Key Takeaways

- The new bitcoin ETFs are largely being driven by retail investors, indicated by the average trade size of $13,000 USD.

- BlackRock's IBIT leads the ETF market with over $14 billion in assets in two months.

- Bitcoin ETFs provide an accessible investment option for more traditional investors.

Data reveals that the demand for spot bitcoin ETFs is primarily from retail investors. The average trade size for BlackRock’s iShares Bitcoin Fund (IBIT) is about $13,000, indicating a significant retail investor presence.

BlackRock’s IBIT Leading the Pack

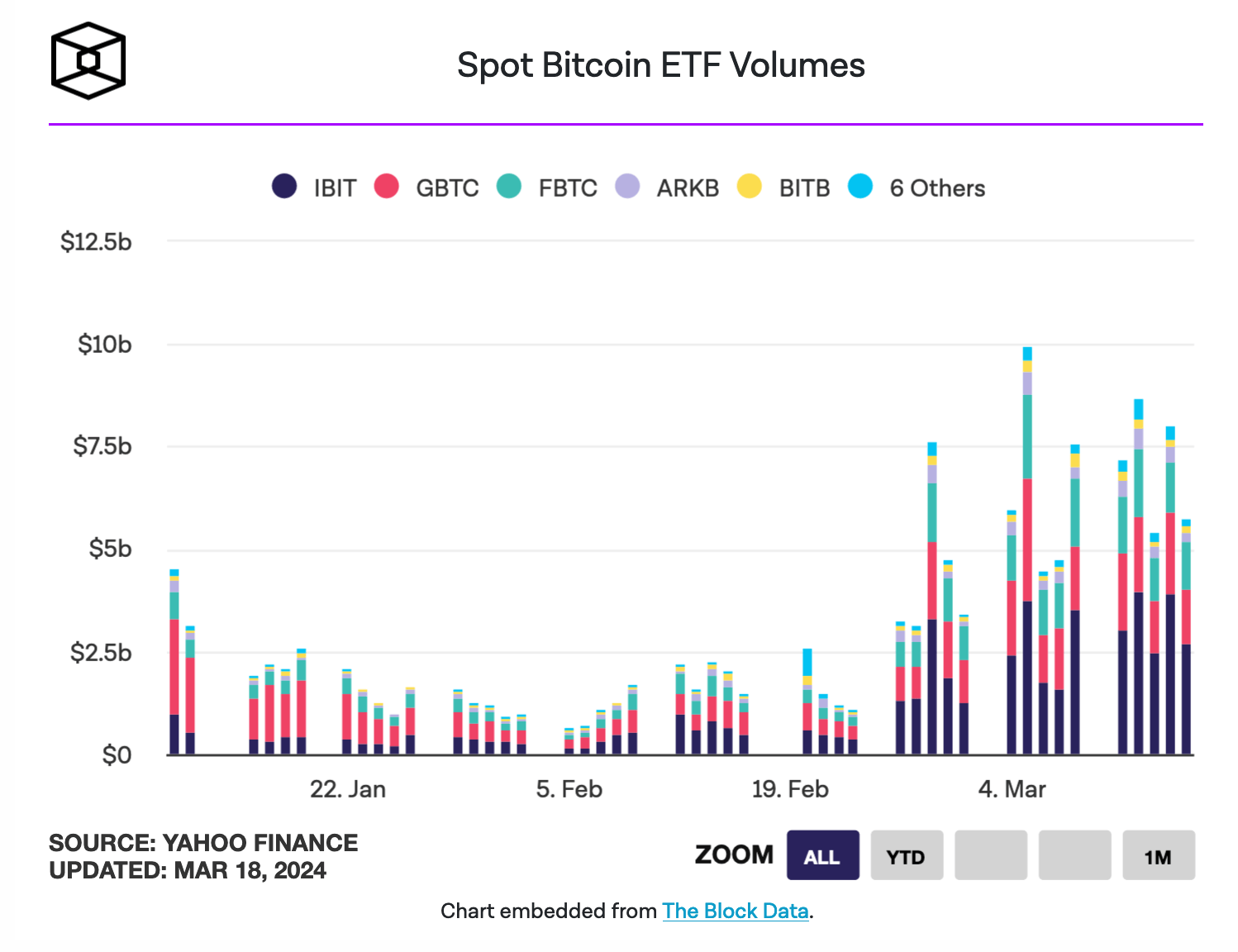

BlackRock’s IBIT has attracted over $14 billion in assets in just two months, becoming the most successful among the bitcoin ETFs.

Eric Balchunas of Bloomberg Intelligence attributes this to its high liquidity, low fees, and the strong BlackRock brand.

Enhanced accessibility for investors

ETFs have changed the landscape of investing in Bitcoin, allowing individuals to participate in the bitcoin market through traditional financial channels.

Whether that pushes people to eventually self-custody remains to be seen.