Ray Dalio warned that the world may be nearing an era of global financial conflict that he described as “capital wars.”

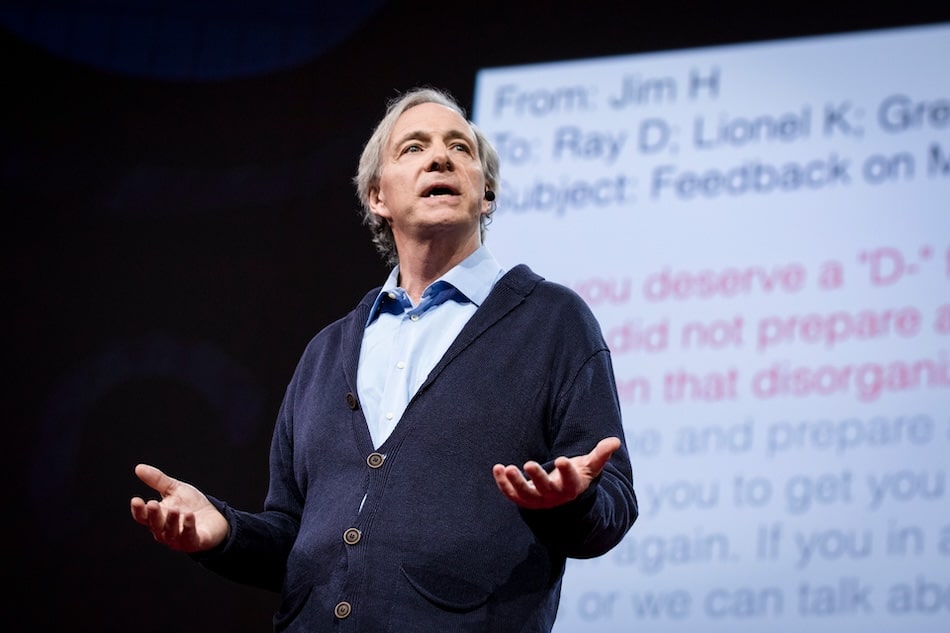

The Bridgewater Associates founder spoke at the World Economic Forum in Davos, Switzerland, as President Donald Trump’s aggressive posture on trade and geopolitics drew attention, including comments related to Greenland.

Dalio’s warning at Davos

Speaking with CNBC, Dalio argued that trade disputes can spill over into capital markets.

Dalio said:

“On the other side of trade deficits and trade wars, there are capital and capital wars.”

He added that investors should not ignore the possibility that foreign buyers become less inclined to purchase US debt.

Trust in US debt

Dalio said frictions between the US and other countries can strain capital flows by raising questions about who finances deficits and which nations are willing to hold certain assets.

He also warned that eroding trust could reduce demand for US Treasurys.

In his view, both the holders of dollar-denominated debt and the US, which needs financing, are increasingly wary of each other.

Inflation and debasement risks

If foreign demand weakens, Dalio said the US could be pushed toward internal measures to fund itself.

He said that could mean higher inflation or currency debasement.

Gold allocation view

Dalio reiterated his positive view of gold as a reserve asset in a period of capital wars.

He said that in normal times, gold should account for 5% to 15% of a well-diversified portfolio.

He also noted he would tilt toward gold more than usual.

Dalio has previously pointed to gold’s strong rally as a potential warning sign for investors heading into 2026.