Key Takeaways

- Ray Dalio recommends a 15% portfolio allocation to bitcoin or gold amid US debt concerns.

- The US government is expected to borrow over $1.5 trillion in the second half of 2025, intensifying worries over currency devaluation.

- Dalio remains skeptical about bitcoin becoming a reserve currency due to transparency and code concerns.

American hedge fund manager Ray Dalio has advised investors to allocate approximately 15% of their portfolios to either bitcoin or gold in response to the ongoing US debt crisis and the devaluation of the dollar.

Dalio increases bitcoin allocation recommendation

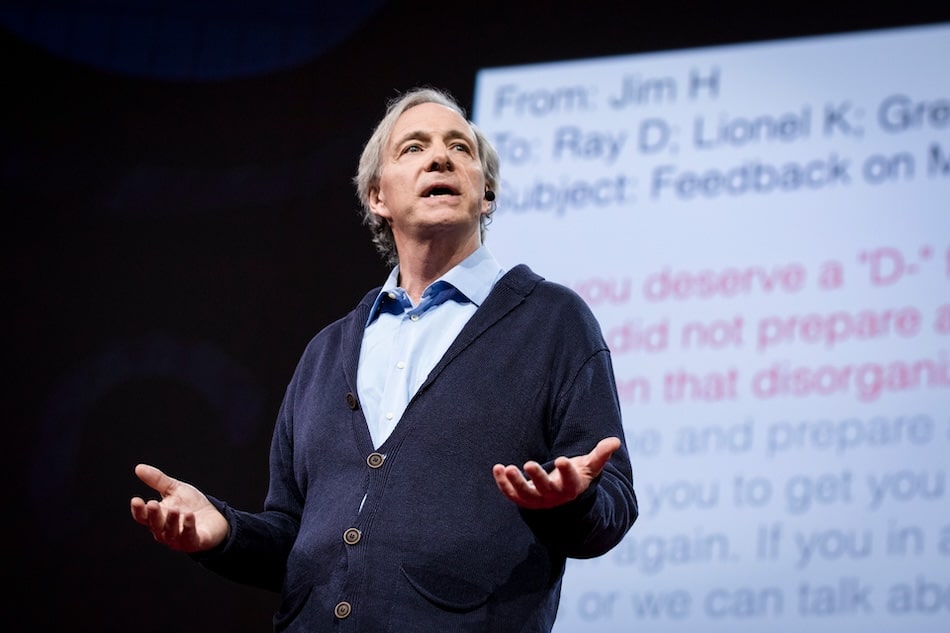

Speaking on the Master Investor podcast, Dalio stated:

“If you were optimizing your portfolio for the best return-to-risk ratio, you would have about 15% of your money in gold or Bitcoin.”

This marks a significant increase from the 1–2% bitcoin allocation he suggested in January 2022.

Although Dalio revealed he personally holds “some Bitcoin, but not much,” he continues to “strongly prefer gold to Bitcoin.” He emphasized that the exact split between the two assets is up to individual investors.

mounting US debt and currency devaluation

Dalio’s comments come as the US national debt reaches $36.7 trillion, with the Treasury Department projecting another $1 trillion in borrowing for the third quarter of 2025.

The Treasury also expects to borrow $590 billion in Q4, highlighting the government’s heavy reliance on debt to cover expenditures.

Dalio warned of the “devaluation of money,” noting that the government may need to issue another $12 trillion in Treasurys over the next year to manage its growing obligations.

For a closer look at the long-term decline in the dollar’s value, see the chart showing US dollar devaluation since 1913.

skepticism over bitcoin as a reserve asset

Despite advocating for bitcoin as a portfolio diversifier and an effective hedge, Dalio expressed doubts that bitcoin could become a reserve currency.

He cited concerns over privacy and transparency, stating:

“Governments can see who is doing what transactions on it.”

He also mentioned potential vulnerabilities in bitcoin’s code as a barrier to its adoption by central banks.

bitcoin and gold hit recent highs

Both bitcoin and gold have reached notable highs in recent months.

Bitcoin is trading at $118,100, about 4% below its July all-time high of $123,230. Gold has also hit multiple record highs this year.