Key Takeaways

- Bitcoin network activity fell to 256,000 daily transactions on June 1, its lowest since October 2023.

- Miners are including ultra-low-fee transactions, like one priced at just 0.1 sat/vB, accepted by MARA.

- Bitcoin Core devs defended the move in a June 6 statement, citing censorship resistance, but faced backlash.

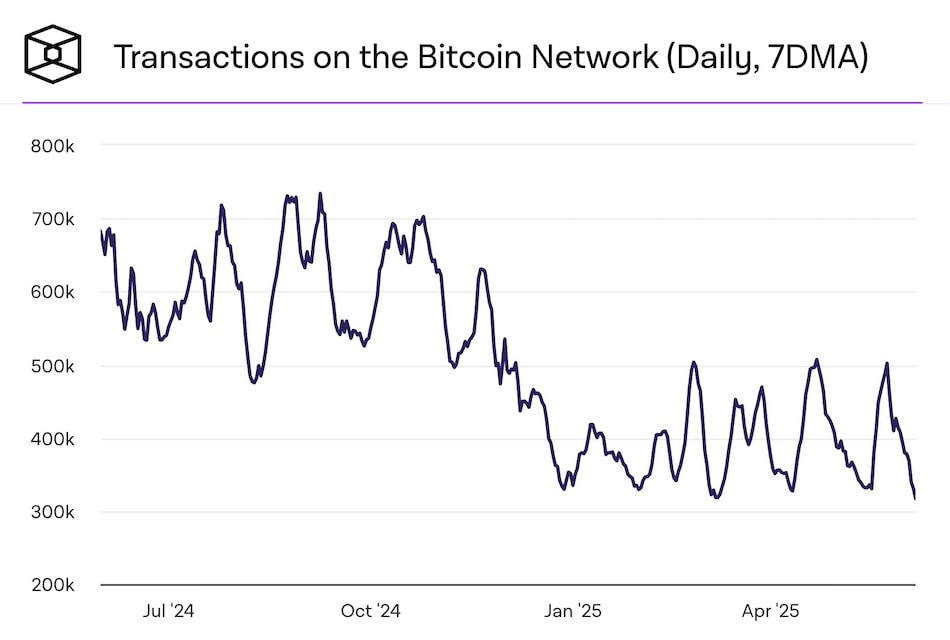

The Bitcoin network’s transaction activity has fallen to its lowest level in over a year and a half, according to data from The Block.

On June 1, just 256,000 transactions were mined into blocks—well below the seven-day moving average of 317,000 recorded on June 7 and nearing October 2023’s low of 269,000.

Impact of low-fee transactions

This decline in usage comes even as Bitcoin trades near its all-time high, raising questions about network demand.

Notably, some miners are now including transactions that fall well below the default relay fee of 1 sat/vB.

Insights from mempool explorer

Open-source Mempool explorer founder Mononaut shared that one of their near-zero fee transactions—priced at just 0.1 sat/vB—was successfully mined by MARA (formerly Marathon Digital), which operates a low-fee transaction pipeline called Slipstream.

Mononaut described the transaction as a…

… bespoke handcrafted artisanal transaction

It costs only 11 sats, or about $0.01, and had waited in the mempool for a month.

Developer statement and criticism

On June 6, 31 Bitcoin Core developers released a statement defending the inclusion of such low-fee or non-standard transactions.

The developers emphasized Bitcoin’s censorship-resistant design.

They wrote:

Bitcoin can and will be used for use cases not everyone agrees on.

However, the statement faced criticism from figures like Samson Mow, who argued the developers are…

… removing barriers for spammers.

Mow accused them of gradually enabling network abuse.