Key Takeaways

- Grayscale's GBTC experienced a record $642M outflow, the largest since its conversion to a spot ETF.

- Bitcoin's price has fallen 10.5% from its recent high.

- Despite current challenges, analysts remain optimistic about the future growth of Bitcoin ETFs.

Grayscale’s Bitcoin ETF, GBTC, experienced a record outflow of $642.5 million on March 18, marking the largest single-day withdrawal since its conversion to a spot ETF on January 11.

This significant outflow contributed to a net decrease in spot Bitcoin ETFs, totaling $154.3 million.

Bitcoin’s price and market sentiment

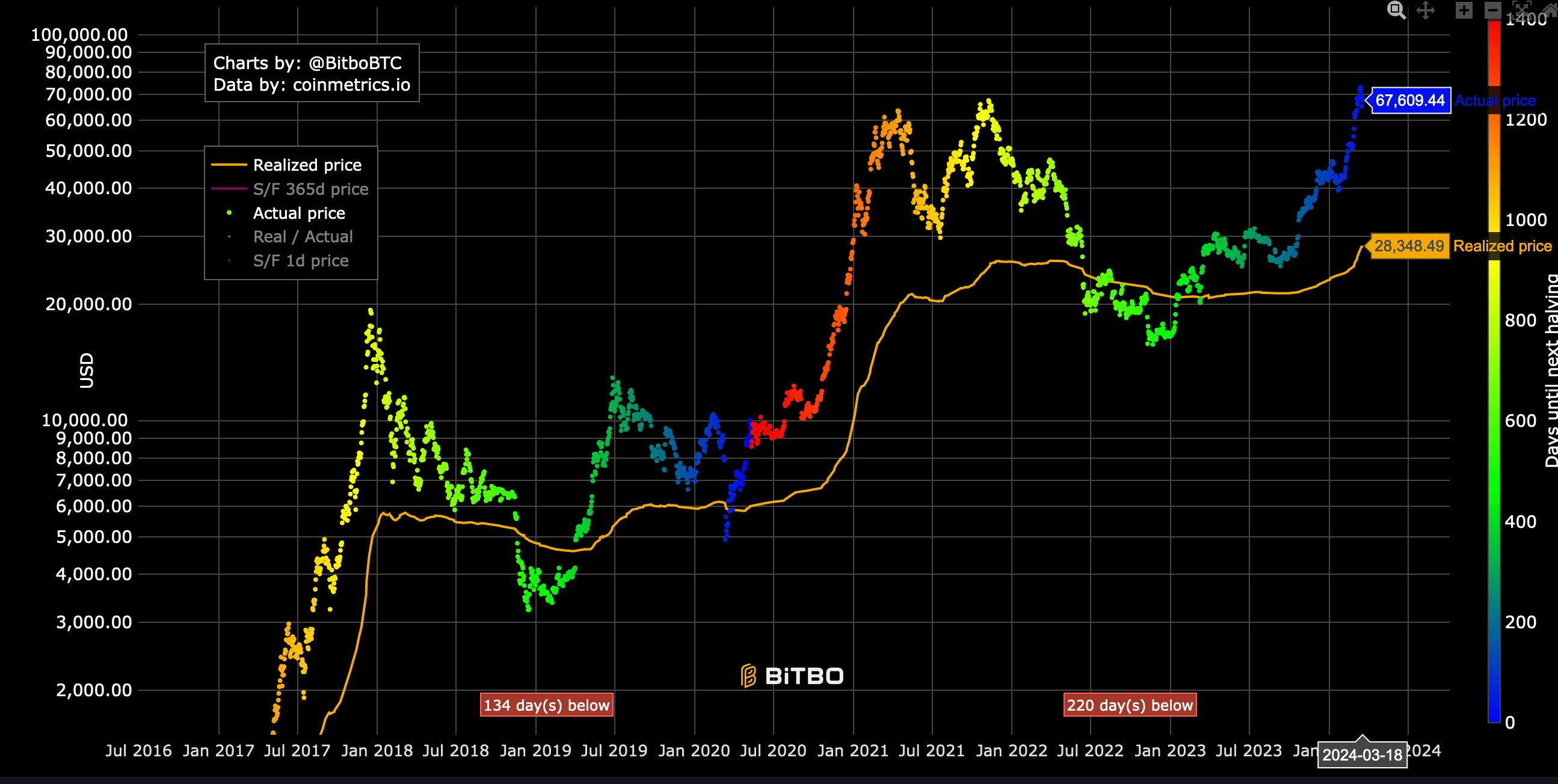

Bitcoin’s price has declined to $65,875, a 10.5% drop from its recent peak of $73,797 on March 14.

Analysts attribute this downturn to slowing ETF flows, the impending Bitcoin halving event, and the anticipation of the Federal Reserve’s meeting on March 20.

Optimistic outlook for Bitcoin ETFs

Despite the current slowdown, some analysts remain optimistic about the future of Bitcoin ETFs.

Grant Engelbart of Carson Group noted that only a small number of advisers have seen clients allocate funds to Bitcoin ETFs, with an average investment ratio of 3.5%.

Bloomberg’s Eric Balchunas echoed this sentiment, suggesting that initial inflows are primarily from early adopters and that wider adoption may follow.