Key Takeaways

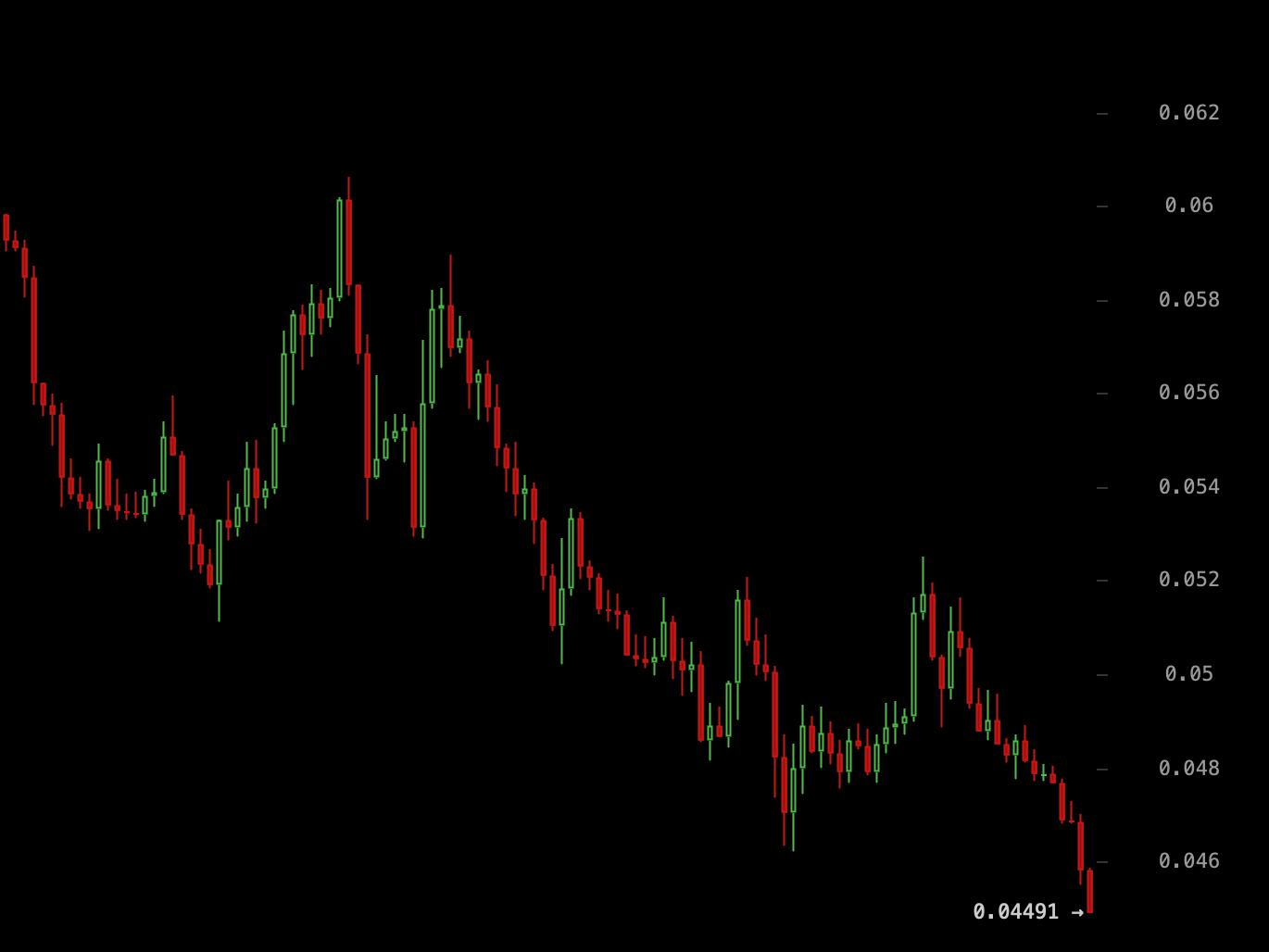

- The Ether-Bitcoin ratio has fallen to its lowest level since April 2021.

- Global Ether ETPs saw net outflows of $63.5 million last week, while Bitcoin ETPs gained $92.5 million.

- The SEC's scrutiny of Ether ETF applications adds uncertainty to their approval process.

The Ether-Bitcoin (ETH/BTC) ratio has fallen to a three-year low, extending year-to-date losses to nearly 16%.

On Binance, the ETH/BTC ratio dropped to 0.04563, its lowest since April 2021, reflecting a growing preference for Bitcoin over Ether.

Factors

This decline is influenced by several factors, including uncertainty about the launch of spot Ether ETFs in the U.S. and the rise of supposed ‘Ethereum competitors’ like Solana.

Bloomberg data indicates that global Ether exchange-traded products (ETPs) saw net outflows of approximately $63.5 million last week, while Bitcoin ETPs gained $92.5 million.

Bitcoin ETFs’ effect

David Han, a research analyst at Coinbase Institutional, noted:

The approval of spot Bitcoin ETFs in the U.S. has reinforced Bitcoin’s store-of-value narrative and its status as a macro asset. On the other hand, open questions about ETH’s fundamental positioning within the crypto sector remain.

The U.S. Securities and Exchange Commission (SEC) approved several spot Bitcoin ETFs in January, which have since attracted around $12 billion in net inflows However, the approval of spot ETFs tied to Ether remains uncertain.

Potential approval

Traders on Polymarket estimate only a 10% chance of the SEC approving a spot Ether ETF by May 31.

Finance lawyer Scott Johnsson highlighted that the SEC is scrutinizing Ether ETF applications more closely, considering whether they qualify as commodity-based trust shares or securities. This scrutiny further complicates the outlook for Ether.

Ilan Solot, co-head of digital assets at Marex Solutions, commented:

Ether is a ‘lightning rod’ for negative sentiment from crypto native and external players and has several weak spots.

Additionally, Ether has recently turned inflationary, reversing the deflationary trend that followed Ethereum’s transition to a proof-of-stake consensus in September 2022.