Representatives of the Bitcoin Policy Institute (BPI) are warning that US lawmakers may move forward with a de minimis tax exemption that applies to stablecoins but not bitcoin.

BPI raises alarm on stablecoin-only exemption

Conner Brown, BPI’s head of strategy, said discussions in Washington are not covering bitcoin transactions below a certain threshold.

Brown wrote on X:

“De Minimis tax legislation may be limited to only stablecoins, leaving everyday Bitcoin transactions without an exemption.”

He added:

“Exclud[ing] Bitcoin is a severe mistake.”

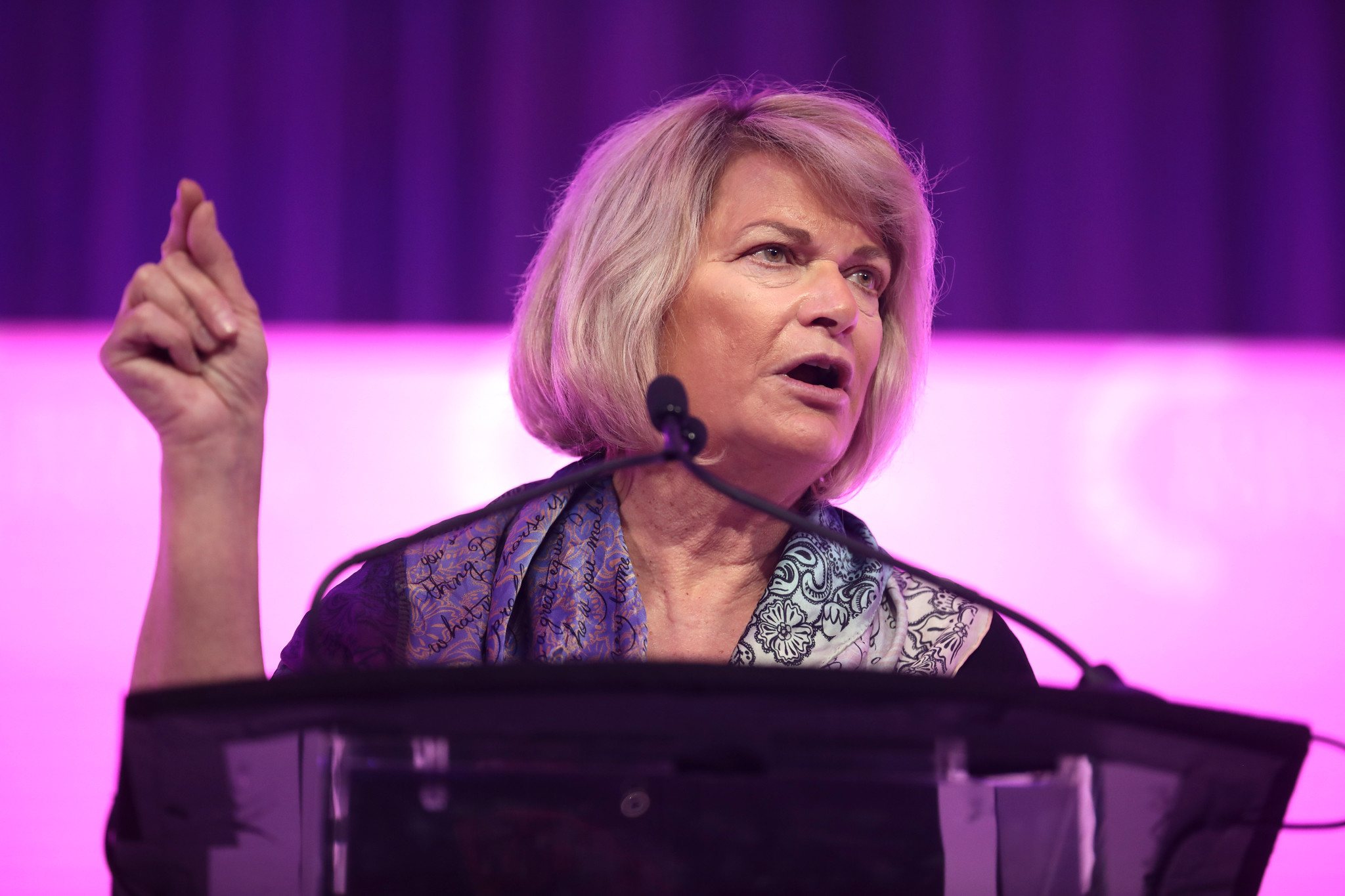

Lummis bill proposed $300 threshold

In July, Sen. Cynthia Lummis introduced a proposal that would exempt digital-asset transactions of $300 or less from capital gains taxes, with a $5,000 annual cap.

The proposal also included exemptions for digital assets used in charitable donations and tax deferment for assets earned through mining.

Critics question why stablecoins need it

The stablecoin focus drew pushback from Marty Bent, founder of Truth for The Commoner (TFTC).

Bent wrote:

“Why would you even need a De Minimis tax exemption for stablecoins.”

He added:

“They don’t change in value. This is nonsensical.”

Payments friction remains for bitcoin

Bitcoin’s design as “peer-to-peer electronic cash” was laid out in Satoshi Nakamoto’s 2008 paper, available in the online Bitcoin whitepaper.

Analysts claim that transaction fees, roughly 10-minute block times, and capital gains taxes can discourage bitcoin payments.

It also pointed to the Lightning Network as a way to make payments faster and cheaper by moving activity offchain and settling net balances back on the base layer.

Cointelegraph reported it contacted BPI for comment on the proposed legislation but had not received a response at publication time.