BlackRock CEO Larry Fink and Coinbase CEO Brian Armstrong appeared together at the New York Times DealBook Summit, where they discussed the evolving role of bitcoin and digital assets in the global financial sector.

Institutional adoption expands

Brian Armstrong revealed that major financial institutions are running pilots with Coinbase for stablecoins, custody, and bitcoin trading.

While he did not specify which banks are involved, Armstrong emphasized the growing interest:

“The best banks see this as an opportunity. Those who resist will be left behind.”

This development comes as Morgan Stanley opens bitcoin trading to its retail investors on E*Trade, and other banking executives—such as JPMorgan’s Jamie Dimon and Bank of America’s Brian Moynihan—express continued interest in bitcoin and related assets.

Regulatory changes

The shift toward bitcoin intensified during Donald Trump’s second term, fueled by a friendlier political and regulatory climate.

Congress and the White House are advancing the first federal stablecoin framework, which industry participants hail as a historic milestone.

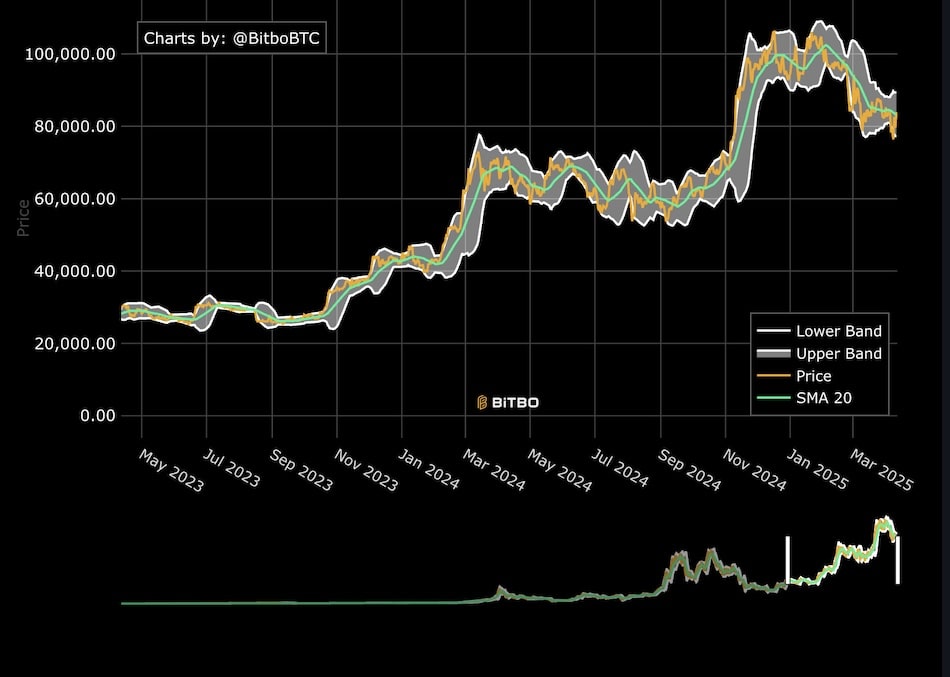

These changes coincide with volatile bitcoin price movements and persistent market uncertainty.

Blackrock’s bitcoin strategy

Larry Fink, once a vocal skeptic, now leads the world’s largest bitcoin ETF and openly supports bitcoin’s use case.

He noted that roughly $4.1 trillion held in digital wallets worldwide is primarily in stablecoins and argued for more efficient movement of these funds through tokenized assets.

Fink described bitcoin as a “fear asset,” stating:

“You own Bitcoin because you’re afraid for your physical security; you’re afraid for your financial security. The main reason people hold Bitcoin long-term is the risk of financial asset devaluation due to budget deficits.”