Key Takeaways

- Blockstream secures $210M to boost Layer 2 and mining operations.

- The Liquid Network has $1.8B in issued assets and $250M in BTC locked on-chain.

- Michael Minkevich joins as COO to lead Blockstream's growth.

Blockstream has secured $210 million through a convertible note financing round led by Fulgur Ventures.

The funds will support the company’s efforts to accelerate adoption of its Bitcoin Layer 2 technologies, expand its mining operations, and grow its bitcoin treasury.

Layer 2 solutions

Blockstream’s Layer 2 solutions include the Liquid Network, a federated sidechain that allows the deployment of tokenized assets, and Core Lightning, which facilitates faster and cheaper bitcoin transactions.

The firm aims to position Liquid as the key infrastructure for tokenizing real-world assets on Bitcoin.

Adam Back comments

CEO Adam Back emphasized the significance of this funding, saying it “represents a defining moment for Blockstream” as the company continues to bridge the gap between Bitcoin and traditional finance.

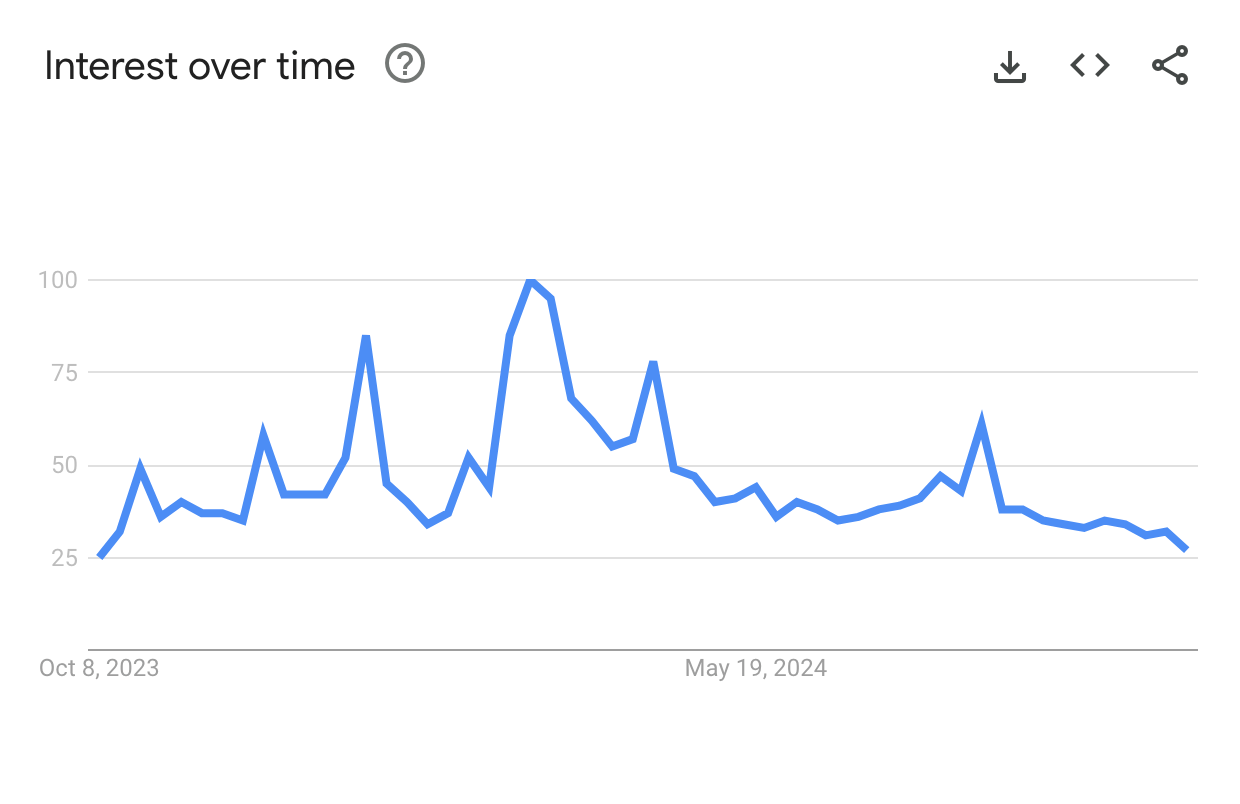

Blockstream claims that over $1.8 billion in assets have been issued on Liquid, with around $250 million worth of bitcoin locked on-chain.

Products using Liquid include Bitfinex’s tokenized securities and MicroStrategy-backed securities from STOKR.

In addition, the company welcomed Michael Minkevich as Chief Operating Officer. His leadership is expected to help Blockstream capitalize on new opportunities in the financial sector and beyond.