Key Takeaways

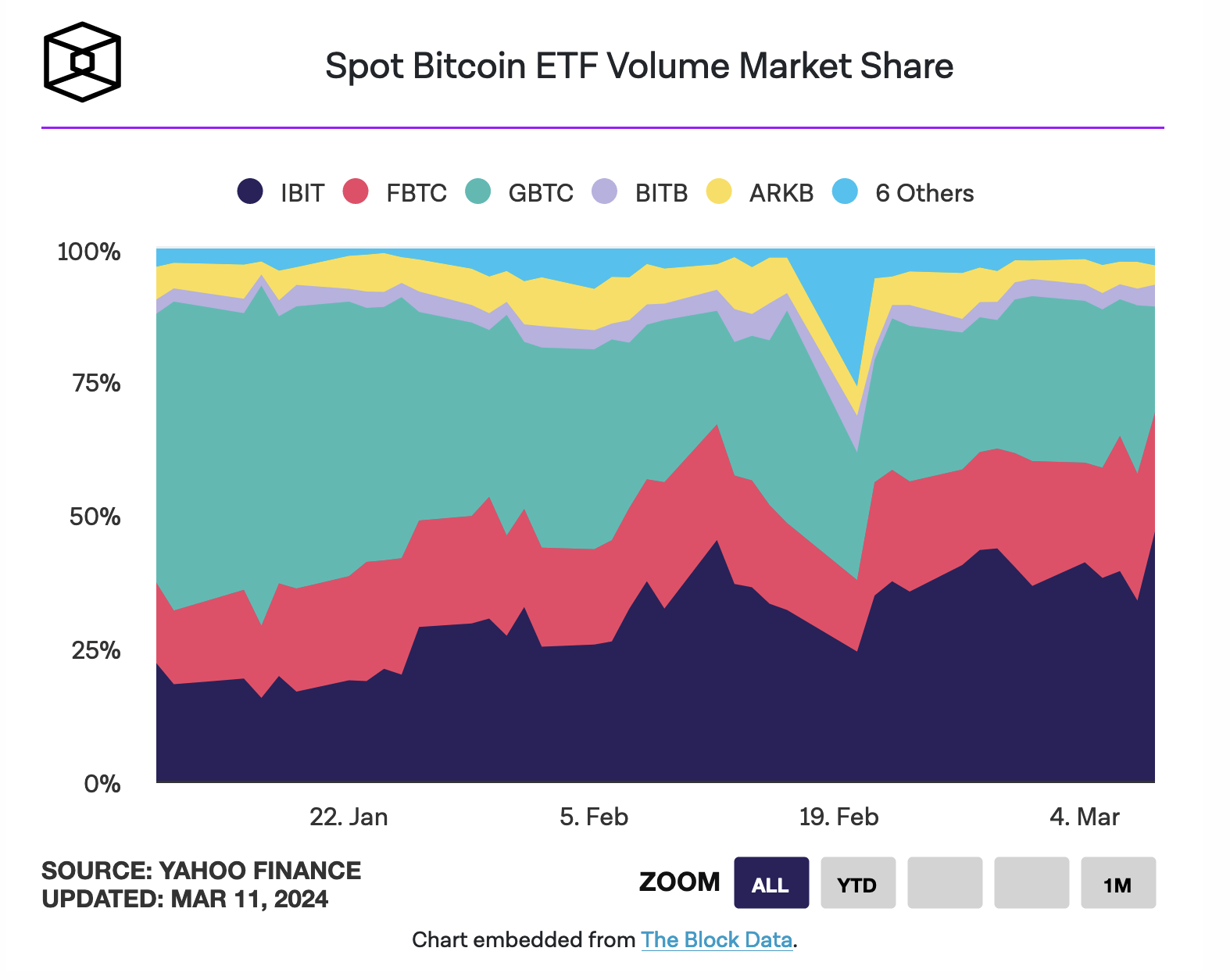

- BlackRock and Fidelity's ETFs now hold 69% of the spot Bitcoin ETF market share.

- Grayscale's market share has dropped to below 20%, its lowest point since the introduction of competing products.

- The assets of ETFs excluding Grayscale have surpassed GBTC's assets for the first time.

BlackRock and Fidelity’s spot Bitcoin ETFs are capturing a larger share of the market.

Their combined trading volume reached 69% last Friday, according to The Block’s Data Dashboard.

This shift is eroding Grayscale’s previously dominant position in the spot Bitcoin ETF market.

Grayscale’s shrinking market share

Grayscale’s market share has dropped to its lowest point since the introduction of competing products.

On Friday, it accounted for less than 20% of total trading volume.

Grayscale’s spot Bitcoin ETF, which converted from its GBTC fund, had initially absorbed about half of all trading activity.

Fee differences and asset management

Grayscale charges a higher management fee of 1.5%, compared to BlackRock’s 0.12% for assets under $5 billion and 0.25% afterward.

Fidelity will not charge any fees until August. This difference in fees may be contributing to the shift in market share.

Additionally, the assets of ETFs excluding Grayscale have now surpassed $28 billion, exceeding GBTC’s assets for the first time, as reported by BitMEX Research.