceeded the Supply Growth Rate, price went VERTICAL.

This accumulation surge began in 2020, when firms like Strategy (formerly MicroStrategy) shifted their treasury assets into bitcoin.

Since then, more companies have followed suit, particularly during the Trump administration.

Correlation with bitcoin price

Edwards also pointed to a strong link between institutional activity—especially trading on Coinbase—and bitcoin’s price movements.

Historically, when institutional trading accounts for 10% to 50% of daily volume on the exchange, bitcoin prices have seen sharp increases.

It’s hard not to be bullish with the exponential growth in the number of treasury companies, the amount of Bitcoin they are buying, and the frequency at which they are buying. … The demand these companies have for Bitcoin is striping 1000% of the daily Bitcoin supply out of the market every day.