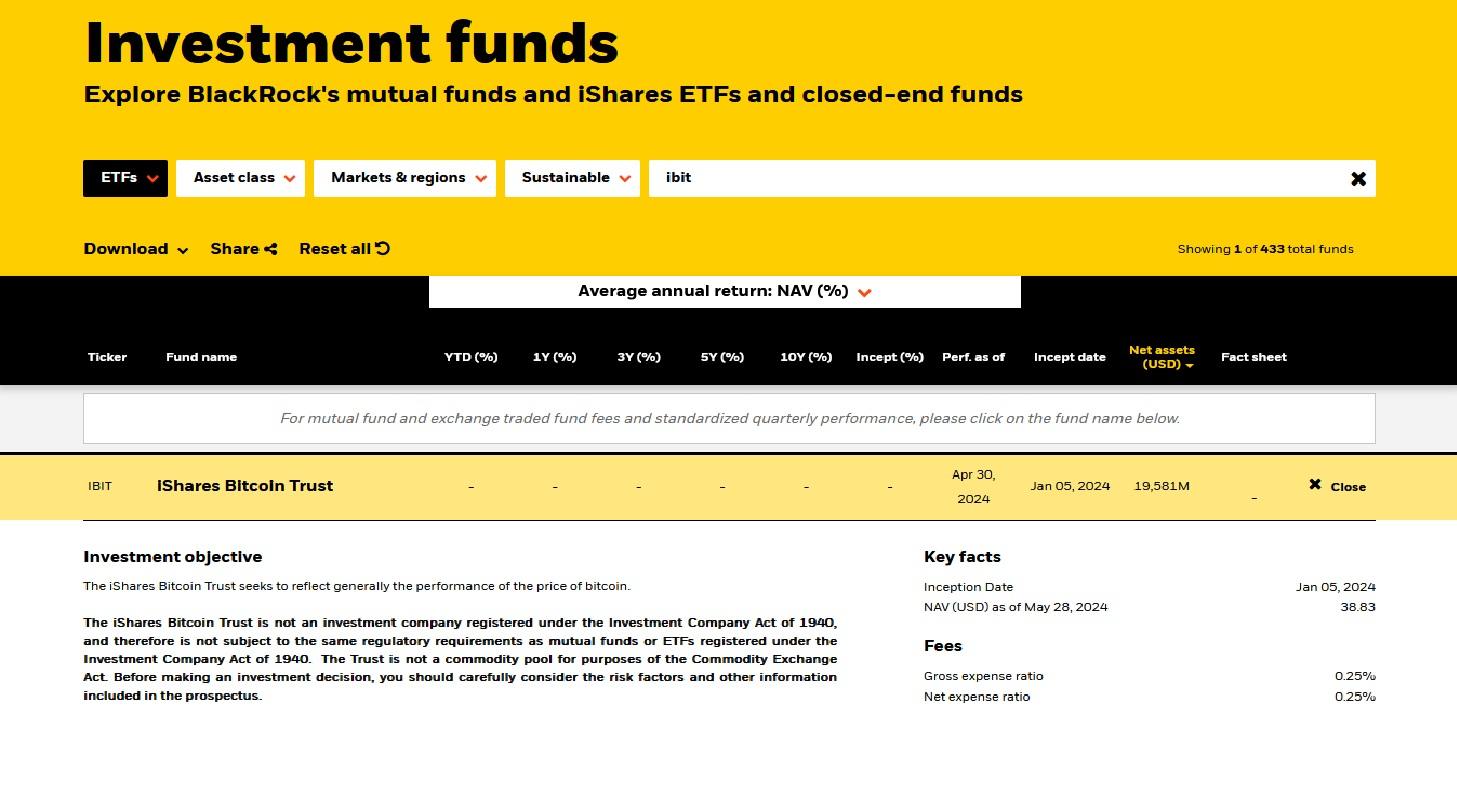

BlackRock’s spot Bitcoin ETF, iShares Bitcoin Trust (IBIT), ranked sixth among all ETFs for year-to-date net inflows in 2025 despite posting a negative annual return.

Bloomberg ETF analyst Eric Balchunas said IBIT drew roughly $25 billion in inflows for the year.

He noted that several equity and bond ETFs ahead of IBIT posted double-digit gains, while gold-backed ETF GLD, up more than 60% in 2025, attracted less capital than IBIT.

Flows despite negative performance

Balchunas described the result as a positive long-term signal, arguing that ETF flows can reveal more about investor behavior than short-term price action.

He wrote:

“If you can do $25 billion in a bad year, imagine the flow potential in a good year.”

Balchunas also characterized the buying as a “HODL clinic” from older, long-term investors.

Why price hasn’t responded

Balchunas responded to questions about why sustained ETF buying has not translated into stronger bitcoin price performance.

He suggested the market may be acting more like a mature asset, where early holders take profits and use income strategies such as selling call options.

He also pointed to bitcoin’s more than 120% rise the prior year as a factor tempering expectations.

Daily flow snapshot

On Friday, US spot Bitcoin ETFs recorded $158 million in net outflows, with Fidelity’s FBTC the only fund showing inflows.

BlackRock addresses prior outflows

IBIT faced pressure in November, recording about $2.34 billion in net outflows, including two large withdrawal days mid-month.

BlackRock business development director Cristiano Castro said at Blockchain Conference 2025 in São Paulo that compression and outflows are normal for ETFs designed to facilitate capital allocation and cash-flow management.