Key Takeaways

- BlackRock advises a 1% to 2% Bitcoin allocation in portfolios.

- Bitcoin's risk profile mirrors tech-heavy investments, per BlackRock.

- The recommendation follows Bitcoin surpassing $100,000 in December.

BlackRock, the world’s largest asset manager, recommends a modest 1% to 2% allocation to Bitcoin in multi-asset portfolios, according to a paper released on December 12. This range aligns with the risk profile of portfolios holding major technology stocks, offering a calculated entry for investors seeking diversification.

Risk analysis & volatility

Bitcoin, with its unique risk characteristics and lower correlation to traditional equities, acts as a distinct driver of portfolio risk, according to BlackRock’s analysis.

However, the firm warns that exceeding the 2% threshold could amplify portfolio volatility excessively.

Samara Cohen, BlackRock’s CIO of ETF and index investments, said:

A small Bitcoin weighting may operate as a separate risk driver in a balanced allocation.

Bitcoin price milestone & fund growth

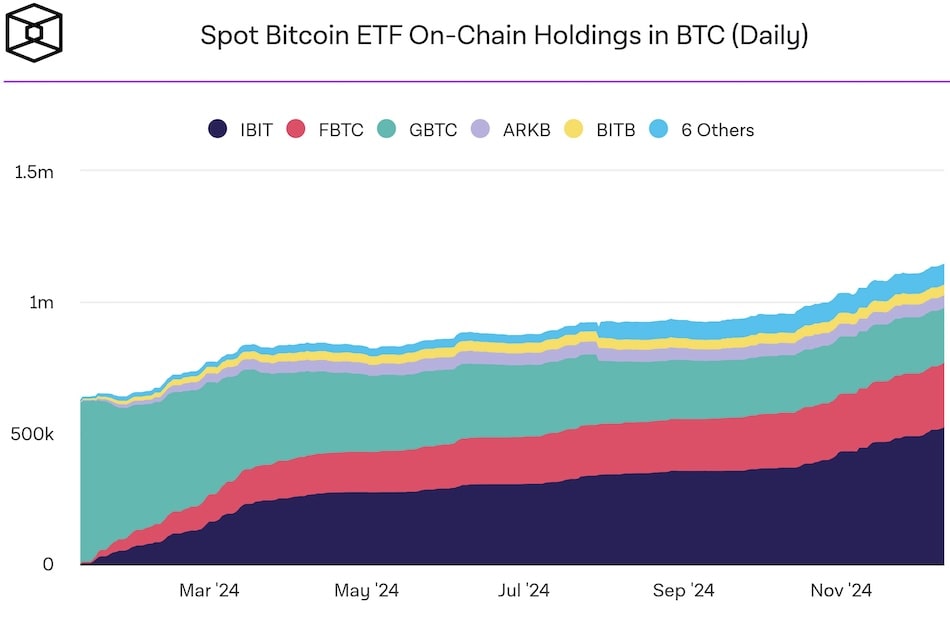

The recommendation comes as Bitcoin recently surpassed $100,000, following institutional endorsements and significant inflows into funds like BlackRock’s iShares Bitcoin Trust (IBIT).

IBIT’s rapid growth highlights increasing institutional demand, further solidifying Bitcoin’s role in mainstream financial strategies.

Comparison to tech stocks

BlackRock’s research draws parallels between Bitcoin’s risk profile and the concentrated impact of the “Magnificent Seven” tech stocks on the S&P 500.

While Bitcoin’s market capitalization and utility differ from corporate assets, its volatility patterns reflect similar risk dynamics.

Strategic integration

This measured approach suggests Bitcoin’s integration into portfolios should remain strategic, emphasizing its potential as an evolving asset in institutional investment frameworks.