Key Takeaways

- German government sold Bitcoin quickly to maximize liquidity.

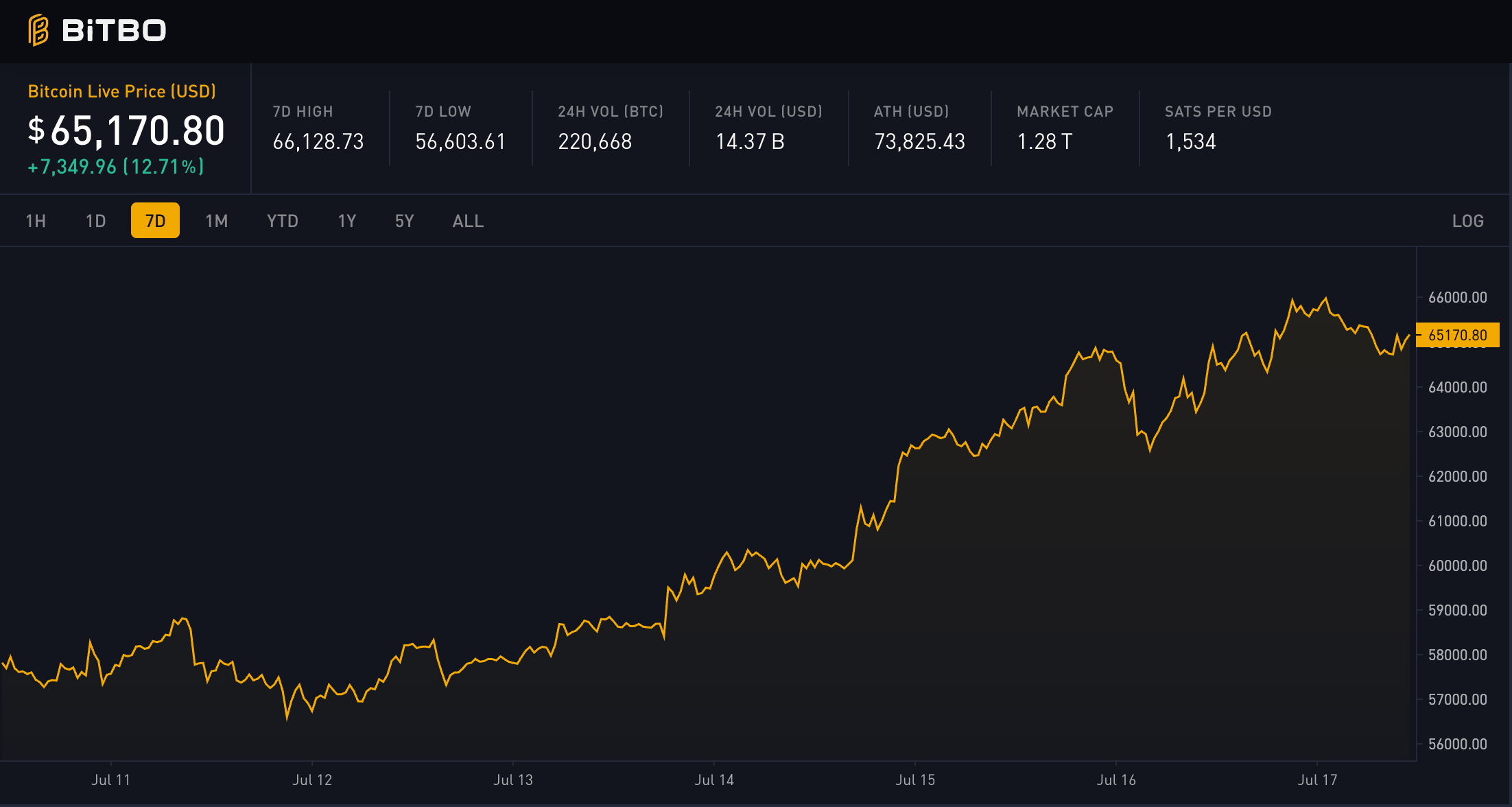

- The sales caused temporary downward pressure on Bitcoin prices.

- Bitcoin prices started recovering after the German government ran out of Bitcoin.

The German government quickly sold its Bitcoin holdings, prioritizing liquidity over market impact and profitability.

The German government swiftly sold its Bitcoin holdings without optimizing for minimal market impact and maximum profitability. According to Miguel Moreno, founder of Arkham Intelligence, the government transferred large amounts of Bitcoin to multiple centralized exchanges (CEXs) to maximize liquidity.

Moreno told Cointelegraph:

The last thing I would have expected is that they would just go to five different exchanges and start market selling… The fact that they’re going to so many different exchanges just reads like they’re just trying to get as much liquidity from each order book as possible, because otherwise, why wouldn’t you just use one?

Using multiple exchanges is more complex than selling through one, suggesting a strategy aimed at rapid liquidation.

This large-scale selling put downward pressure on Bitcoin prices, which only began to recover after the government exhausted its Bitcoin supply. Bitcoin price fell over 7% in June but staged an 11% recovery, trading at $64,688 by July 14. Moreno noted that the news of the government’s sales had a greater impact on prices than the actual sales volume.

Additional factors such as Mt. Gox creditor repayments and stagnating ETF flows also contributed to Bitcoin’s price slump. Despite these pressures, analysts like RunnerXBT believe that once the market digests these sales, there will be opportunities for long positions in Bitcoin.