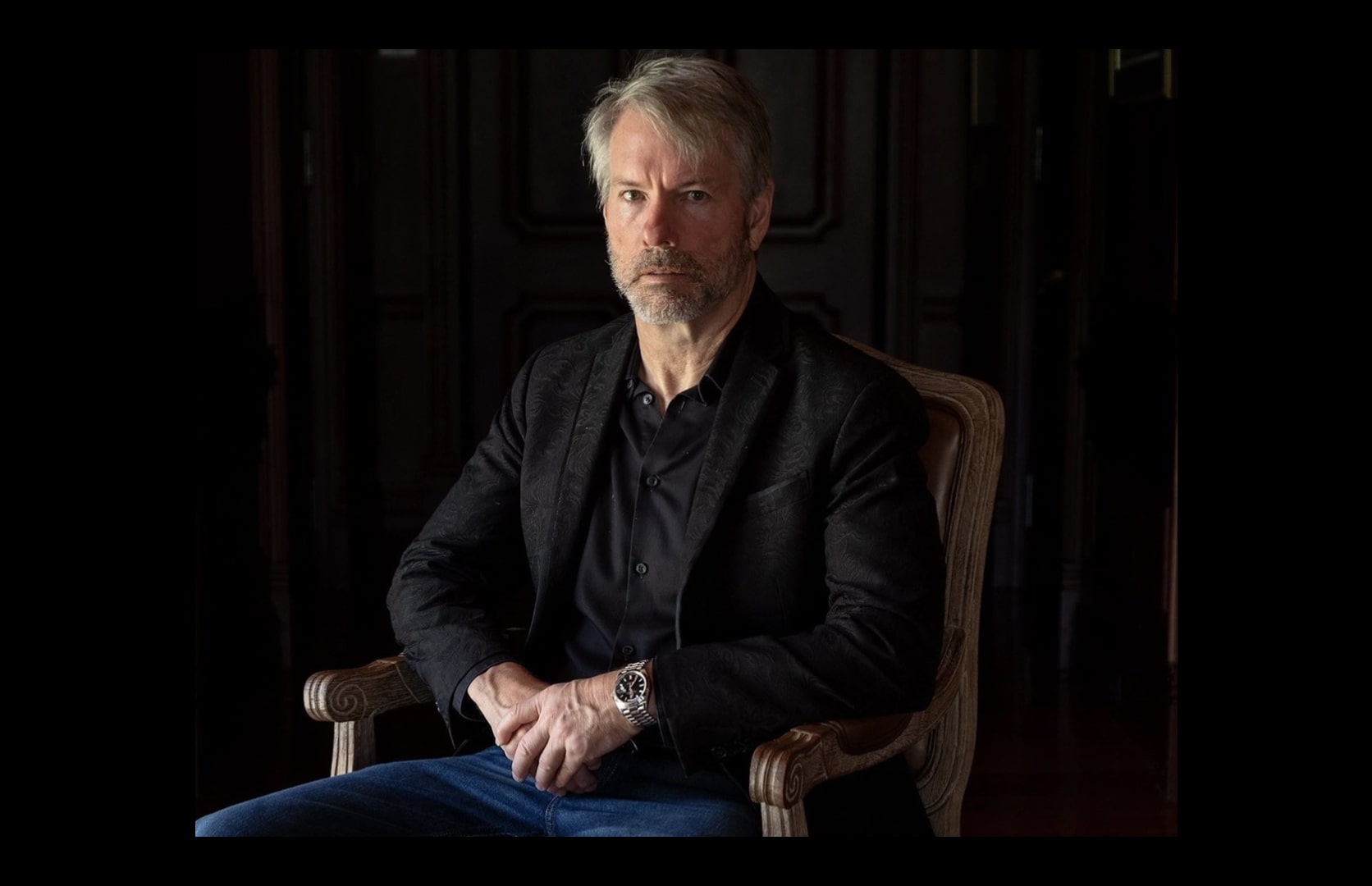

Luke Gromen recently discussed how China’s clampdown on rare earth exports marks a critical turning point for the global monetary order, accelerating the decline of the U.S. dollar-based reserve system.

Rare earths and U.S. vulnerability

Gromen emphasized that China’s effective ban on supplying rare earths to U.S. defense contractors is not merely a trade dispute but highlights the fragility of America’s debt-driven economic model.

He noted that the U.S. would struggle to reconstitute its supply chains and industrial capacity in the short term, while China could withstand a prolonged standoff. Gromen stated:

“They’re done selling rare earths into U.S. weapon systems. That’s the end of the post-’71 dollar structure.”

Gold and Bitcoin rise as reserve alternatives

As the dollar’s dominance is challenged, Gromen pointed to the rise of gold—and now Bitcoin—as preferred reserve assets over Treasuries.

He explained that central banks are increasing gold allocations, and Bitcoin is emerging as a parallel, free-market challenger. Gromen remarked:

“The fix isn’t political, it’s monetary: Bitcoin or gold.”

He also observed that the dollar and gold rising in tandem signals the end of the current dollar-based system, with Bitcoin’s role expanding as more individuals and businesses accumulate and self-custody it.

Political gridlock and slow reindustrialization

Gromen warned that U.S. political polarization and a high-time-preference culture hamper the kind of industrial and educational mobilization needed to address the crisis.

He called for a Manhattan-Project-style push for metals, refining, and skilled trades, but acknowledged the slow pace of change.

Market solutions and individual action

Until policy catches up, Gromen urged households and businesses to build resilience by adopting hard-money balance sheets—specifically, through steady accumulation and self-custody of Bitcoin.

He concluded that a market-led transition, not government mandates, will restore financial sovereignty and mitigate the risks of America’s debt spiral.