Key Takeaways

- Bitcoin ETF trading volume hit a record $111 billion in March.

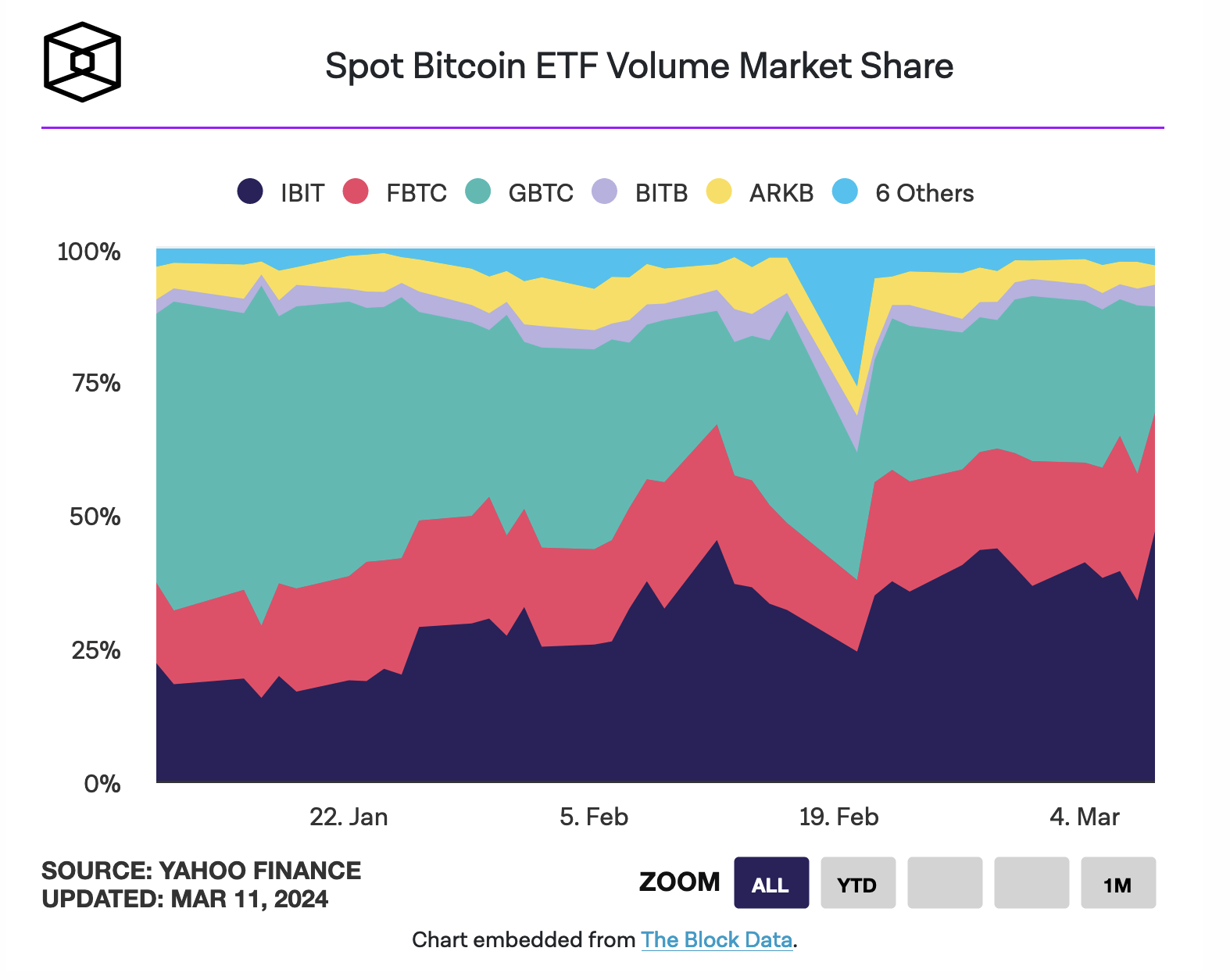

- BlackRock's IBIT led the market, capturing 50% of the total volume.

- ETFs are altering market dynamics, with demand outpacing the supply of newly mined Bitcoin.

In March, Bitcoin ETFs experienced unprecedented inflows, with trading volume soaring to $111 billion.

This marked a significant increase from February’s $42 billion.

Leading the pack: BlackRock’s Bitcoin ETF

BlackRock’s Bitcoin ETF (IBIT) dominated the market, accounting for 50% of the total ETF trading volume.

Grayscale’s GBTC and Fidelity’s FBTC followed with 20% and 17%, respectively.

Surging demand and market dynamics

The surge in trading activity coincided with Bitcoin reaching new all-time highs.

The influx of ETFs like IBIT and FBTC has altered market dynamics and increased demand, outpacing the supply of newly mined bitcoin each day.